In today’s digital world, online security has become a critical concern for individuals and organizations alike. Among the many threats facing the digital economy, credit card fraud stands out as one of the most significant. Criminals are constantly finding new ways to exploit vulnerabilities in financial systems, and platforms like Bclub.tk have emerged as key players in the illicit trade of stolen credit card information, dumps, and CVV2 data. This article will explore the operations of dumps and CVV2 shops, the role of Bclub.tk in this underground marketplace, and the broader impact of credit card fraud.

Understanding Dumps and CVV2 Data

Before diving into the specifics of Bclub.tk, it’s essential to understand the terms “dumps” and “CVV2,” which are commonly associated with credit card fraud.

-

Dumps: A dump is a collection of data stolen from the magnetic stripe of a credit or debit card. This data includes sensitive information such as the cardholder’s name, card number, and expiration date. Cybercriminals can steal this information by skimming devices placed on ATMs, gas pumps, or other payment terminals. Once obtained, the stolen data can be used to create cloned credit cards or be sold on platforms like Bclub.tk.

-

CVV2: The CVV2 (Card Verification Value 2) is a three- or four-digit security code located on the back of most credit cards. It is used as an additional layer of security for online or over-the-phone transactions. When cybercriminals gain access to both dumps and CVV2 codes, they can engage in fraudulent transactions online or create counterfeit cards for in-person purchases.

These stolen details are then sold on platforms like Bclub.tk, making it easier for criminals to carry out fraud.

The Role of Bclub.tk in the Dark Web Economy

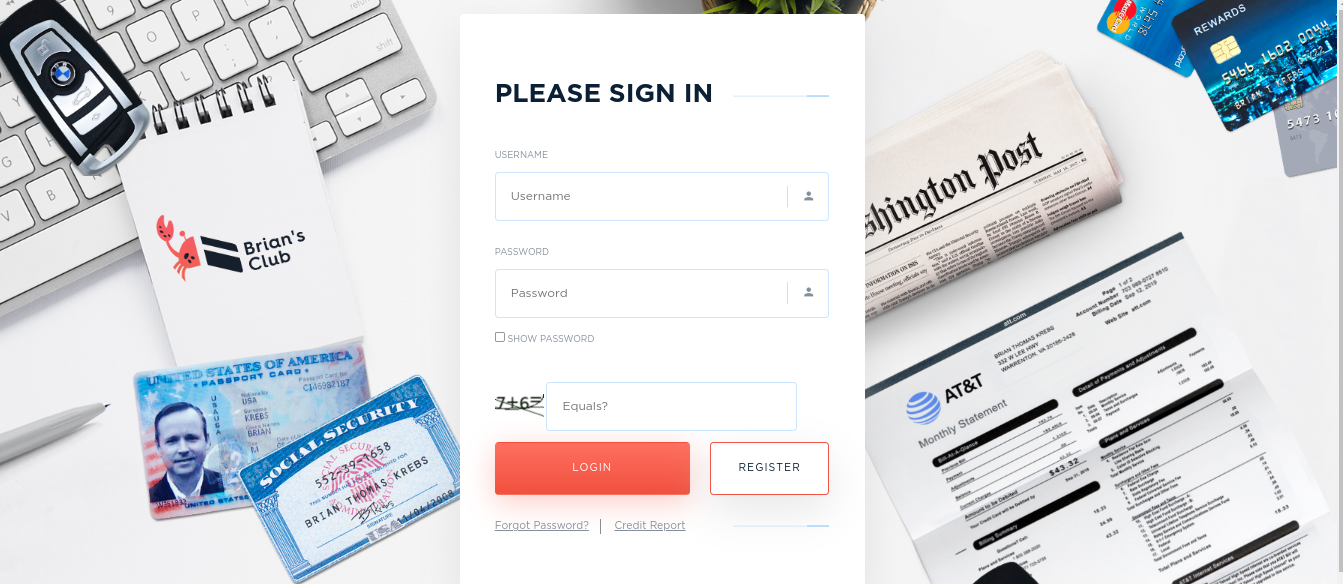

Bclub.tk has established itself as a prominent platform in the underground market, serving as a hub for buying and selling stolen credit card information, including dumps and CVV2 data. It operates like an online marketplace, where users can browse and purchase stolen financial data for a variety of fraudulent purposes.

In the dark web ecosystem, Bclub.tk functions similarly to e-commerce websites on the surface web. Users can sign up for accounts, browse listings of available credit card data, and make purchases using cryptocurrencies such as Bitcoin. Cryptocurrencies are favored for their anonymity, making it harder for law enforcement agencies to track the transactions.

The platform lists various types of stolen financial information, including:

- Credit Card Dumps: Stolen card data from magnetic stripes, which can be used to clone physical cards for use in ATMs or physical stores.

- CVV2 Data: Security codes paired with other card information, which are commonly used in online transactions.

- Fullz: Comprehensive stolen information packages, including credit card details, personal identification, and sometimes even Social Security numbers.

By offering a one-stop shop for stolen financial data, Bclub.tk provides cybercriminals with the resources they need to carry out a range of fraudulent activities.

