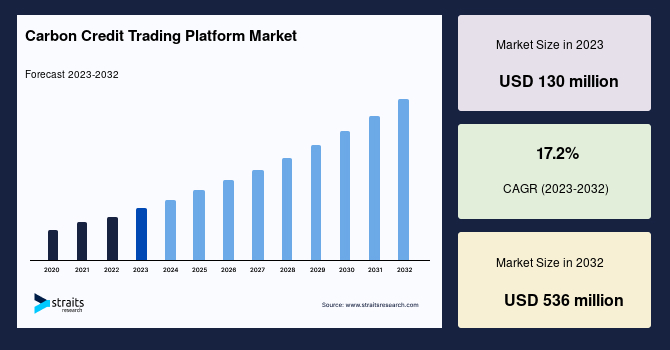

The global carbon credit trading platform market is witnessing significant growth as the world increasingly prioritizes sustainability and climate change mitigation. Valued at USD 130 million in 2023, the market is projected to grow from USD 152 million in 2024 to USD 536 million by 2032, reflecting a robust compound annual growth rate (CAGR) of 17.2% during the forecast period (2024–2032). Carbon credit trading platforms are pivotal in enabling businesses and governments to offset carbon emissions, fostering a transition to a low-carbon economy. These platforms provide a transparent and efficient marketplace for buying and selling carbon credits, driven by regulatory mandates, corporate sustainability goals, and technological advancements.

Get Free Sample Report for Detailed Market Insights : https://straitsresearch.com/report/carbon-credit-trading-platform-market/request-sample

Market Scope and Research Methodology

The carbon credit trading platform market encompasses digital platforms that facilitate the exchange of carbon credits between buyers and sellers. These credits represent verified reductions in greenhouse gas emissions, allowing organizations to meet regulatory requirements or voluntary sustainability targets. The research methodology for this analysis combines primary and secondary research. Primary research includes interviews with industry experts, platform providers, and end-users, while secondary research leverages data from industry reports, government publications, and market databases. The study period spans from 2020 to 2032, with 2023 as the base year for market size estimation.

Key Growth Drivers

-

Government Regulations and Climate Policies

Governments worldwide are implementing stringent regulations to combat climate change, driving the demand for carbon credit trading platforms. For instance, the European Union’s Climate Law mandates a 55% reduction in greenhouse gas emissions by 2030 and aims for climate neutrality by 2050. Similarly, Denmark has introduced one of Europe’s highest corporate carbon taxes to achieve its ambitious emission reduction targets. These policies create a favorable environment for carbon credit trading, as businesses seek cost-effective ways to comply with regulations. -

Corporate Sustainability Initiatives

Companies are increasingly adopting carbon credit trading platforms to meet their sustainability goals and enhance their environmental, social, and governance (ESG) performance. Voluntary carbon markets, where businesses purchase credits to offset emissions voluntarily, are gaining traction as organizations strive to demonstrate their commitment to sustainability.

Restraining Factors

Despite its growth potential, the market faces challenges such as the rising cost of carbon credits and complex verification processes. Price volatility and high transaction costs can deter market participation, while lengthy certification procedures may limit the availability of credits. Additionally, concerns about the credibility of carbon offset projects could hinder market expansion.

Get Free Sample Report : https://straitsresearch.com/report/carbon-credit-trading-platform-market/request-sample

Market Segmentation

-

By Type

-

Voluntary Carbon Market: Dominates the market, driven by corporate sustainability initiatives and voluntary emission reduction commitments.

-

Regulated Carbon Market: Growing rapidly due to government-mandated emission reduction targets and compliance requirements.

-

-

By System Type

-

Cap and Trade: The largest segment, where governments set emission caps and allow trading of allowances.

-

Baseline and Credit: The fastest-growing segment, where entities earn credits for reducing emissions below a baseline level.

-

-

By End-User Industry

-

Industrial: The largest segment, as industries seek to offset emissions and comply with regulations.

-

Utilities: The fastest-growing segment, driven by decarbonization efforts in the energy sector.

-

Energy: Significant growth due to investments in renewable energy projects and carbon offset initiatives.

-

Regional Insights

-

North America

North America is the largest market, with the U.S. and Canada leading the way. The Biden administration’s commitment to the Paris Agreement and Canada’s net-zero emissions target by 2050 are key drivers. The region’s focus on sustainability and corporate responsibility has spurred the adoption of carbon credit trading platforms. -

Asia-Pacific

Asia-Pacific is the fastest-growing region, with countries like China, India, and South Korea implementing emission trading systems. China’s national Carbon Emissions Trading Scheme (ETS) is the largest in the world, while India’s National Solar Mission promotes renewable energy adoption. These initiatives are driving demand for carbon credits in the region.

Key Players

- Nasdaq Inc.

- EEX Group

- AirCarbon Exchange

- Xpansiv

- CME Group

- Climate Impact X

- Planetly

- Likvidi

These companies are focusing on strategic partnerships and technological innovations to strengthen their market position. For example, in April 2024, ZERO13 partnered with Decarb. Earth and CarbonCX to launch a digital solution for carbon credit verification and trading.

Future Outlook

The carbon credit trading platform market is poised for substantial growth, driven by regulatory mandates, corporate sustainability initiatives, and technological advancements. The integration of blockchain, IoT, and AI is expected to enhance transparency, efficiency, and trust in carbon credit transactions. As global efforts to combat climate change intensify, the demand for carbon credits will continue to rise, creating lucrative opportunities for market players.