As a small business owner, managing payroll can feel like a daunting task. From calculating wages to ensuring tax compliance, there’s a lot to keep track of. Fortunately, a paystub creator can simplify payroll and save you valuable time. In this blog, we’ll explore what a paystub creator is, how it works, and why it’s a game-changer for small businesses. By the end, you’ll see how using a paystub creator can streamline your payroll process, reduce errors, and improve your overall business efficiency.

What is a Paystub Creator?

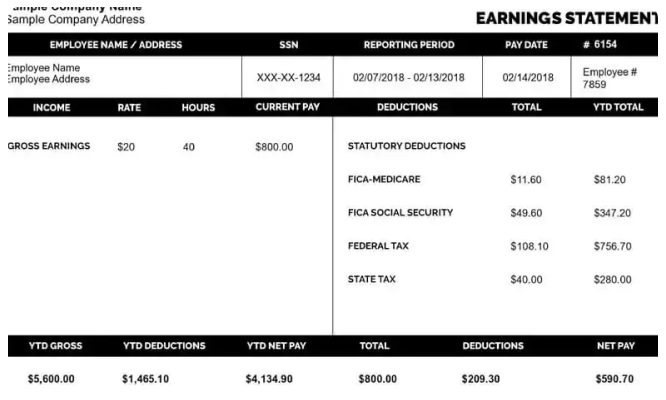

A paystub creator is an online tool or software that helps businesses generate pay stubs or pay slips. These pay stubs provide a detailed breakdown of an employee’s earnings, taxes, and deductions. A pay stub is a vital document for both the employer and the employee because it ensures transparency and keeps records accurate.

When you run payroll manually, it can be time-consuming and prone to mistakes. A paystub creator automates the process, ensuring that all the required information is correctly calculated and presented in an easy-to-read format.

Here are the key details typically included on a pay stub generated by a paystub creator:

- Employee information: Name, address, and other personal details.

- Earnings: Regular wages, overtime pay, bonuses, or commissions.

- Deductions: Federal and state taxes, Social Security, Medicare, insurance, and retirement contributions.

- Net pay: The final amount an employee takes home after deductions.

- Pay period: The time frame the paycheck covers, typically weekly, bi-weekly, or monthly.

How Does a Paystub Creator Work?

Using a pay stub creator is simple and intuitive. Here’s a basic breakdown of how it works:

-

Input Employee Details: You enter essential details like the employee’s name, pay rate, deductions, and any additional earnings (such as overtime or bonuses).

-

Select the Pay Period: You specify whether the employee is being paid weekly, bi-weekly, or monthly.

-

Enter Earnings and Deductions: The software allows you to input regular wages, bonuses, and commissions, along with deductions like taxes, insurance, and retirement contributions.

-

Generate the Paystub: Once all the details are entered, the paystub creator automatically generates a paystub. The pay stub will include the breakdown of gross pay, deductions, and net pay.

-

Download or Share: The paystub is available for download, printing, or sharing electronically with your employees.

Most paystub creators also offer features like saving employee records for future payroll runs and integrating with accounting software.

Benefits of Using a Paystub Creator for Small Businesses

For small businesses, managing payroll without a paystub creator can be a time-consuming task that leads to errors and unnecessary stress. Let’s take a look at the key benefits of using a paystub creator:

1. Saves Time

A paystub creator automates much of the payroll process, reducing the time you spend calculating each employee’s pay and deductions. Instead of manually adding up hours worked, taxes owed, and other variables, the software does it for you. This means you can focus on other important aspects of running your business.

2. Reduces Errors

Manually calculating pay can lead to mistakes, especially when it comes to deductions and overtime. These errors can be costly, potentially resulting in unhappy employees or even fines for tax non-compliance. A paystub creator ensures all calculations are accurate, reducing the risk of errors and helping you stay compliant with tax regulations.

3. Ensures Compliance

With constantly changing tax laws and regulations, staying compliant can be tricky. A paystub creator is updated regularly to reflect current tax rates and legal requirements. This helps ensure that all deductions, taxes, and other legal requirements are correctly calculated. By using a paystub creator, you’re more likely to avoid penalties or audits related to payroll issues.

4. Streamlines Record-Keeping

Keeping track of payroll records is crucial for tax purposes, audits, and employee disputes. A paystub creator automatically stores all pay stubs in a digital format, which makes record-keeping easier and more organized. You can quickly access pay stubs for past pay periods without the hassle of digging through paper records.

5. Improves Employee Transparency

Employees appreciate having clear and accurate pay stubs that outline how their earnings are calculated. A paystub creator ensures that pay stubs are easy to understand, offering transparency about their pay, deductions, and net earnings. This can improve employee satisfaction and reduce payroll-related disputes.

6. Cost-Effective

For small businesses, budget constraints are always a consideration. A paystub creator is an affordable solution compared to hiring an accountant or payroll service. Many paystub creators offer subscription-based pricing, which means you only pay for what you use. This makes it a highly cost-effective option for businesses looking to streamline their payroll processes.

7. Convenience for Remote Workers

In today’s world, more businesses have employees working remotely or in different locations. A paystub creator allows you to generate and send pay stubs electronically, which is convenient for remote workers. Employees can access their pay stubs from anywhere, reducing the need for physical copies and ensuring they have easy access to their payment information.

How to Choose the Right Paystub Creator

Not all paystub creators are the same, and it’s essential to find one that suits your business’s needs. Here are a few factors to consider when choosing a paystub creator:

1. User-Friendliness

The paystub creator should be easy to use, even for those without much experience in payroll processing. Look for a tool with an intuitive interface and clear instructions that make creating pay stubs a straightforward task.

2. Customization Options

Every business is different, and you may need certain customization options. Look for a paystub creator that allows you to add specific deductions, bonuses, and benefits relevant to your business. Customization options ensure your pay stubs reflect your unique payroll structure.

3. Security

Since pay stubs contain sensitive information, security is a top priority. Choose a paystub creator that offers secure data storage and encryption to protect employee and business information. This helps prevent unauthorized access to confidential payroll data.

4. Integration with Other Tools

If you use accounting or time-tracking software, look for a paystub creator that integrates with these tools. Integration can help eliminate duplicate data entry and streamline your entire payroll process.

5. Pricing

Paystub creators come with a range of pricing options. Consider how often you run payroll and compare the pricing models of different tools. Some creators offer pay-as-you-go options, while others have subscription plans based on the number of employees. Choose one that fits your business budget.

Final Thoughts

Managing payroll is one of the most critical tasks for small business owners, but it doesn’t have to be overwhelming. A free paystub creator can simplify payroll by automating calculations, reducing errors, and ensuring compliance. It saves you time, keeps your records organized, and helps improve employee satisfaction. By using a paystub creator, you’re not only streamlining your payroll process but also ensuring your business operates more efficiently.

For small businesses looking to minimize administrative work and avoid payroll-related headaches, a paystub creator is a smart investment. It’s a user-friendly, cost-effective tool that allows you to focus on growing your business while ensuring your employees are paid accurately and on time.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season