The Process of Credit Card Fraud on Bclub.tk

Credit card fraud generally follows a predictable pattern, from the theft of card information to its use in fraudulent transactions. Here’s how the process works on platforms like Bclub.tk:

-

Data Theft: Cybercriminals use skimming devices, phishing attacks, or malware to steal credit card information. These methods allow criminals to capture the data stored on a card’s magnetic stripe or CVV2 code without the cardholder’s knowledge.

-

Selling the Data: Once the data has been stolen, it is listed for sale on platforms like Bclub.tk. Sellers provide details about the card issuer, the balance, and whether the card includes a CVV2 code. Prices vary depending on the card’s issuing bank, available balance, and the seller’s reputation.

-

Purchasing the Data: Buyers on Bclub.tk can browse listings and select the stolen data they want to purchase. Once they have paid in cryptocurrency, the information is delivered, typically through an encrypted communication method.

-

Monetizing the Data: After purchasing the stolen information, cybercriminals can use it in several ways. They may create cloned cards for use in physical stores, withdraw cash from ATMs, or make online purchases using the CVV2 data. The stolen goods are often sold on secondary markets for a profit, or the cards may be resold to other criminals for further exploitation.

The Consequences of Credit Card Fraud

Credit card fraud facilitated by platforms like Bclub.tk has serious consequences for both consumers and financial institutions.

-

Impact on Consumers: Victims of credit card fraud face the immediate inconvenience of having their cards canceled and dealing with unauthorized charges. While most banks offer fraud protection, resolving these disputes can take time and cause significant stress. In severe cases, victims may face long-term financial damage if their personal information is used for identity theft.

-

Impact on Financial Institutions: Banks and credit card companies bear much of the financial burden when fraud occurs. While customers are usually reimbursed for unauthorized transactions, the financial institutions must absorb the cost. This, in turn, leads to higher fees and interest rates for all customers, as banks try to recoup their losses.

-

Impact on Businesses: Merchants can also suffer from credit card fraud. When fraudulent transactions occur, businesses are often required to cover the costs of chargebacks, where the card issuer reverses the payment. In addition, businesses that experience high levels of fraud may face reputational damage, losing the trust of their customers.

Legal Risks for Cybercriminals on Bclub.tk

Engaging in credit card fraud is illegal, and law enforcement agencies around the world are actively working to shut down platforms like Bclub.tk. Cybercriminals who buy and sell stolen credit card data risk facing severe legal consequences if caught.

Despite the anonymity offered by cryptocurrencies, law enforcement agencies have developed sophisticated methods for tracking transactions on the dark web. In recent years, several large-scale dark web marketplaces have been dismantled, and many of their users arrested.

Cybercriminals face charges that can range from identity theft to wire fraud, with penalties including hefty fines and long prison sentences. As governments continue to improve their ability to track and prosecute cybercrime, the risks for criminals operating on platforms like Bclub.tk will only increase.

How Financial Institutions Are Fighting Back

In response to the growing threat of credit card fraud, financial institutions have implemented a variety of security measures designed to protect their customers’ data.

-

EMV Chip Cards: One of the most effective tools in the fight against card cloning is the EMV chip card, which creates a unique transaction code each time the card is used. This makes it much harder for cybercriminals to clone cards, as the stolen data is essentially useless without the physical chip.

-

Fraud Detection Systems: Banks and credit card companies use advanced fraud detection systems to monitor transactions in real-time. Machine learning algorithms analyze a cardholder’s spending patterns and flag unusual transactions for review.

-

Tokenization: Tokenization replaces sensitive card information with a randomly generated identifier, or token, during online transactions. This ensures that even if the data is intercepted, it cannot be used for fraud.

-

Consumer Education: Financial institutions are also working to educate their customers on how to protect themselves from credit card fraud. Many banks offer resources on how to identify phishing scams, secure their online accounts, and monitor their credit card activity.

How to Protect Yourself from Credit Card Fraud

While financial institutions play a significant role in preventing fraud, consumers must also take steps to protect their credit card information. Here are a few tips to safeguard your financial data:

-

Monitor Your Accounts Regularly: Regularly check your credit card and bank statements for any unauthorized transactions. Most banks offer mobile alerts for suspicious activity, allowing you to act quickly if your information is compromised.

-

Use Two-Factor Authentication (2FA): Enable two-factor authentication for your online banking accounts. This adds an extra layer of security by requiring you to enter a code sent to your phone or email in addition to your password.

-

Be Cautious with Public Wi-Fi: Avoid accessing sensitive accounts, such as your online banking, while connected to public Wi-Fi networks. These networks are often unsecured and can be a hotspot for cybercriminals.

-

Use Virtual Credit Cards for Online Purchases: Some banks and financial services offer virtual credit cards that generate a temporary card number for each online transaction. This limits the risk of your actual card information being stolen.

-

Consider Identity Theft Protection Services: Identity theft protection services can monitor your financial accounts for unusual activity and alert you if your personal information has been compromised.

Conclusion

The rise of platforms like Bclub.tk has created new opportunities for cybercriminals to profit from stolen credit card data, dumps, and CVV2 codes. However, as law enforcement and financial institutions continue to crack down on these activities, the risks for criminals operating in this space are growing. For consumers, the best defense against credit card fraud is vigilance and proactive measures to secure their financial information. By staying informed and taking steps to protect themselves, consumers can help mitigate the impact of this widespread and damaging form of cybercrime.