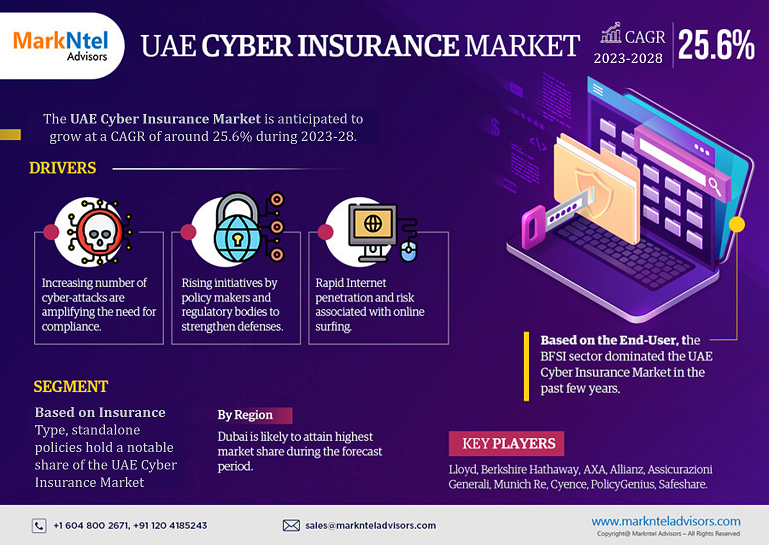

A Quick Overview of UAE Cyber Insurance Market

The key object of this report on the UAE Cyber Insurance Market is to offer worthy data and a geographical perspective for predictions of market growth in the future. The recommendations added in this detailed report are insightful, and actionable offering a deep understanding of the industry. Moreover, it includes a comprehensive importance of aspects that have impacted the industry.

MarkNtel Advisors has recently studied an extensive market intelligence evaluation on the UAE Cyber Insurance Market. Also, the newly released report exhibits an engaging format that comprises compelling graphs, tables, charts, and figures as well. These seamlessly combined visual aids are designed to support the clarity and accuracy of the details presented, offering analysts a deep knowledge of the topic at hand.

✅In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecast for years 2025 to 2028, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

If you’re interested in the assumptions considered in this study, you can download the PDF brochure- – https://www.marknteladvisors.com/query/request-sample/uae-cyber-insurance-market.html

UAE Cyber Insurance Market Scenario:

The UAE Cyber Insurance Market is anticipated to grow at a CAGR of around 25.6% during the forecast period, i.e., 2023-28. Most of the market expansion would be propelled by the increasing incidence of cyberattacks among organizations, resulting in massive financial losses, coupled with ever-increasing requirements of enterprises to protect sensitive data from ransomware & malware. Besides, the increasing adoption of advanced technologies like the IoT, AI, etc., coupled with technological advancements like next-generation as well as integrated security solutions and the rapid transition of businesses to cloud-based models, are other prominent aspects projected to stimulate the market expansion through 2028.

UAE Cyber Insurance Market – Industry Dynamics, Size, And Opportunity Forecast To 2028:

Market Driver – Increasing Instances of Cyberattacks & Data Breaches in the UAE

The rapid digitalization in businesses across the UAE has resulted in an astronomical surge in the incidences of data breaches & cybercrimes. Many sectors like BFSI, retail, and healthcare are becoming the most attractive target for attackers due to the large volume of sensitive customer data within these sectors. Additionally, the increasing adoption of online shopping, mobile banking, Electronic Medical Records (EMRs) is another crucial aspect that proliferates the risk of data breaches in these industries. Hence, the increasing number of cybercrimes is likely to propel the demand for cyber insurance in the year to come.

UAE Cyber Insurance Market Segmentation Analysis:

UAE Cyber Insurance Industry, analyzes, identifies, and highlights the main trends and drivers which are affecting each segment of the market. The market has been further divided into the following categories:

By Component

- Solution

- Cyber Insurance Analytics Platform

- Disaster Recovery and Business Continuity

- Cybersecurity Solutions

- Service

- Consulting/Advisory

- Security Awareness Training

- Other Services

By Coverage

- First Party

- Theft and Fraud

- Computer Program and Electronic Restoration

- Extortion

- Forensic Investigation

- Business Interruption

- Third Party

- Crisis Management

- Credit Monitoring

- Regulatory Response

- Privacy and Security Liability

- Network Security Liability

- Media and Communication Liability

By Insurance Type

- Packed

- Standalone

By Organization Size

- Large Enterprises

- Small & Medium Sized Enterprise

By End-User

- BFSI

- IT & Telecom

- Defence

- Energy & Power

- Retail

- Healthcare

- Others

By Country

- Dubai

- Abu Dhabi

- Sharjah

- Rest of UAE.

Browse Full Report Along with TOC and Figures – https://www.marknteladvisors.com/research-library/uae-cyber-insurance-market.html

Who are the Key Market Players in the UAE Cyber Insurance Market?

In the fast-changing UAE Cyber Insurance Market, understanding what our competitors are doing is crucial. By carefully analyzing things, we figured out some of the dominating players in the industry. So, the top companies of the UAE Cyber Insurance market ruling the industry are:

List of Key Companies Profiled:

- Lloyd

- Berkshire Hathaway

- AXA

- Allianz

- Assicurazioni Generali

- Munich Re

- Cyence

- PolicyGenius

- Safeshare.

Note – If there are any particular details you need that are not currently included in the report, we will be happy to provide them as part of our customization services.

*Reports Delivery Format – Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address

Other Report:

- https://whatech.com/og/markets-research/it/895856-exploring-the-growth-of-the-global-custom-t-shirt-printing-market-valued-at-usd-6-2-billion-in-2023-projected-to-grow-at-a-9-2-cagr-from-2024-to-2030.html

- https://whatech.com/og/markets-research/consumer/895857-exploring-the-future-global-data-catalog-market-expected-to-grow-at-23-3-cagr-from-2023-to-2028.html

- https://whatech.com/og/markets-research/materials-chemicals/895866-the-global-geofoam-market-expected-cagr-growth-of-6-8-over-the-2023-2028-forecast-period.html

Why Choose MarkNtel Advisors:

- Focused Industry Expertise

- Diverse Report Offerings

- Personalized Research Solutions

- Robust Research Methodology

- In-depth Report Coverage

- Tracking Technological Advancements

- Comprehensive Value-Chain Analysis

- Discovering Market Opportunities

- Analyzing Growth Trajectories

- Assured Quality Insights

- Dedicated After-Sales Support

- Trusted by Fortune 500 Companies

Contact Us –

Call +1 628 895 8081 +91 120 425.68433

Email: sales@marknteladvisors.com