India Factoring Market Overview

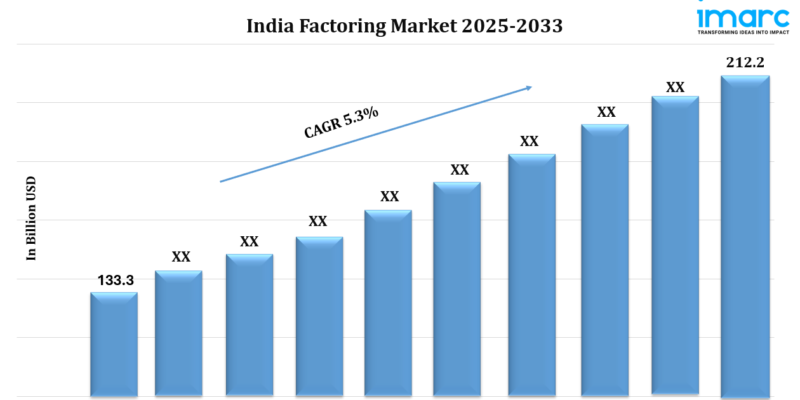

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Growth Rate: 5.3% (2025-2033)

Market Size in 2024: USD 133.3 Billion

Market Size in 2033: USD 212.2 Billion

The India factoring market is expanding quickly due to calls for MSME financing, increased trade volumes, and advantageous legislative developments. According to the latest report by IMARC Group, the market size reached USD 133.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 212.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.3% during 2025-2033.

India Factoring Market Trends and Drivers:

The India factoring market is poised for significant growth, driven by emerging trends and increasing adoption. Businesses are increasingly recognizing factoring as an essential financing solution for managing capital and improving cash flow. This shift began prior to 2024 as companies realized its potential in addressing liquidity challenges. The rise of e-commerce and digital transactions has further intensified the need for quick access to cash, which is vital for smooth business operations.

India’s factoring landscape has evolved, with streamlined processes allowing businesses to access services online and swiftly convert receivables into cash. Supportive regulations, technological advancements, and growing awareness of factoring’s benefits are accelerating this trend. As businesses seek flexible funding options, factoring is becoming a key pillar of India’s financial ecosystem.

Small and medium enterprises (SMEs) are a significant driver of this growth. Due to challenges in securing traditional financing, such as credit limitations and lack of collateral, SMEs are increasingly turning to factoring to improve cash flow. This financial solution enables them to invest in growth opportunities and continue thriving. Government initiatives that support SMEs have also contributed to the sector’s expansion, leading to a rise in their numbers. Digital platforms are making factoring services more accessible to SMEs, fostering wider adoption.

The ongoing digital transformation of financial services is reshaping the factoring industry. Fintech companies are leveraging technology to offer faster, more efficient solutions. Digital factoring enables instant invoicing, payment tracking, and enhanced risk management, boosting transparency and reducing fraud. As more businesses embrace digital platforms, the demand for factoring services is expected to grow. Innovations like AI and machine learning are revolutionizing risk assessment, improving accuracy and speed, and driving the market forward.

Regulatory support is crucial for sustaining this momentum. The Reserve Bank of India (RBI) has introduced measures to simplify factoring and protect stakeholders, particularly MSMEs. The Trade Receivables Discounting System (TReDS) helps businesses transparently discount receivables, ensuring timely payments and reducing default risks. With favorable policies and ongoing digital innovation, the Indian factoring market is on a strong growth trajectory, attracting more participants and transforming the financial landscape.

Request for a sample copy of this report: https://www.imarcgroup.com/india-factoring-market/requestsample

India Factoring Market Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Type:

-

International

-

Domestic

Breakup by Organization Size:

-

Small and Medium Enterprises

-

Large Enterprises

Breakup by Application:

-

Transportation

-

Healthcare

-

Construction

-

Manufacturing

-

Others

Breakup by Region:

-

North India

-

West and Central India

-

South India

-

East and Northeast India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=21607&flag=C

Key highlights of the Report:

-

Market Performance (2019-2024)

-

Market Outlook (2025-2033)

-

Porter’s Five Forces Analysis

-

Strategic Recommendations

-

Historical, Current and Future Market Trends

-

Market Drivers and Success Factors

-

SWOT Analysis

-

Structure of the Market

-

Value Chain Analysis

-

Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145