In today’s fast-paced business world, small businesses face numerous challenges, from managing finances to ensuring employee satisfaction. One often overlooked tool that can significantly benefit small businesses is the check stub. Check stubs, also known as pay stubs or paycheck stubs, are essential documents provided to employees with each paycheck. They detail important information about wages, deductions, and other financial details. While primarily serving employees, check stubs also offer several advantages for small businesses themselves. Let’s delve into how small businesses can leverage check stubs to streamline operations, enhance transparency, and foster a more productive work environment.

Understanding Check Stubs

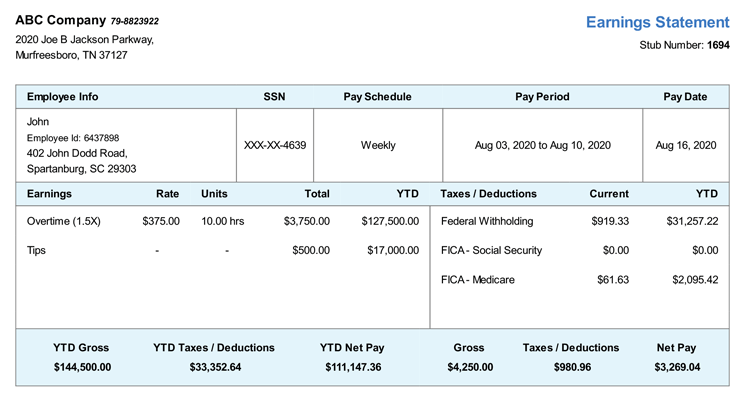

Before diving into their benefits, it’s important to understand what check stubs entail. A check stub typically includes:

- Employee Information: Details such as the employee’s name, address, and Social Security number.

- Earnings: Breakdown of the employee’s wages or salary for the pay period.

- Deductions: Taxes, insurance premiums, retirement contributions, and any other deductions.

- Net Pay: The amount the employee receives after deductions.

- Employer Contributions: Contributions made by the employer, such as to retirement plans or health insurance.

These details are crucial for employees to understand their earnings and deductions clearly. Beyond this, however, check stubs can offer significant advantages to small businesses themselves.

Benefits for Small Businesses

1. Enhanced Record Keeping and Compliance

Small businesses often struggle with maintaining accurate records and ensuring compliance with tax and labour regulations. Check stubs serve as detailed records of each employee’s earnings and deductions. This documentation is invaluable during tax season, audits, or disputes over wages. By consistently generating and storing check stubs, businesses can demonstrate compliance with labour laws and taxation requirements, thereby avoiding penalties and legal issues.

2. Transparency and Employee Trust

Transparency in payroll processes is crucial for fostering trust and satisfaction among employees. Providing detailed check stubs allows employees to verify that they have been paid correctly and understand how deductions affect their net pay. This transparency can reduce misunderstandings and complaints related to payroll, enhancing overall employee morale and loyalty.

3. Budgeting and Financial Planning

For small businesses, managing cash flow and budgeting effectively are critical for sustainability. Check stubs provide valuable insights into labour costs, helping businesses to budget more accurately. By analyzing trends in payroll expenses over time, businesses can make informed decisions about hiring, compensation adjustments, and operational expenses.

4. Facilitate Loan Applications and Financial Transactions

When small businesses apply for loans or financial transactions, lenders often require detailed financial records, including payroll information. Check stubs serve as proof of income for employees, which can be crucial documentation for securing financing. Having organized and accurate payroll records enhances a business’s credibility and increases the likelihood of loan approval.

5. Employee Benefit Administration

Many small businesses offer benefits such as health insurance, retirement plans, or bonuses. Check stubs provide a clear platform to communicate these benefits to employees. They can detail employer contributions to retirement plans or deductions for health insurance premiums, ensuring that employees are informed about their total compensation package.

6. Efficiency in Payroll Processing

Automated tools such as check stub makers can significantly streamline payroll processing for small businesses. These tools generate accurate and professional-looking check stubs quickly, reducing the time and effort required to prepare payroll. This efficiency allows businesses to focus more on core activities and less on administrative tasks.

Using a Check Stub Maker

In today’s digital age, several online tools and software solutions offer check stub-generating services. These check stub makers are designed to simplify the process of creating detailed and compliant pay stubs. Here are some key features and benefits of using a check stub maker:

- Customization: Customize the look and feel of check stubs with business logos, colours, and fonts to maintain brand identity.

- Accuracy: Ensure calculations for wages, taxes, and deductions are accurate and compliant with current regulations.

- Accessibility: Access check stubs anytime, anywhere through secure online portals or cloud storage.

- Cost Savings: Reduce costs associated with printing and distributing physical pay stubs by opting for digital delivery.

- Integration: Some check stub makers integrate with accounting software, further streamlining payroll and financial reporting processes.

Conclusion

In conclusion, check stubs makers are not just a legal requirement or a formality but a powerful tool for small businesses to enhance transparency, efficiency, and compliance. By leveraging check stubs effectively, small businesses can improve record-keeping practices, build trust with employees, streamline financial operations, and facilitate growth. Investing in a reliable check stub maker can further amplify these benefits, allowing businesses to focus on their core activities and strategic goals.

Whether you’re a small business owner looking to improve payroll processes or an employee wanting to understand your earnings better, check stubs play a crucial role in modern business operations. Embracing technology and utilizing tools like check stub makers can empower small businesses to navigate challenges more effectively and thrive in competitive markets.

Remember, the key to reaping these benefits lies in consistently generating accurate and detailed check stubs, ensuring compliance with regulations, and prioritizing transparency in payroll practices. By doing so, small businesses can lay a solid foundation for financial stability and long-term success.