As a small business owner, managing payroll can often feel like a balancing act. From calculating wages and taxes to ensuring compliance with labor laws, there are many details to track, and even the smallest mistake can have significant consequences. Fortunately, there’s a simple and effective tool to help you streamline this process: a paystub creator.

A paystub creator is an online tool or software designed to help small business owners generate accurate and professional pay stubs for their employees. Pay stubs are essential documents that provide a breakdown of an employee’s earnings and deductions, and having a paystub creator can make the payroll process much easier, faster, and more efficient.

In this blog, we’ll explore how a paystub creator can simplify payroll for small business owners, improve accuracy, and save time. Whether you’re new to running a business or simply looking for a better way to handle payroll, this guide will show you how a paystub creator can be a game-changer.

What is a Paystub Creator?

A paystub creator is a digital tool that automatically generates pay stubs for employees based on the information you input. These tools typically require basic details such as the employee’s name, pay rate, hours worked, tax deductions, and any other relevant data (like overtime or benefits).

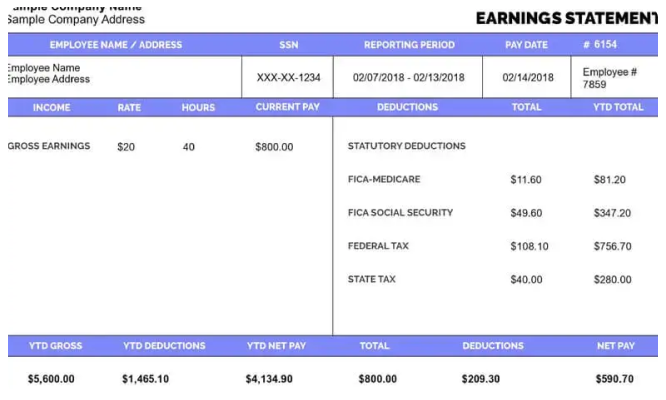

Once this information is entered, the paystub creator generates a pay stub that includes important elements like:

- Gross earnings: Total wages before any deductions.

- Taxes and deductions: Amounts withheld for federal and state taxes, Social Security, Medicare, and other deductions.

- Net pay: The employee’s take-home pay after all deductions.

- Pay period: The time frame the pay stub covers (e.g., weekly, bi-weekly, monthly).

These pay stubs are important for record-keeping, employee transparency, and tax reporting. A paystub creator simplifies this process by generating accurate pay stubs automatically, reducing the chances of mistakes and freeing up your time to focus on other aspects of your business.

Why Small Business Owners Should Use a Paystub Creator

There are numerous reasons why small business owners should consider using a paystub creator to handle their payroll. Let’s look at some of the most compelling benefits.

1. Saves Time and Effort

Running a small business involves juggling multiple tasks, from managing inventory to handling customer service. Payroll should be as efficient as possible to allow you to focus on other business operations. A paystub creator streamlines the process by eliminating the need for manual calculations and formatting. Simply input your employees’ hours and deductions, and the tool will generate the pay stub for you.

This time-saving benefit is especially valuable for small business owners who may not have a dedicated HR or payroll department. Instead of spending hours on payroll every pay period, a paystub creator allows you to quickly generate pay stubs in a matter of minutes.

2. Ensures Accuracy

Payroll involves complex calculations, including taxes, overtime, and benefits. Even a small mistake can lead to unhappy employees, tax penalties, or financial discrepancies. A paystub creator ensures that all calculations are done correctly, minimizing the risk of errors.

Most paystub creators are programmed with up-to-date tax rates, ensuring that the correct federal, state, and local taxes are automatically deducted. By relying on a paystub creator, you can ensure your calculations are accurate and compliant with current tax laws, reducing the likelihood of costly mistakes.

3. Improves Professionalism

When you create pay stubs using a paystub creator, the resulting documents are professional, organized, and easy to read. This is important for creating a positive image for your business, especially when dealing with employees. Clear and consistent pay stubs show that you’re organized and serious about managing your business finances.

Professional pay stubs also contribute to employee satisfaction. Employees want transparency in their pay and appreciate when their pay stubs are clear, accurate, and easy to understand. Using a paystub creator makes it easier to provide this level of professionalism.

