In today’s fast-paced business world, managing payroll accurately and efficiently is no longer optional. Whether you’re a small business owner, a freelancer, or managing a team of hundreds, creating and maintaining accurate paystubs is critical. A paystub creator simplifies this process, saving time, reducing errors, and ensuring compliance with legal and financial requirements.

This blog will explore why every business needs a paystub creator in 2024, the benefits it brings, and how it can transform your payroll process.

What is a Paystub Creator?

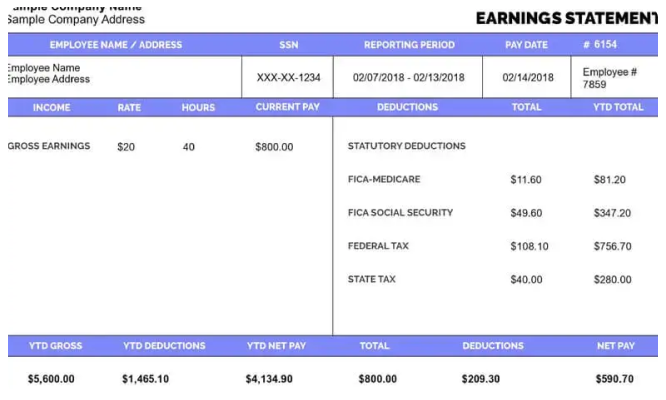

A paystub creator is a digital tool that generates paystubs, which are detailed records of an employee’s earnings, deductions, and net pay for a specific period. These documents are essential for both employers and employees, offering transparency and ensuring proper financial tracking.

Gone are the days of manually crafting paystubs on spreadsheets or paper. Paystub creators offer automated, user-friendly interfaces that produce professional and accurate paystubs in minutes.

Why Are Paystubs Important?

Paystubs serve as a financial roadmap for employees and a record-keeping tool for employers. Here’s why they’re essential:

- Employee Transparency: Employees can see exactly how their pay is calculated, including taxes, deductions, and overtime.

- Compliance: Many states in the U.S. require businesses to provide paystubs to employees.

- Loan and Credit Applications: Employees need paystubs to verify income when applying for loans, mortgages, or renting apartments.

- Tax Filing: Paystubs help both employers and employees reconcile earnings and deductions during tax season.

Benefits of a Paystub Creator

Here are the top reasons why every business needs a paystub creator in 2024:

1. Saves Time

Manual payroll management is time-consuming and prone to errors. A paystub creator automates calculations, ensuring that every detail—such as taxes, benefits, and deductions—is accurate. This frees up valuable time for business owners and HR professionals to focus on growth.

2. Reduces Errors

Payroll errors can lead to employee dissatisfaction, compliance issues, and financial penalties. A paystub creator minimizes the risk of miscalculations by automating the entire process with precision.

3. Ensures Compliance

Employment laws regarding pay transparency and payroll reporting vary by state. A reliable paystub creator incorporates these legal requirements, ensuring your business stays compliant.

4. Improves Employee Trust

Providing clear and professional paystubs demonstrates your commitment to transparency. When employees understand how their pay is calculated, they are more likely to trust their employer.

5. Enhances Professionalism

A well-designed pay stub with your company’s branding adds a level of professionalism that reflects positively on your business.

6. Supports Remote and Freelance Workforce

As remote work and freelancing become the norm, paystub creators provide an easy solution to manage payroll for employees and contractors across various locations.

7. Cost-Effective

Many paystub creators are affordable and even offer free trials. Compared to the cost of hiring payroll services, they’re a budget-friendly solution for small businesses.

Key Features of a Good Paystub Creator

When choosing a paystub creator, look for these features:

- Customization: The ability to include company logos, employee details, and specific deductions.

- Accuracy: Automated calculations for taxes, benefits, and overtime.

- User-Friendly Interface: A simple, intuitive platform that doesn’t require advanced technical skills.

- Cloud Access: Ensures you can access and generate paystubs from anywhere.

- Security: Protects sensitive financial and personal data with encryption and secure servers.

- Legal Compliance: Adheres to state and federal payroll regulations.

- Download and Print Options: Provides flexibility for employees to access their paystubs in various formats.

Who Needs a Paystub Creator?

1. Small Business Owners

For small businesses with limited resources, a paystub creator is a game-changer. It simplifies payroll processing and ensures compliance without the need for costly software or payroll specialists.

2. Freelancers and Contractors

Freelancers often need paystubs to provide proof of income for loans or tax purposes. A paystub creator allows them to generate professional paystubs that meet financial requirements.

3. HR and Payroll Professionals

For HR departments, a paystub creator streamlines payroll management, reducing workload and ensuring accuracy.

4. Remote and Gig Workers

Businesses employing remote workers or gig employees need a reliable way to issue paystubs, especially when working across state lines with varying tax regulations.

How to Choose the Right Paystub Creator

With so many options available, selecting the right paystub creator for your business can feel overwhelming. Here are some tips:

- Assess Your Needs: Determine the number of employees, frequency of payroll, and any specific requirements, such as multi-state compliance.

- Read Reviews: Look for tools with positive feedback from similar businesses.

- Test Free Trials: Many paystub creators offer free trials or demos to help you evaluate their features.

- Compare Costs: Choose a paystub creator that fits your budget without compromising on quality.

- Customer Support: Opt for a platform with reliable customer service to help with any issues.

Top Paystub Creators to Consider in 2024

Here are some popular paystub creators known for their reliability and user-friendly features:

- PayStubCreator: Known for its ease of use and customization options.

- Real Check Stubs: Offers professional templates and fast delivery.

- Stub Creator: Ideal for small businesses, offering accurate and affordable solutions.

- Check Stub Maker: A simple and efficient tool for freelancers and small businesses.

Frequently Asked Questions About Paystub Creators

1. Are paystub creators legal?

Yes, paystub creators are legal as long as they are used to generate accurate and honest paystubs that reflect real financial transactions.

2. Can I use a paystub creator for contractors?

Absolutely. Many paystub creators allow you to customize paystubs for independent contractors, including their unique tax and payment details.

3. How much do paystub creators cost?

Costs vary depending on the provider and features. Some offer pay-as-you-go pricing, while others have monthly subscriptions or free basic options.

Conclusion

In 2024, a Free paystub creator is not just a luxury—it’s a necessity for every business. From saving time and ensuring accuracy to enhancing professionalism and compliance, these tools offer a host of benefits that streamline payroll management.

Whether you’re running a small business, managing a team of remote workers, or freelancing, a paystub creator empowers you to handle payroll with confidence. Investing in a reliable paystub creator is a step toward better financial management and smoother operations.

Make the smart choice for your business today—start using a paystub creator and experience the difference it can make.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season