In this blog post, we will explore everything you need to know about using a free paycheck calculator and how it can simplify your financial planning.

Table of Contents

ToggleWhat is a Paycheck Calculator?

A paycheck calculator, also known as a paycheck creator, is a simple online tool that helps you determine your net income. This means the amount of money you take home after deductions like taxes, insurance, and retirement contributions are subtracted from your gross earnings. By using a paycheck calculator, you can easily see how much you’re really earning per paycheck, whether it’s weekly, bi-weekly, or monthly.

Why You Should Use a Free Paycheck Calculator

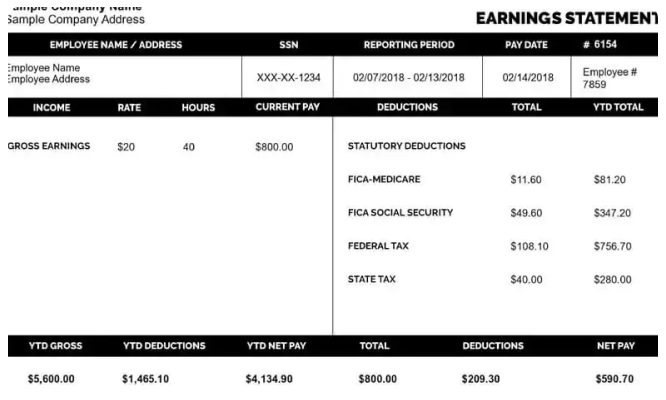

You might be wondering why you should bother with a paycheck creator when your employer already provides you with a pay stub. While pay stubs are helpful, they can sometimes be confusing, especially if you don’t understand all the deductions listed. A paycheck calculator can make things much clearer and give you a better sense of your financial situation.

Here are a few reasons to use a free paycheck calculator:

-

Quick and Easy Calculation: Calculating your take-home pay manually can be time-consuming and prone to errors. A paycheck calculator provides quick, accurate results by taking into account federal and state taxes, Social Security, Medicare, and other deductions.

-

Understand Your Deductions: Many employees don’t fully understand the deductions that appear on their paycheck. A paycheck creator breaks down each deduction, making it easy to see how much is taken out for things like taxes, insurance premiums, and retirement contributions.

-

Budgeting Made Simple: Knowing exactly how much you bring home helps you make better decisions about budgeting and saving. With a paycheck calculator, you can plan your expenses around your actual take-home pay rather than relying on a rough estimate.

-

Understand Overtime and Bonuses: If you work overtime or receive bonuses, a paycheck calculator can help you calculate how much additional money you’ll earn and how much will be deducted from it. This is particularly useful if your pay fluctuates.

-

No Cost Involved: One of the best things about paycheck calculators is that they are typically free to use. Unlike paid financial planning services, these online tools can be accessed without any cost.

How Does a Free Paycheck Calculator Work?

Using a free paycheck calculator is easy, and most websites offer user-friendly interfaces. Here’s a step-by-step guide to using one:

-

Enter Your Gross Pay: This is the amount you earn before any deductions are taken out. It can be your hourly wage or annual salary. If you are paid hourly, you’ll need to input your hourly rate and the number of hours you work.

-

Input Tax Information: The calculator will ask for information about your tax status. This includes your filing status (single, married, etc.), the number of exemptions you claim, and any state-specific tax information. This allows the calculator to estimate how much federal and state taxes will be deducted.

-

Add Deductions: You will need to input any additional deductions, such as health insurance premiums, retirement contributions (e.g., 401(k)), and other withholdings. The calculator will then subtract these from your gross pay.

-

View Your Results: Once you’ve entered all the necessary information, the calculator will provide you with a breakdown of your take-home pay. It will show the deductions, taxes, and other withholdings, giving you a clear picture of your net income.

Key Features of a Good Paycheck Calculator

Not all paycheck calculators are created equal. To get the most out of your experience, look for a calculator that offers the following features:

-

Accurate Tax Calculations: A good paycheck calculator will factor in federal, state, and local taxes, as well as any additional withholding allowances you may have.

-

Real-Time Updates: Since tax rates and deductions can change, choose a calculator that is updated regularly to reflect the latest rates.

-

Customizable Deductions: Some calculators allow you to input custom deductions for things like student loans, insurance, or other personal expenses. This makes it more accurate for your specific situation.

-

Simple and Clear Interface: The best paycheck calculators are straightforward and easy to navigate. They should not require complicated steps or advanced knowledge of payroll.

Types of Paycheck Calculators Available

When you search for a free paycheck creator, you’ll find various types available online. Here are a few common options:

-

Hourly Paycheck Calculators: If you are paid hourly, this type of calculator will help you determine your take-home pay based on the number of hours worked and your hourly wage. It will also factor in overtime if applicable.

-

Salary Paycheck Calculators: For salaried employees, these calculators allow you to input your annual salary and provide a breakdown of your paycheck after taxes and deductions.

-

Freelancer and Contractor Paycheck Calculators: Freelancers and independent contractors often face different tax situations than regular employees. Some paycheck calculators are designed specifically for these workers, taking into account self-employment taxes and other factors.

Benefits for Different Audiences

For Employees:

Using a paycheck calculator helps employees understand their net income better. This is especially useful for those who want to ensure they’re being taxed correctly or need a clearer picture of their finances for saving or spending.

For Freelancers and Contractors:

Freelancers have a unique set of needs when it comes to calculating paychecks. A paycheck creator can help freelancers estimate their take-home pay after accounting for self-employment taxes and other deductions. This allows them to set appropriate rates and plan for quarterly tax payments.

For New Employees:

If you’ve just started a new job, you may be unfamiliar with all the tax and deduction details. A paycheck calculator can help you get comfortable with how much you should expect to take home after the necessary deductions.

Conclusion

A free paycheck calculator is a powerful tool that can help you understand your earnings and manage your finances more effectively. Whether you’re a full-time employee, freelancer, or contractor, using an online paycheck creator will give you quick and accurate results, empowering you to make better financial decisions. With a few simple inputs, you can get a clear picture of your net income and use that information to budget, save, and plan for the future.

Don’t underestimate the value of these tools. They save time, reduce confusion, and provide the clarity you need to take control of your finances. Try a free paycheck calculator today and start understanding your paychecks better!

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs