Japan Electric Car Market Growth Poised for Significant Growth Amidst Global EV Trends

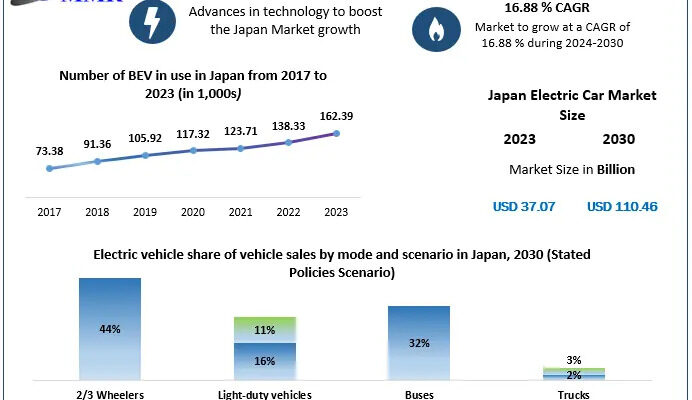

Japan Electric Car Market Growth is on the brink of substantial expansion, reflecting both domestic initiatives and global shifts toward sustainable transportation. Recent analyses indicate that the market, valued at approximately USD 37.07 billion in 2023, is projected to reach USD 110.46 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 16.88% during the forecast period.

Click here for free sample + related graphs of the report @https://www.maximizemarketresearch.com/request-sample/64510/

Market Definition and Estimation

Electric cars, powered exclusively by electric motors using energy stored in rechargeable batteries, have emerged as pivotal solutions to reduce greenhouse gas emissions and dependence on fossil fuels. In Japan, the transition toward electric vehicles (EVs) aligns with national goals to achieve net-zero emissions by 2050 and a 46% reduction by 2030. In 2021, electric vehicles constituted 2.2% of all new passenger car sales in Japan, with 88,535 units sold.

Market Growth Drivers and Opportunities

Several factors are propelling the growth of Japan’s electric car market:

-

Government Policies and Incentives: The Japanese government has implemented robust policies, including subsidies and tax incentives, to encourage EV adoption. Notably, subsidies have reached up to 800,000 yen (approximately USD 7,000), making electric cars more accessible to consumers.

-

Environmental Awareness: Increasing public consciousness about environmental issues, such as air pollution and climate change, is driving demand for cleaner transportation alternatives.

-

Technological Advancements: Progress in battery technology, leading to improved energy density and reduced costs, enhances the practicality and appeal of electric vehicles.

-

Charging Infrastructure Development: Expansion of charging networks across Japan addresses range anxiety and supports the daily use of electric cars.

Segmentation Analysis

The Japanese electric car market can be segmented based on vehicle type and drivetrain technology:

-

Vehicle Type:

- Passenger Vehicles: Comprising the majority of EV sales, passenger vehicles are favored for personal use due to their efficiency and lower operating costs.

- Commercial Vehicles: Electric commercial vehicles, including buses and delivery trucks, are gaining traction, particularly in urban areas, due to their environmental benefits and lower maintenance requirements.

-

Drivetrain Technology:

- Battery Electric Vehicles (BEVs): Operating solely on battery power, BEVs are the most common type of electric car in Japan.

- Plug-in Hybrid Electric Vehicles (PHEVs): Combining internal combustion engines with electric propulsion, PHEVs offer flexibility but are less prevalent compared to BEVs.

Country-Level Analysis: USA and Germany

The global landscape of electric vehicle adoption provides valuable insights:

-

United States: In 2023, electric car sales in the U.S. neared 14 million units, with electric vehicles accounting for approximately one in ten new car registrations.

Companies like Ford and General Motors have reported significant increases in EV sales, with GM’s EV sales growing by over 50% to 114,000 units in 2024.

-

Germany: The German electric vehicle market has experienced fluctuations. In 2024, battery electric vehicle (BEV) sales declined by 27.4% to 380,609 units, representing 13.5% of the market share, down from 18.4% in 2023.

This decline is attributed to the abrupt end of BEV subsidy programs at the end of 2023.

For more information about this report visit: https://www.maximizemarketresearch.com/market-report/japan-electric-car-market/64510/

Competitive Landscape

Key players in Japan’s electric car market include:

-

Nissan: Leading domestic EV sales with 54,800 units, 68% of which were the light-duty Sakura model.

-

Mitsubishi Motors: Reported sales of 7,021 eK X electric vehicles.

-

Toyota: Sold 2,929 electric vehicles, reflecting a growing commitment to electrification.

1. Toyota Motor Corporation

2. Nissan Motor Corporation

3. Mitsubishi Motors Corporation

4. Subaru Corporation

5. Mazda Motor Corporation

6. Daihatsu Motor Co. Ltd

7. Volvo Car Japan Ltd

8. Suzuki Motor Corporation

These companies are investing in research and development to enhance battery technology, expand model lineups, and improve charging infrastructure, aiming to increase their market share in the evolving EV landscape.