Running a small business comes with a variety of challenges. From managing inventory to keeping customers happy, it’s easy for small business owners to become overwhelmed with the numerous tasks they have to juggle daily. One of the most time-consuming—and critical—tasks is payroll. Paying your employees accurately and on time is not just a matter of keeping them happy; it’s also essential for staying compliant with tax laws and labor regulations.

Luckily, modern technology has made payroll processing easier, faster, and more accurate. One tool that can significantly simplify payroll is a paycheck generator. This article will dive into how small businesses can streamline payroll using a paycheck generator, the benefits it offers, and why it’s an essential tool for any business owner.

Table of Contents

ToggleWhat Is a Paycheck Generator?

A paycheck generator is a software tool designed to calculate employee pay and generate paychecks or pay stubs. It helps small business owners accurately calculate wages, deductions, taxes, and other withholdings to ensure compliance with federal and state regulations. Whether you’re paying employees hourly, salaried, or through commission-based systems, a paycheck generator can make the process quick and straightforward.

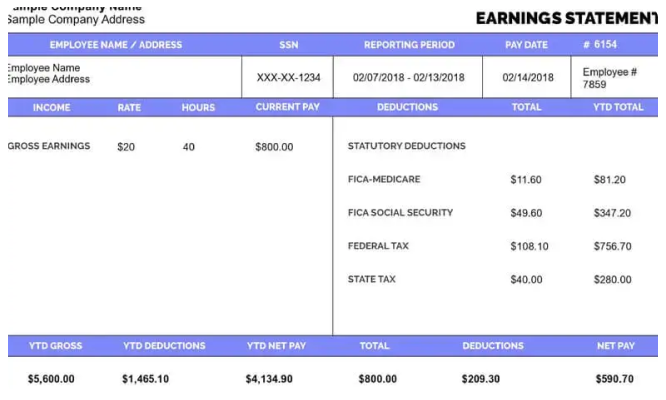

With just a few pieces of information, such as the employee’s pay rate, hours worked, and tax deductions, a paycheck generator can produce a pay stub that reflects all the necessary details, including the gross pay, deductions (like taxes, insurance, and retirement contributions), and net pay. Some paycheck generators also integrate with accounting software, making it even easier to manage payroll and maintain accurate financial records.

Why Small Businesses Need a Paycheck Generator

For small business owners, handling payroll is often a daunting task. There are numerous factors to consider, including:

-

Accurate Calculations: Getting payroll wrong can result in unhappy employees, fines, or even legal action. A paycheck generator ensures that wages, taxes, and deductions are calculated correctly every time.

-

Time-Saving: Calculating payroll manually is time-consuming. A paycheck generator automates the process, reducing the time spent on this task and allowing business owners to focus on more important aspects of the business.

-

Tax Compliance: Small businesses must adhere to both federal and state tax laws. A paycheck generator can automatically calculate the correct tax withholdings, ensuring compliance with the IRS and local authorities.

-

Record-Keeping: Accurate payroll records are necessary for tax filings and audits. A paycheck generator helps businesses maintain detailed records that are easy to access and organize.

Let’s take a closer look at how a paycheck generator can streamline payroll for small businesses.

1. Faster and More Accurate Payroll Processing

A paycheck generator automates many of the manual tasks involved in payroll processing. Instead of calculating each employee’s pay and deductions by hand, the generator does it for you in a matter of seconds. This not only speeds up the process but also reduces the risk of human error.

When you enter an employee’s hours worked, pay rate, and other necessary information into the paycheck generator, it will calculate:

- Gross pay (before deductions)

- Federal, state, and local taxes

- Deductions for benefits like health insurance, retirement contributions, etc.

- Overtime pay (if applicable)

- Net pay (after all deductions)

For example, if you have employees working in different states, the paycheck generator can take into account the state-specific tax rates and rules to ensure that the correct amount is deducted for taxes. This is especially useful for small businesses that operate in multiple states or cities.

2. Ensure Tax Compliance

One of the biggest headaches for small business owners is staying compliant with the complex world of tax regulations. Payroll taxes include federal income tax, Social Security, Medicare, state taxes, unemployment insurance, and sometimes local taxes. A small mistake in tax calculations can lead to fines or penalties from the IRS.

