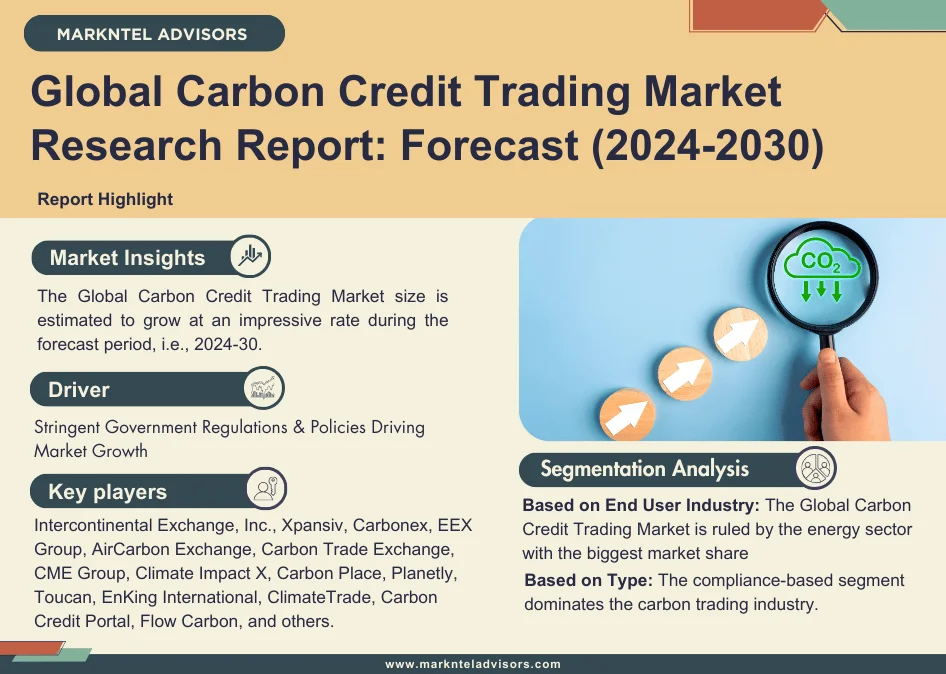

Market Insights

As per recent research by MarkNtel Advisors, The Global Carbon Credit Trading Market size is estimated to grow at an impressive rate during the forecast period, i.e., 2024-30.

Global Carbon Credit Trading Market Driver:

Stringent Government Regulations & Policies Driving Market Growth – The carbon credit trading industry is growing & witnessing impressive revenue growth as a result of strict government policies and regulations. Around the world, governments are enforcing strict environmental laws to mitigate the negative impacts of greenhouse gas (GHG). These strict regulations frequently involve mandatory emission reduction caps and targets, forcing companies to come up with practical solutions to comply. Carbon credit trading enables companies to effectively adhere to these regulations without facing additional costs. Organizations that cut their emissions below the mandated levels can earn from selling their extra carbon credits, while those that offset their emissions and stay under the established limits can do so by acquiring carbon credits.

A strict regularity framework stimulates enterprises to invest in sustainable practices and greener technology. Therefore, strict government regulations and laws are key factors in developing a healthy carbon trading market, increasing the demand for carbon credits, while inspiring greater numbers of individuals to get involved in the fight against climate change.

Request Free Sample Report: https://www.marknteladvisors.com/query/request-sample/carbon-credit-trading-market.html

Market Segmentation and Consumer Behavior:

By Type

- Voluntary – Market Size & Analysis By Revenues- USD Million

- Compliance Based – Market Size & Analysis By Revenues- USD Million

By End User Industry

- Energy – Market Size & Analysis By Revenues- USD Million

- Power generation

- Oil and gas

- Renewable Projects

- Manufacturing and Heavy Industry– Market Size & Analysis By Revenues- USD Million

- Cement

- Steel

- Chemicals

- Others

- Transportation– Market Size & Analysis By Revenues- USD Million

- Aviation

- Marine

- Automobile OEMs

- Forestry and Agriculture – Market Size & Analysis By Revenues- USD Million

- Others– Market Size & Analysis By Revenues- USD Million

By Type of Enterprises

- Large Enterprises– Market Size & Analysis By Revenues- USD Million

- Medium & Small Enterprises – Market Size & Analysis By Revenues- USD Million

Read Full Report: https://www.marknteladvisors.com/research-library/carbon-credit-trading-market.html

Carbon Credit Trading Market Geographical Analysis:

By Region:

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific

Key Players and Competitive Strategies in the Carbon Credit Trading Market

Several prominent players dominate the Carbon Credit Trading Market, including:

- Intercontinental Exchange, Inc.

- Xpansiv

- Carbonex

- EEX Group

- AirCarbon Exchange

- Carbon Trade Exchange

- CME Group

- Climate Impact X

- Carbon Place

- Planetly

- Toucan

- EnKing International

- ClimateTrade

- Carbon Credit Portal

- Flow Carbon

Report Delivery – MarkNtel Advisors offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Questions Addressed in this Study

1.What factors are driving the Carbon Credit Trading Market growth?

2.How is the Carbon Credit Trading Market expected to grow over the next five years?

3.What are the key insights into the current trends in the Carbon Credit Trading Market?

4.What is the current size of the Carbon Credit Trading Market, and how is it projected to change in the future?

6.What is the future outlook for the Carbon Credit Trading Market in terms of technological advancements and market expansion?

Request Customization – https://www.marknteladvisors.com/query/request-customization/carbon-credit-trading-market.html

Read More:

- https://www.marknteladvisors.com/blogs/future-of-coronary-stents-market.html

- https://www.marknteladvisors.com/blogs/future-of-organic-coffee-market.html

- https://www.marknteladvisors.com/blogs/growth-potential-of-colorectal-cancer-market.html

- https://www.marknteladvisors.com/blogs/good-mattresses-enhances-human-health.html

- https://www.marknteladvisors.com/blogs/how-ductile-iron-pipes-are-part-modern-water-infrastructure.html

Why MarkNtel Advisors?

MarkNtel Advisors is a leading research, consulting, & data analytics firm that provides an extensive range of strategic reports on diverse industry verticals. We deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, & individuals, among others.

Our specialization in niche industries & emerging geographies allows our clients to formulate their strategies in a much more informed way and entail parameters like Go-to-Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing & forecasting, & trend analysis, among others, for 15 diverse industrial verticals.

For Media Inquiries, Please Contact:

Call: +1 628 895 8081 | +91 120 4278433

Email: sales@marknteladvisors.com

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

Celebrate in style with our Miami bachelorette party bus. Our Miami VIP bachelorette party bus offers unmatched luxury and fun. Ideal for bachelorette celebrations, this bachelorette party transportation Miami ensures a night to remember with our premium Miami bachelorette party bus rental.