Freelancing has become a popular career choice, offering flexibility and the opportunity to work on diverse projects. However, with the freedom of freelancing comes the responsibility of managing your finances efficiently. One of the essential tools for staying on top of your financial game is a paycheck creator. This tool simplifies the process of tracking income, preparing documentation, and staying organized.

In this blog, we’ll dive into how a paycheck creator can help freelancers manage their finances, stay organized, and even prepare for tax season.

What Is a Paycheck Creator?

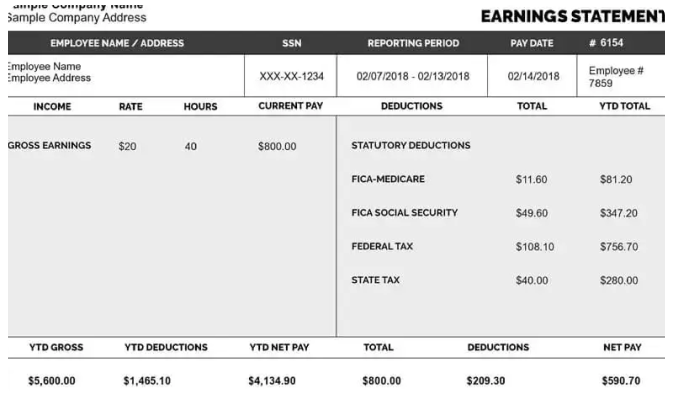

A paycheck creator is an online tool or software that generates professional pay stubs. These documents include details like gross income, taxes, deductions, and net pay. While traditional employees receive pay stubs from their employers, freelancers often lack this formal documentation because they are their own bosses. A paycheck creator bridges this gap, helping freelancers generate pay stubs that look official and detailed.

Why Do Freelancers Need a Paycheck Creator?

Freelancers juggle many roles—they are marketers, accountants, and business managers rolled into one. Managing multiple clients and payments can get chaotic. Here’s where a paycheck creator steps in to make life easier:

1. Track Your Earnings

Freelancers typically receive income from various sources. Without proper documentation, it’s easy to lose track of how much you’re earning and where the money is coming from. A paycheck creator allows you to record each payment systematically.

For example, if you work on five different projects in a month, you can use the paycheck creator to generate pay stubs for each payment, detailing the source, amount, and date. This provides a clear picture of your monthly income.

2. Stay Tax-Ready

Tax season can be stressful for freelancers. Unlike traditional employees, freelancers don’t have taxes automatically deducted from their payments. They need to calculate and pay estimated taxes quarterly. A paycheck creator simplifies this process by:

- Detailing gross income and deductions on each pay stub.

- Helping you calculate the taxes owed.

- Providing organized documentation for IRS filing.

When it’s time to file your taxes, you’ll have a record of your earnings and deductions ready to go, reducing the chances of errors or missed payments.

3. Present Professional Documentation

Freelancers often need proof of income for various reasons, such as:

- Renting an apartment.

- Applying for loans or credit cards.

- Setting up utility accounts.

A paycheck creator helps you generate professional-looking pay stubs that demonstrate your income reliably. These documents are often accepted as proof of income because they include all the necessary details, such as your name, the client’s name, payment dates, and amounts.

4. Manage Irregular Income

Freelancers’ income can fluctuate from month to month. A paycheck creator helps smooth out the chaos by organizing your payments. You can:

- Create pay stubs on a schedule (weekly, biweekly, or monthly) to mimic a traditional paycheck cycle.

- Spot trends in your income to better plan your budget.

- Avoid surprises by having a clear record of high and low-income months.

5. Simplify Client Relationships

Sometimes, clients require invoices, but providing additional documentation like a pay stub can reinforce professionalism. A paycheck creator allows you to create these stubs effortlessly, building trust with your clients. Additionally, you can use the tool to track late payments or discrepancies, making it easier to follow up with clients when needed.

How to Use a Paycheck Creator Effectively

Using a paycheck creator is straightforward, but here are a few tips to maximize its benefits:

1. Choose the Right Paycheck Creator Tool

Not all paycheck creators are created equal. Look for tools that are user-friendly and customizable. Ensure the tool you choose allows you to include essential details like:

- Payment date

- Gross income

- Taxes and deductions

- Net pay

Some paycheck creators even let you add a company logo or custom notes, which can be helpful for branding.

2. Keep Accurate Records

While paycheck creators simplify the process, accuracy is key. Ensure you input the correct figures for each client and project. Keep a folder (digital or physical) to store all your generated pay stubs in case you need them for reference.

3. Use Pay Stubs for Financial Planning

Once you have a record of your income, use it to make informed financial decisions. Analyze your pay stubs to:

- Set savings goals.

- Identify unnecessary expenses.

- Plan for slow months.

Benefits of Using a Paycheck Creator for Freelancers

Let’s summarize the key advantages of using a paycheck creator:

1. Increased Financial Awareness

Knowing exactly how much you earn and spend gives you control over your finances. A paycheck creator provides the clarity needed to make smart money decisions.

2. Time Savings

Manually tracking income and preparing documentation can be time-consuming. A paycheck creator automates these tasks, giving you more time to focus on your projects and clients.

3. Improved Credibility

Professional pay stubs enhance your image as a reliable freelancer. They show clients, landlords, and financial institutions that you’re serious about your business.

4. Stress-Free Tax Preparation

By maintaining organized records, you’ll eliminate much of the stress associated with tax filing. Paycheck creators help you stay compliant and avoid penalties.

5. Adaptability for All Freelancers

Whether you’re a graphic designer, writer, photographer, or consultant, a paycheck creator is versatile enough to fit any freelancing niche.

Choosing the Right Paycheck Creator

When selecting a paycheck creator, consider these factors:

- Ease of Use: The tool should be simple and intuitive.

- Customization Options: Ensure you can tailor pay stubs to suit your needs.

- Affordability: Many paycheck creators offer free or affordable plans, perfect for freelancers on a budget.

- Accuracy: The tool should handle calculations accurately, including taxes and deductions.

Final Thoughts

Freelancing offers unparalleled freedom, but it also comes with unique challenges, especially when it comes to managing finances. A free paycheck creator is an indispensable tool for freelancers who want to stay organized, present professional documentation, and be prepared for tax season.

By using a paycheck creator, you can focus less on administrative tasks and more on what you do best—delivering exceptional work to your clients. If you haven’t already, explore paycheck creator tools and see how they can transform the way you manage your freelancing career.

With the right tools and strategies, you can streamline your freelance finances and set yourself up for long-term success. Happy freelancing!

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease