Creating accurate pay stubs is crucial for both employers and employees. For business owners, having precise pay stubs helps maintain clear financial records and ensures compliance with labor laws. For employees, pay stubs provide essential information about earnings and deductions, which can be vital for personal budgeting and tax filings. In this blog, we will explore how to create accurate pay stubs using a paystub generator, discuss the benefits of using these tools, and offer tips for ensuring your pay stubs are correct and reliable.

What is a Paystub Generator?

A paystub generator is an online tool that allows you to create pay stubs easily and quickly. These generators can produce professional-looking pay stubs in just a few minutes by inputting your specific payroll information. With a user-friendly interface, most paystub generators require minimal effort to generate accurate documents that comply with industry standards.

Why Use a Paystub Generator?

-

Time-Saving: Manually creating pay stubs can be time-consuming. A paystub generator speeds up the process, allowing you to focus on other important aspects of your business.

-

Accuracy: Automated calculations minimize the chances of human error, ensuring that the figures on your pay stubs are correct.

-

Cost-Effective: Many paystub generators offer free or low-cost options, making them an affordable solution for small businesses and freelancers.

-

Convenience: Generate pay stubs from anywhere with an internet connection. Whether you’re at the office or working from home, you can create pay stubs on the go.

-

Professional Appearance: Paystub generators produce clean, well-formatted pay stubs that enhance your business’s professionalism.

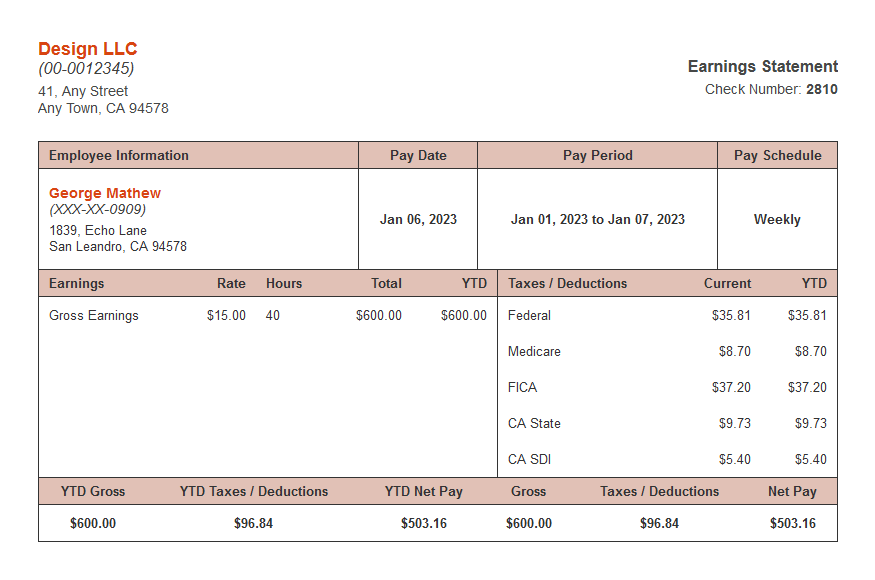

Key Components of a Pay Stub

To create an accurate pay stub, you need to include specific information. Here’s what to include:

-

Employee Information:

- Name

- Address

- Social Security Number (last four digits for privacy)

-

Employer Information:

- Business Name

- Address

- Employer Identification Number (EIN)

-

Pay Period:

- Start and end date of the pay period.

-

Earnings:

- Gross pay: Total earnings before deductions.

- Deductions: Taxes, insurance, retirement contributions, etc.

- Net pay: Amount the employee takes home after deductions.

-

Hours Worked:

- Total hours worked during the pay period, including regular and overtime hours.

-

Pay Date:

- The date on which the employee is paid.

-

Year-to-Date (YTD) Totals:

- Cumulative totals for gross pay, deductions, and net pay for the current year.

Steps to Create Accurate Pay Stubs Using a Paystub Generator

Now that we understand the key components, let’s dive into the step-by-step process of creating pay stubs using a paystub generator.

Step 1: Choose a Reputable Paystub Generator

Research different paystub generators available online. Look for one that is user-friendly, offers a range of features, and has positive reviews. Popular options include Stub Creator, eFormscreator, and ThePayStubs Generator.

Step 2: Gather Necessary Information

Before using the paystub generator, gather all the necessary information about the employee and the pay period. This includes their details, earnings, hours worked, and deductions. Having this information ready will streamline the process.

Step 3: Enter Employee and Employer Information

Once you’ve chosen a paystub generator, start by entering the employee’s information and your business details. Make sure to double-check these entries for accuracy, as errors can lead to complications down the line.

Step 4: Input Pay Period and Earnings

Next, enter the pay period dates and the employee’s earnings. Input the gross pay, any overtime hours worked, and all applicable deductions. The paystub generator will typically calculate net pay for you, ensuring accuracy.

Step 5: Review for Accuracy

Before finalizing the pay stub, review all the information you’ve entered. Look for any typos or errors in numbers. A small mistake can lead to confusion or issues for the employee. If you’re unsure, it’s always best to double-check your figures.

Step 6: Generate and Save the Pay Stub

After confirming that all information is correct, use the generator to create the pay stub. Most generators will allow you to download the pay stub as a PDF or print it directly. Save a copy for your records and provide one to the employee.

Common Mistakes to Avoid

Even with a paystub generator, mistakes can happen. Here are some common pitfalls to watch out for:

-

Incorrect Information: Always double-check names, addresses, and numbers. One wrong digit can lead to significant issues.

-

Missing Components: Ensure that all necessary components are included. A pay stub lacking essential information can raise questions during audits.

-

Outdated Tax Rates: If your paystub generator isn’t updated with the latest tax rates, your calculations could be off. Choose a generator that regularly updates its tax information.

-

Not Keeping Records: Always keep a record of generated pay stubs. This will help you manage payroll better and provide documentation when needed.

-

Neglecting Year-to-Date Totals: Forgetting to include YTD totals can cause confusion for employees, especially at tax time. Always ensure these are part of the pay stub.

Benefits of Accurate Pay Stubs

Creating accurate pay stubs through a paystub generator offers numerous benefits:

-

Transparency: Clear documentation fosters trust between employers and employees. Employees can see exactly how their pay is calculated.

-

Financial Planning: Employees can use pay stubs for budgeting, loan applications, and tax preparation. Accurate pay stubs provide a reliable snapshot of earnings.

-

Compliance: Keeping accurate payroll records helps businesses comply with labor laws and tax regulations, reducing the risk of penalties.

-

Employee Satisfaction: Providing accurate pay stubs can lead to greater employee satisfaction and morale. When employees feel informed about their compensation, they are more likely to feel valued.

Conclusion

Creating accurate pay stubs is essential for both employers and employees. Using a pay stub generator simplifies this process, saving time and reducing the likelihood of errors. By including all necessary components and ensuring accuracy, you can generate professional pay stubs that contribute to clear communication and financial transparency.

Whether you’re a small business owner or a freelancer, understanding how to use a paystub generator can empower you to manage your payroll effectively. With the right tools and practices in place, you can ensure that both you and your employees stay informed and satisfied with your pay processes.

Read Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a McDonald’s Pay Stubs?

Access and Manage Your Walmart Paystub