Managing payroll is one of the most essential yet time-consuming tasks for any business, whether small or large. Ensuring that your employees are paid on time and accurately is critical to maintaining a happy and motivated workforce. For businesses that don’t have the resources to hire a dedicated payroll department, using a paycheck creator can be a game-changer.

A paycheck creator is a software tool designed to generate paychecks, including tax calculations, deductions, and other payroll-related information. Whether you’re a small business owner, HR manager, or payroll administrator, using a paycheck creator can simplify and streamline your payroll management. This blog will explore how a paycheck creator can help businesses manage payroll with ease, offering key benefits that save time, reduce errors, and ensure compliance.

Table of Contents

ToggleWhat is a Paycheck Creator?

A paycheck creator is a tool, often software-based, that automatically generates paychecks for employees based on the data you input. These tools typically include:

- Pay Period Information: The start and end dates for the pay period.

- Employee Details: Information like names, addresses, salary, and hourly rates.

- Tax Calculations: Automatic calculations of federal, state, and local taxes, including deductions for social security, Medicare, and more.

- Deductions: Options to include health insurance, retirement contributions, and other employee benefits.

- Net Pay: After all taxes and deductions are calculated, the software computes the employee’s take-home pay.

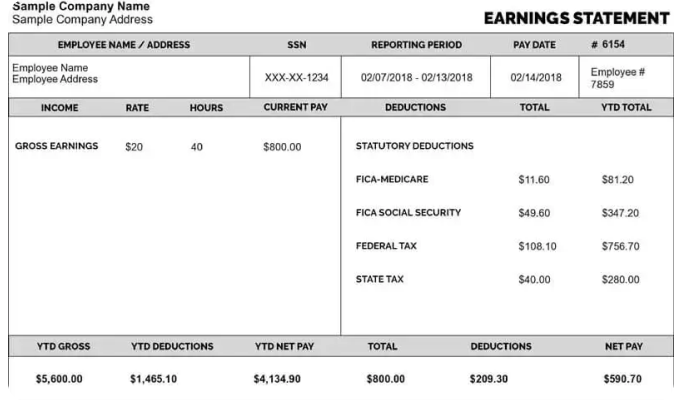

- Pay Stub Generation: The paycheck creator generates a pay stub detailing the gross pay, taxes, deductions, and net pay, which can be printed or shared electronically.

For businesses, the advantage of using a paycheck creator is clear: it eliminates manual payroll tasks, reduces human error, and ensures compliance with tax laws and regulations.

Why Should You Use a Paycheck Creator?

If you are still manually calculating payroll, you may be spending hours or even days every pay period ensuring everything is accurate. A paycheck creator simplifies this process in several ways, making it a vital tool for modern payroll management.

1. Time-Saving

One of the biggest advantages of using a paycheck creator is the significant amount of time it saves. When you manually calculate payroll, you need to gather data, perform calculations, double-check numbers, and create pay stubs. This can be incredibly time-consuming, especially for businesses with many employees.

With a paycheck creator, these tasks are automated. You only need to input employee information, and the software will handle everything else. This saves time not just during pay periods, but also in the long run, allowing you to focus on other important business tasks.

2. Accuracy and Error Reduction

Calculating payroll manually is prone to human error. Missing a deduction, entering incorrect tax rates, or making mistakes with overtime calculations can lead to costly mistakes. Incorrect paychecks can lead to disgruntled employees, which can hurt morale and lead to potential legal issues.

A paycheck creator automatically calculates taxes, deductions, and net pay based on the most recent tax laws, reducing the likelihood of errors. These tools also help with complex payroll situations, such as calculating overtime, holiday pay, or bonuses, ensuring that employees are paid exactly what they are owed.

3. Compliance with Tax Laws

Payroll is subject to numerous regulations at the federal, state, and local levels. These laws can change frequently, making it difficult for business owners to keep up. Failure to comply with tax laws can result in fines, penalties, and audits.

A paycheck creator helps ensure that your business remains compliant with current tax laws. The software is regularly updated to reflect the latest tax rates, so your payroll is automatically calculated based on the correct tax rules. Whether it’s calculating federal income tax, state tax withholdings, or contributions to Social Security and Medicare, a paycheck creator helps you stay on the right side of the law.