A free paycheck generator helps businesses ensure tax compliance by automatically calculating all necessary withholdings. Many paycheck generators are updated regularly to reflect changes in tax rates and regulations, so you won’t have to worry about staying up to date on tax law changes.

Moreover, a paycheck generator can also generate tax forms like W-2s and 1099s, making it easier for you to file taxes at the end of the year. Some systems even allow you to e-file these forms directly with the IRS.

3. Customizable Pay Stub Templates

A pay stub, also known as a paycheck stub, is a document that outlines an employee’s pay for a specific pay period. It includes details like:

- Hours worked

- Overtime hours

- Gross pay

- Deductions (taxes, insurance, retirement contributions)

- Net pay

Having a paycheck generator allows you to create professional-looking pay stubs for your employees. Many paycheck generators offer customizable templates, so you can adjust the design and layout to fit your business’s branding. This adds a professional touch and makes it easier for employees to understand the breakdown of their pay.

Providing employees with clear, detailed pay stubs also promotes transparency and helps build trust. Employees appreciate being able to see exactly where their money is coming from and going. It can also prevent disputes over pay discrepancies.

4. Reduce the Risk of Penalties and Fines

Payroll mistakes are costly. If you miscalculate an employee’s pay, underpay them, or fail to deduct the correct amount of taxes, you could face fines or legal issues. In some cases, failing to issue a paycheck on time or providing incorrect pay stubs could lead to lawsuits.

A paycheck generator helps minimize these risks by ensuring accurate and timely payroll processing. The automated calculations reduce the likelihood of mistakes, and the generator’s built-in features help you adhere to regulations. For example, some paycheck generators automatically check for issues like unpaid overtime or incorrect deductions, alerting you to potential problems before they become serious.

5. Integration with Accounting and HR Systems

Managing payroll isn’t just about paying employees—it’s also about keeping accurate financial records. A paycheck generator can often be integrated with your accounting and HR software. This makes it easy to sync payroll data with your other financial records, reducing the need for manual data entry and ensuring consistency across all systems.

For example, when a paycheck generator is connected to your accounting software, it can automatically record payroll expenses, tax withholdings, and other deductions. This makes it easier to generate financial reports, track business expenses, and file taxes.

Additionally, integrating your paycheck generator with HR software allows you to track employee information, benefits, and time off. This integration streamlines employee management and reduces administrative tasks.

6. Customizable Pay Periods

A paycheck generator allows small businesses to create customized pay periods based on their unique needs. Whether your employees are paid weekly, biweekly, semimonthly, or monthly, the generator can accommodate any pay schedule. This flexibility is especially useful for businesses with varying work schedules or contract employees.

By using a paycheck generator, you ensure that all employees are paid accurately according to their specific pay period, reducing the risk of payroll delays or errors.

7. Improved Employee Satisfaction

Employees value timely and accurate pay. By using a paycheck generator, you can ensure that employees are paid on time and that their pay stubs are easy to understand. This not only helps keep employees satisfied but also fosters a positive work environment.

Providing employees with easy access to their pay stubs can also reduce inquiries about pay, allowing HR and payroll departments to focus on more critical tasks.

8. Affordable for Small Businesses

When you’re running a small business, every penny counts. The good news is that many paycheck generators are affordable and offer pricing plans that scale to your business size. Whether you have a few employees or several dozen, there’s likely a paycheck generator that fits your budget.

Additionally, the time saved and the reduction in payroll errors will more than makeup for the cost of using a paycheck generator. It’s an investment that can help you save money and avoid costly mistakes.

Conclusion

Managing payroll can feel overwhelming as a small business owner, but it doesn’t have to be. By implementing a paycheck generator, you can streamline payroll processing, ensure tax compliance, and reduce the risk of costly mistakes. The time saved by automating payroll tasks allows you to focus on growing your business and improving employee satisfaction.

Whether you’re just starting or looking for a way to improve your current payroll system, a paycheck generator is an essential tool for small business owners. It makes payroll faster, more accurate, and less stressful, ensuring that you can run your business smoothly and efficiently.

Invest in a paycheck generator today, and take the first step toward simplifying your payroll process and improving your business operations.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?