Staying compliant with tax laws is one of the most critical responsibilities for businesses of all sizes. Whether you’re an entrepreneur managing a small team or the head of a larger organization, payroll management plays a pivotal role in ensuring compliance. Inaccurate payroll processes can lead to fines, audits, and even legal complications.

Enter the paycheck generator—a practical and efficient tool designed to simplify payroll processing, enhance accuracy, and help businesses meet their tax obligations. In this blog, we’ll explore how a paycheck generator can support compliance with tax laws, its benefits, and tips for using one effectively.

What is a Paycheck Generator?

A paycheck generator is a digital tool or software that automates the creation of paychecks for employees. It calculates employee earnings, taxes, and deductions, generating accurate paychecks and paystubs. These documents are essential for keeping detailed payroll records, which are often required by law.

Why is Tax Compliance Important?

Compliance with tax laws is non-negotiable for businesses. Here’s why:

- Avoid Penalties: Non-compliance can lead to hefty fines from the IRS or state tax authorities.

- Legal Protection: Accurate payroll records protect your business in the event of an audit or lawsuit.

- Employee Trust: Proper payroll practices ensure employees are paid correctly and on time, building trust and satisfaction.

- Business Reputation: Compliance safeguards your company’s credibility with stakeholders, clients, and partners.

How a Paycheck Generator Ensures Compliance with Tax Laws

1. Automatic Tax Calculations

A paycheck generator simplifies tax compliance by automatically calculating federal, state, and local taxes. These tools are regularly updated to reflect the latest tax laws, ensuring that your payroll calculations are accurate.

For example, paycheck generators consider:

- Federal Income Tax: Withholdings based on the employee’s W-4 form.

- Social Security and Medicare (FICA): Accurate deductions based on current rates.

- State Taxes: Adjustments for specific state requirements, including local taxes where applicable.

2. Accurate Deduction Tracking

Paycheck generators handle other mandatory deductions, including:

- Health insurance premiums

- Retirement contributions (e.g., 401(k))

- Wage garnishments

This level of detail ensures compliance with regulations that require transparency in payroll reporting.

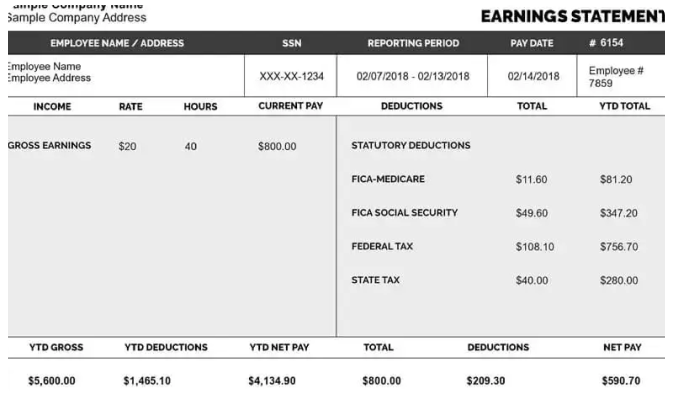

3. Provides Detailed Paystubs

Many states require employers to provide detailed paystubs to employees. A paycheck generator creates professional paystubs that include:

- Gross and net pay

- Tax withholdings

- Overtime pay (if applicable)

- Deductions and contributions

These paystubs serve as proof of compliance with labor and tax laws.

4. Facilitates Accurate Record-Keeping

Tax laws often mandate businesses to maintain payroll records for a specific period. Paycheck generators store payroll data securely, making it easy to access records during audits or tax filings.

5. Multi-State Compliance

If your business operates in multiple states, staying compliant with varying tax laws can be challenging. A paycheck generator simplifies this by applying the correct tax rates for each state where your employees work.

6. End-of-Year Reporting Made Easy

Generating W-2 and 1099 forms during tax season can be daunting. Paycheck generators compile the necessary data, streamlining the preparation and submission of these forms to the IRS and employees.

Key Benefits of Using a Paycheck Generator

In addition to compliance, a paycheck generator offers several benefits:

1. Saves Time and Effort

Manually calculating payroll is time-consuming and prone to errors. A paycheck generator automates the process, freeing up time to focus on growing your business.

2. Reduces Errors

Even small payroll errors can have big consequences. A paycheck generator minimizes mistakes by automating calculations, ensuring accuracy every time.

3. Improves Employee Satisfaction

Accurate and timely paychecks show employees that you value their work, fostering trust and satisfaction.

4. Cost-Effective

Using a paycheck generator is more affordable than hiring additional payroll staff or outsourcing payroll services.

5. Easy Integration

Many paycheck generators integrate with existing accounting and payroll software, making implementation seamless.

Best Practices for Using a Paycheck Generator

To maximize the benefits of a paycheck generator, follow these tips:

1. Keep Employee Data Updated

Ensure the generator has accurate information, including:

- Employee names and addresses

- Tax filing status (single, married, etc.)

- Benefits and deductions

2. Stay Informed About Tax Laws

While paycheck generators update automatically, it’s essential to stay informed about tax changes that may affect your business.

3. Conduct Regular Audits

Review your payroll records periodically to ensure they match your financial reports and tax filings.

4. Choose a Reputable Tool

Select a paycheck generator with a strong reputation for accuracy, security, and customer support.

5. Train Your Team

Ensure your payroll or HR team knows how to use the paycheck generator effectively, minimizing errors and maximizing efficiency.

Common Challenges and Solutions

1. Multi-State Tax Compliance

Challenge: Managing payroll across states with different tax laws.

Solution: Use a paycheck generator that supports multi-state compliance and automatically applies state-specific rates.

2. Handling Employee Queries

Challenge: Employees may have questions about deductions or net pay.

Solution: Provide them with detailed paystubs generated by the tool to explain earnings and deductions transparently.

3. Integration Issues

Challenge: Difficulties integrating the paycheck generator with existing systems.

Solution: Choose a tool compatible with your current accounting or payroll software.

Why Tax Compliance Matters in Payroll

Staying compliant with tax laws is more than a legal obligation—it’s a cornerstone of ethical business practices. When payroll is handled correctly:

- Employees trust your business, knowing their taxes and deductions are managed properly.

- You avoid legal complications, allowing your company to operate smoothly.

- Your business reputation grows, making it easier to attract and retain talent.

How to Choose the Right Paycheck Generator

Selecting the right paycheck generator is crucial for compliance. Here’s what to look for:

- Automatic Tax Updates: Ensure the tool stays updated with the latest tax laws.

- Customizable Options: Ability to add unique deductions or benefits.

- Secure Data Storage: Protect sensitive payroll information with robust security features.

- User-Friendly Interface: A simple design that’s easy to navigate.

- Support for Multi-State Operations: If applicable, ensure the tool can handle varying state tax laws.

Conclusion

Managing payroll and staying compliant with tax laws can be challenging, but a Free paycheck generator makes it significantly easier. By automating calculations, providing detailed paystubs, and simplifying record-keeping, a paycheck generator ensures that your business meets its tax obligations while saving time and reducing errors.

Investing in a paycheck generator is a smart move for any business looking to streamline payroll, maintain compliance, and build trust with employees. Make payroll headaches a thing of the past—choose a reliable paycheck generator and focus on what truly matters: growing your business.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season