4. Helps with Tax Compliance

Paying taxes on time and correctly is one of the most critical responsibilities of a small business owner. Payroll is a major part of your tax obligations, and failing to file or pay taxes properly can result in penalties and fines. A paystub creator helps ensure that the proper amounts are withheld for federal, state, and local taxes, which can help you stay compliant with tax laws.

Additionally, pay stubs are crucial for tax reporting purposes. They provide a record of how much you’ve paid your employees, what deductions were taken, and what taxes were withheld. By using a pay stub creator, you can easily maintain accurate payroll records that are essential for filing your taxes.

5. Reduces the Risk of Errors

Manual payroll processing is prone to mistakes—whether it’s forgetting to account for overtime or miscalculating tax deductions. These mistakes can lead to employee frustration, legal complications, and costly penalties. A paystub creator minimizes these risks by automating the calculations and ensuring that all deductions and taxes are applied correctly.

By using a pay stub creator, you reduce the chances of errors and avoid the hassle of having to correct mistakes later. This peace of mind can be incredibly valuable for small business owners who may not have the time or resources to deal with payroll errors.

6. Better Record Keeping

As a business owner, keeping accurate records is essential for tax purposes, audits, and resolving disputes. Pay stubs are important financial documents that provide proof of payment to employees. A paystub creator makes it easy to store these documents digitally, reducing the need for paper records and making it easier to organize and retrieve pay stubs when needed.

Most paystub creators allow you to download pay stubs as PDFs, which are easy to store and share. These records can be stored in a cloud system or a secure internal database, making them accessible whenever you need to reference them. Proper record-keeping also helps when it’s time to file your taxes, as you’ll have a clear record of all employee earnings and deductions.

7. Increased Employee Transparency and Trust

Transparency is key to building trust with your employees. When employees receive a pay stub, they can see how their wages are calculated, what deductions have been made, and how much they will take home. This transparency helps to avoid misunderstandings and builds trust between you and your employees.

A paystub creator ensures that the pay stubs are easy to read, clear, and professional, which can help improve your employees’ confidence in your payroll process. By showing employees how their pay is calculated, you demonstrate that you value their work and want to ensure they are compensated fairly.

Don’t Miss: Free Paystub Generator

How to Use a Paystub Creator

Using a pay stub creator is a straightforward process. Here’s how it typically works:

1. Select a Paystub Creator Tool

There are many paystub creators available online, both free and paid. When choosing a tool, look for one that offers accurate calculations, a user-friendly interface, and customizable options. Some popular paystub creators also include features such as employee portals or integration with time-tracking software.

2. Input Employee Information

Once you’ve chosen a paystub creator, you’ll need to input your employees’ information. This includes their name, pay rate (hourly or salaried), tax exemptions, deductions (e.g., retirement contributions, health insurance), and hours worked during the pay period. The more accurate the information you provide, the more accurate the generated pay stubs will be.

3. Customize the Pay Stub Layout

Most paystub creators offer customization options that allow you to add your business logo, company name, and other personalized details. This adds a professional touch to the pay stub and makes it unique to your business.

4. Generate the Pay Stub

Once all the information has been entered and reviewed, simply click the button to generate the pay stub. The tool will automatically calculate wages, taxes, and deductions, creating a professional pay stub that you can save or print.

5. Distribute the Pay Stub

After generating the pay stub, you can distribute it to your employees. Most paystub creators allow you to download the pay stub as a PDF, which you can then print out or email directly to your employees. This saves you time and ensures that employees receive their pay stubs quickly and securely.

Conclusion

A paystub creator is a valuable tool that can simplify payroll for small business owners. Automating the creation of accurate and professional pay stubs, it saves time, reduces errors, improves tax compliance, and helps keep your business organized.

Whether you’re a new small business owner or looking for a better way to handle payroll, a paystub creator can make your life easier and give you more time to focus on growing your business. By streamlining the payroll process and providing transparency to your employees, you’ll foster a more efficient and trusted workplace.

Consider integrating a paystub creator into your payroll process today and experience the benefits it can bring to your small business!

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown