Being a freelancer or independent contractor comes with many benefits—flexible hours, control over projects, and the ability to be your own boss. However, one of the biggest challenges of self-employment is managing finances, especially when it comes to tracking income. Unlike traditional employees who receive regular pay stubs from their employers, freelancers and contractors need to create their own records of income.

A check stub (also called a pay stub) is an important document that helps freelancers track their earnings, report income for taxes, and provide proof of payment when needed. In this blog, we’ll discuss why check stubs matter for freelancers and contractors, how they can benefit from them, and the best ways to generate check stubs easily.

What Is a Check Stub?

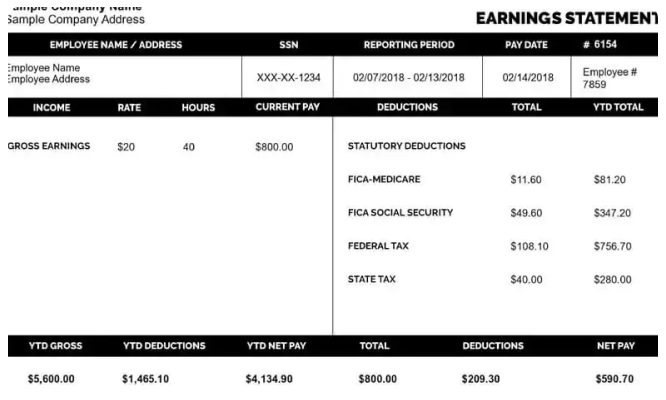

A check stub is a document that provides a breakdown of an individual’s income, including:

✔ Gross pay (total earnings before deductions)

✔ Deductions (taxes, insurance, and other withholdings)

✔ Net pay (final take-home amount)

For traditional employees, check stubs are provided by their employer. However, freelancers and independent contractors must generate their own check stubs since they don’t have a payroll department managing their earnings.

Even though freelancers may receive payments via PayPal, bank transfers, or checks, they often don’t get official pay stubs. This can create issues when proving income for things like loans, tax filing, and financial planning.

That’s why freelancers and contractors need to create and keep check stubs for their records.

Why Freelancers and Contractors Need Check Stubs

If you’re self-employed, you might wonder, “Why do I need check stubs?” After all, you might already keep invoices and bank statements. However, check stubs offer specific benefits that invoices and bank records don’t.

Here’s why freelancers and contractors should generate check stubs:

1. Proof of Income for Loans, Credit, and Rentals

When applying for:

✔ Personal loans

✔ Mortgages

✔ Auto loans

✔ Credit cards

✔ Apartment rentals

Lenders and landlords usually require proof of steady income before approving an application. Since freelancers don’t have employer-generated W-2s or pay stubs, they may struggle to prove how much they earn.

A check stub serves as an official document that shows consistent earnings, making it easier for freelancers to qualify for loans, credit, and rental agreements.

2. Simplifies Tax Filing

Freelancers and contractors are responsible for filing their own self-employment taxes, which can be complicated without proper income records. Unlike traditional employees who receive W-2 forms from their employers, self-employed individuals must track their own earnings.

A check stub helps with tax filing by:

✔ Keeping a record of total income earned

✔ Showing tax deductions and withholdings (if applicable)

✔ Making it easier to complete forms like the 1040 Schedule C

By generating check stubs, freelancers can stay organized and ensure they report accurate income to the IRS.

3. Better Budgeting and Financial Planning

Without a steady paycheck, freelancers often experience income fluctuations from month to month. This makes budgeting and financial planning more challenging.

A check stub provides a clear breakdown of income and deductions, helping freelancers:

✔ Track monthly earnings

✔ Plan for upcoming expenses

✔ Set aside money for taxes and savings

By keeping detailed check stubs, freelancers can manage their cash flow more effectively and avoid financial surprises.

4. Helps With Insurance and Benefits Applications

Freelancers applying for:

✔ Health insurance

✔ Life insurance

✔ Disability insurance

May be required to provide proof of income. Since freelancers don’t receive traditional pay stubs, they must find alternative ways to document their earnings.

A check stub helps demonstrate consistent income, making it easier to qualify for insurance and benefits.

5. Professionalism and Client Trust

Creating and maintaining check stubs also adds a layer of professionalism to a freelancer’s business. It shows that the freelancer takes their finances seriously and operates in a structured manner.

If a client ever requests a proof of payment record, having a check stub on hand can make the process much smoother. This is particularly useful for long-term contracts where clients need financial documentation for their own bookkeeping.

6. Helps With Self-Employment Retirement Contributions

Freelancers don’t have access to employer-sponsored retirement plans like 401(k)s, so they must set up their own retirement savings. Many freelancers contribute to:

✔ Traditional or Roth IRAs

✔ SEP IRAs

✔ Solo 401(k)s

A check stub helps track how much income is available for retirement contributions and provides documentation for tax deductions on retirement savings.

How to Generate Check Stubs as a Freelancer or Contractor

Generating check stubs is easier than you think! There are several ways to create professional pay stubs without needing a payroll department.

1. Use an Online Check Stub Generator

Online check stub generators allow freelancers to quickly create pay stubs by entering:

✔ Income amount

✔ Business name

✔ Pay period

✔ Tax withholdings (if applicable)

Some popular check stub generators include:

✔ PayStubs.com

✔ CheckStubMaker

✔ ThePayStubs.com

✔ FormPros

✔ StubCreator

These tools generate instant check stubs that can be downloaded and printed for record-keeping.

2. Use Accounting Software

If you already use accounting software, many platforms allow you to generate check stubs. Popular options include:

✔ QuickBooks

✔ FreshBooks

✔ Wave Accounting (Free option)

These tools not only create check stubs but also help track expenses, invoices, and taxes.

3. Create a Check Stub Manually

Freelancers who prefer to create their own check stubs can use Microsoft Excel or Google Sheets to make a simple template that includes:

✔ Gross income

✔ Deductions

✔ Net pay

This option requires more effort but allows full customization.

What Information Should a Freelancer’s Check Stub Include?

A check stub should contain:

🔹 Personal Information – Name and address of the freelancer

🔹 Client or Business Information – Name and address of the payer

🔹 Pay Period – Start and end dates of the payment period

🔹 Gross Earnings – Total income before deductions

🔹 Deductions – Taxes, business expenses, retirement contributions (if applicable)

🔹 Net Pay – Final take-home pay

Keeping detailed check stubs ensures accuracy and credibility in financial matters.

FAQs About Check Stubs for Freelancers and Contractors

1. Are check stubs required for freelancers?

No, check stubs are not legally required for freelancers, but they are highly recommended for financial tracking and proof of income.

2. Can check stubs be used for tax reporting?

Yes! Check stubs help freelancers report accurate income and deductions when filing taxes.

3. Can I use check stubs to apply for a mortgage or loan?

Absolutely! Lenders often request check stubs as proof of income when approving loans.

4. Are online check stub generators legal?

Yes, as long as the information entered is accurate and truthful, check stubs created online are valid and widely accepted.

Final Thoughts

Freelancers and independent contractors should take their financial management seriously, and generating check stubs is a smart way to stay organized. Whether you need them for taxes, loan applications, or budgeting, check stubs provide a clear record of income and help maintain financial stability.

With easy-to-use check stub generators, creating professional pay stubs has never been easier. If you’re a freelancer or contractor, start generating check stubs today and take control of your finances! 🚀💰