4. Employee Transparency and Satisfaction

Employees expect transparency when it comes to their pay. They want to understand how their salary or hourly wages were calculated, what deductions were made, and how much they will take home after taxes. A paycheck creator makes it easy to generate pay stubs that include all the necessary details about their earnings and deductions.

By providing employees with clear and accurate pay stubs, you can reduce confusion and improve satisfaction. Employees who have easy access to their pay details are less likely to raise concerns or have misunderstandings about their pay, contributing to a more positive work environment.

5. Integration with Other Systems

Modern paycheck creators often integrate seamlessly with other systems, such as accounting software, HR platforms, or time-tracking tools. This integration makes it easier to transfer data between systems without the need for manual data entry. For example, your time-tracking software can sync with the paycheck creator to ensure that employees are paid correctly for the hours they’ve worked.

By using software that integrates with other business tools, you can streamline payroll, reduce errors, and maintain better records. This can save time, improve accuracy, and make financial reporting more efficient.

6. Employee Self-Service Options

Many paycheck creators also offer employee self-service portals. With these portals, employees can access their pay stubs, tax forms (such as W-2s), and other payroll-related information at any time. This reduces the need for HR staff to answer payroll questions and empowers employees to manage their payroll information independently.

Employees can also update their tax information, view their earning history, and track vacation or sick leave balances. This reduces administrative workload and improves efficiency for both HR teams and employees.

7. Cost-Effective Solution

For small businesses, cost is often a major concern. Hiring a payroll service or dedicated payroll staff can be expensive. On the other hand, using a paycheck creator is typically a low-cost solution, especially if you’re using a free or affordable version of the software.

Even premium paycheck creator software is often more affordable than outsourcing payroll, and it can pay for itself quickly by reducing errors, saving time, and ensuring compliance with tax laws. Many free paycheck creators are available for small businesses, offering enough features to meet the needs of most companies without requiring a large investment.

Key Features to Look for in a Paycheck Creator

When choosing a paycheck creator for your business, there are several key features to consider. These features can ensure that the software meets your needs and helps you manage payroll effectively.

1. Tax Calculations

A good paycheck creator should calculate all relevant taxes automatically, including federal, state, and local taxes. This feature is essential for compliance and accuracy.

2. Deductions and Benefits

The software should allow you to input various deductions, such as retirement contributions, health insurance premiums, and other benefits. This ensures that each employee’s paycheck reflects their unique deductions.

3. Overtime and Bonus Calculations

For businesses with hourly workers or employees eligible for overtime pay, the paycheck creator should include functionality for calculating overtime, holiday pay, and bonuses.

4. Pay Stub Generation

A paycheck creator should generate professional pay stubs that clearly outline the employee’s gross pay, deductions, taxes, and net pay. It should also include year-to-date earnings for easy reference.

5. Direct Deposit Support

Direct deposit is the most efficient way to pay employees. Look for a paycheck creator that integrates with a direct deposit system, allowing you to quickly and securely transfer funds to your employees’ bank accounts.

6. Employee Access

Consider software that allows employees to access their pay stubs and tax forms online, reducing the workload for HR staff.

7. Scalability

As your business grows, your payroll needs may change. Choose a paycheck creator that can scale with your business, whether that means handling more employees, managing multiple pay rates, or integrating with additional software tools.

Conclusion

Managing payroll doesn’t have to be a daunting task. A free paycheck creator simplifies the process by automating tax calculations, generating pay stubs, ensuring compliance with regulations, and offering transparency for both employers and employees. Whether you’re a small business owner or an HR manager, investing in a paycheck creator can save you time, reduce errors, and ensure that your employees are paid accurately and on time.

By using a paycheck creator, you can streamline your payroll processes, improve efficiency, and focus on growing your business rather than worrying about payroll headaches. With a wide range of options available, from free to premium software, there’s a paycheck creator solution out there for businesses of all sizes. Don’t wait—take the first step towards simplified payroll management today.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons