Running a small business comes with a lot of responsibilities, and managing payroll is one of the most critical tasks. Payroll involves tracking employee hours, calculating wages, handling taxes, and issuing payments—a process that can be time-consuming and prone to errors. For small business owners who may not have a dedicated HR team, these tasks can quickly become overwhelming.

This is where a check stubs maker comes into play. A check stub maker is an online tool that allows small business owners to generate professional and accurate pay stubs for their employees. It simplifies payroll, ensuring accuracy, compliance, and efficiency. Let’s explore how a check stub maker can be a game-changer for small businesses.

1. Streamlining Payroll Processes

Manual payroll calculations can be tedious and time-consuming. A check stubs maker automates many aspects of payroll, allowing small business owners to:

-

Quickly generate pay stubs: Enter employee details, hours worked, and deductions, and the tool does the rest.

-

Save time: Eliminate the need for complex spreadsheets or hiring outside help for payroll tasks.

-

Reduce errors: Automated calculations minimize mistakes, ensuring employees are paid correctly every time.

By using a check stub maker, small businesses can streamline their payroll process, freeing up time to focus on growth and operations.

2. Ensuring Accuracy in Payroll

Mistakes in payroll can lead to unhappy employees, penalties from tax authorities, and additional administrative work. A check stub maker ensures accuracy by:

-

Automating tax calculations: Accurately calculate federal, state, and local taxes, as well as deductions for benefits or retirement contributions.

-

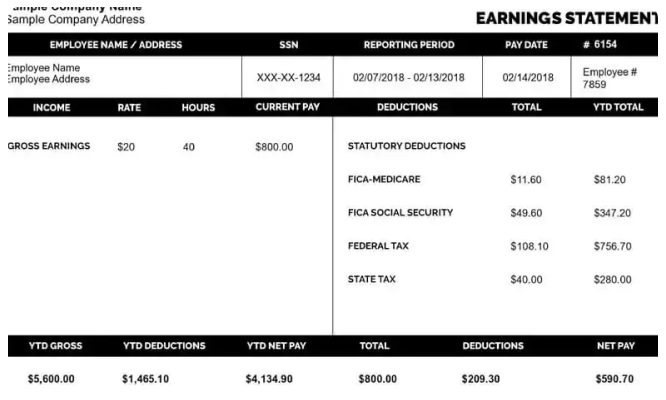

Breaking down earnings: Clearly show gross pay, net pay, and deductions, leaving no room for confusion.

-

Providing consistent formatting: Professional and uniform pay stubs enhance transparency and reduce disputes.

Accuracy in payroll not only boosts employee satisfaction but also ensures compliance with tax laws and regulations.

3. Simplifying Tax Compliance

Tax compliance is a significant concern for small business owners. With different tax rates, deductions, and filing requirements, staying compliant can be challenging. A check stubs maker simplifies tax compliance by:

-

Tracking deductions: Automatically calculate Social Security, Medicare, and other withholdings.

-

Recording payroll history: Maintain detailed records of all employee payments and deductions.

-

Preparing for tax season: Generate year-end summaries and other documentation needed for tax filings.

Having accurate records and documentation can also protect your business in the event of an audit.

4. Saving Costs on Payroll Management

Small businesses often operate on tight budgets, making it essential to find cost-effective solutions. A check stub maker is an affordable alternative to hiring an accountant or purchasing expensive payroll software. Benefits include:

-

Low cost: Many check stubs makers offer affordable pricing plans or pay-per-use options.

-

No additional software needed: Most tools are web-based, eliminating the need for costly installations or updates.

-

DIY convenience: Small business owners can handle payroll independently, reducing reliance on external services.

With a check stub maker, you can achieve professional results without breaking the bank.

5. Providing Proof of Payment

Pay stubs serve as a vital record for both employers and employees. They provide proof of payment, which is essential for:

-

Employee satisfaction: Clear and detailed pay stubs build trust and transparency with your team.

-

Loan and credit applications: Employees often need pay stubs as proof of income for financial transactions.

-

Business audits: Accurate pay stubs help demonstrate compliance during audits or disputes.

A check stubs maker ensures that you have a professional record of every payment, enhancing your business’s credibility.

6. Enhancing Employee Trust and Satisfaction

Employees appreciate transparency when it comes to their earnings. A check stub maker provides detailed pay stubs that show:

-

Gross pay

-

Taxes and deductions

-

Net pay

By offering professional pay stubs, small business owners demonstrate that they value their employees and are committed to clear communication. This can lead to increased employee loyalty and satisfaction.

7. Easy Accessibility and Convenience

Most check stub makers are online tools that can be accessed anytime, anywhere. This convenience is especially beneficial for small business owners who:

-

Work remotely: Manage payroll while on the go.

-

Have flexible schedules: Generate pay stubs at any time that suits their workflow.

-

Need quick solutions: Create and download pay stubs within minutes.

The user-friendly nature of check stubs makers ensures that even those with minimal technical expertise can use them effectively.

8. Supporting Compliance with Labor Laws

Labor laws in the United States often require employers to provide employees with detailed records of their earnings and deductions. A check stubs maker helps small business owners meet these requirements by:

-

Ensuring detailed documentation: Include all necessary information, such as hours worked, overtime, and deductions.

-

Creating audit-ready records: Maintain organized payroll records that comply with federal and state regulations.

-

Avoiding penalties: Stay on the right side of labor laws and avoid fines for non-compliance.

By using a check stub maker, small businesses can confidently navigate the complexities of labor law compliance.

9. Preparing for Business Growth

As your small business grows, so will your payroll needs. A check stub maker can scale with your business, making it easy to:

-

Add more employees: Handle increased payroll demands without additional complexity.

-

Maintain organization: Keep detailed and accurate records as your team expands.

-

Stay efficient: Save time and reduce errors, even with a growing workforce.

Investing in a check stub maker early ensures that your payroll system remains efficient as your business evolves.

10. Features to Look for in a Check Stubs Maker

When selecting a check stubs maker for your small business, look for the following features:

-

Customizable templates: Tailor pay stubs to suit your business needs.

-

Accurate calculations: Ensure precise tax and deduction computations.

-

Secure storage: Protect sensitive employee and payroll information.

-

Easy-to-use interface: Simplify the process for non-technical users.

-

Affordable pricing: Choose a solution that fits your budget.

Selecting the right tool ensures that you get the most value out of your investment.

How to Use a Check Stubs Maker

Using a check stubs maker is simple. Follow these steps:

-

Enter business details: Include your company name, address, and contact information.

-

Add employee information: Input the employee’s name, address, and payment details.

-

Input payment data: Specify hours worked, hourly rate, and any deductions.

-

Review and generate: Check the details for accuracy and generate the pay stub.

-

Download and share: Save the pay stub and provide a copy to the employee.

Conclusion

Managing payroll is one of the most important yet challenging aspects of running a small business. A check stubs maker simplifies the process, ensuring accuracy, compliance, and efficiency. By using this tool, small business owners can save time, reduce costs, and provide their employees with the professional documentation they deserve.

Investing in a check stub maker is not just about making payroll easier; it’s about building trust, ensuring compliance, and preparing your business for growth. Whether you’re managing a team of two or twenty, this tool can help you stay organized and focused on what matters most—growing your business.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown