In this blog, we will walk you through the process of creating payroll checks for your employees using free tools, explain the benefits of doing so, and discuss how to ensure that your checks meet all legal requirements. If you are new to payroll or looking for ways to simplify the process, this article is for you.

Table of Contents

ToggleWhat is a Payroll Check?

Before we dive into creating payroll checks, let’s quickly define what a payroll check is. A payroll check is a document that a company issues to its employees as a form of payment for their work. Unlike direct deposits or electronic payments, payroll checks are physical checks that employees can cash or deposit at their bank.

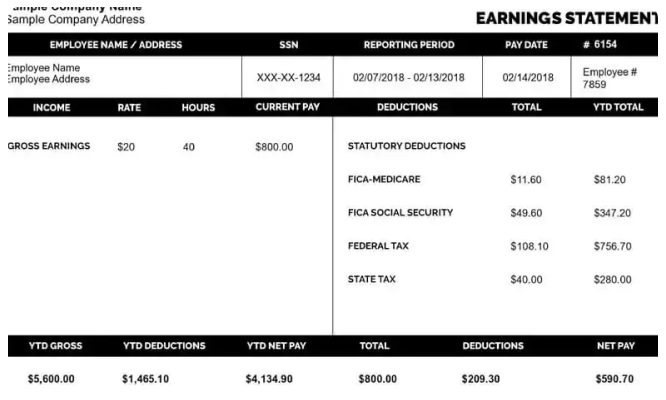

Payroll checks typically contain important information, such as:

- Employee’s name

- Pay period

- Gross wages (before taxes and deductions)

- Deductions (e.g., taxes, insurance)

- Net pay (the amount the employee takes home)

- Employer’s details

- Check the number and date

Given that payroll checks have both legal and financial significance, it’s essential to create them properly and ensure that all the information is accurate.

Why Use an Online Payroll Check Maker?

You may wonder why you should use an online payroll check maker rather than a traditional method or manual system. Here are a few reasons why an online payroll check maker is an excellent tool for small businesses and freelancers:

1. Cost-Effective

Hiring payroll experts or purchasing expensive software for payroll can be costly for small businesses. Online payroll check makers, however, are free or low-cost, making them a more affordable option. By using a free payroll check maker, you can save money and still ensure your employees are paid accurately and on time.

2. Time-Saving

Creating payroll checks manually can be time-consuming, especially if you have multiple employees. With online payroll check makers, you can generate checks in a matter of minutes, significantly reducing the amount of time spent on payroll tasks.

3. Accuracy

Online payroll checkmakers are designed to help you avoid human error. They automatically calculate tax deductions, withholdings, and other payroll components, ensuring your checks are accurate. This helps you stay compliant with tax regulations and prevents issues with employees regarding their pay.

4. Easy to Use

Most online payroll check makers are user-friendly, even for people with little to no experience in payroll management. These tools offer simple templates, step-by-step guides, and easy-to-follow instructions to help you create checks effortlessly.

5. Customizable

Online payroll check makers offer customizable templates that allow you to add your company logo, employee details, and other important information. This helps you create professional-looking checks that reflect your company’s branding.

Steps to Create Payroll Checks for Free

Now that we know why using a free payroll check maker is a great idea, let’s dive into the process of creating payroll checks. Follow these simple steps to generate checks for your employees.

Step 1: Choose a Payroll Check Maker Tool

There are many online payroll check makers available. Some tools are completely free, while others may offer free trials or limited features at no cost. A quick search online will give you a list of options, and you can choose the one that best suits your needs. Some popular free payroll check maker tools include:

- CheckWriter

- PayStubGenerator

- Payroll4Free

- Online Check Writer

Ensure that the tool you choose meets your requirements, such as the ability to add employee information, customize check templates, and calculate deductions.

Step 2: Sign Up or Create an Account

Once you have chosen your payroll check maker tool, you’ll likely need to create an account. This process is usually free and involves entering basic details about your business, such as your company name, address, and phone number.

Some tools may also ask you to provide your bank account information to ensure that the checks can be generated correctly with your banking details.

Step 3: Enter Employee Information

After setting up your account, the next step is to enter the necessary details for your employees. This includes:

- Employee name

- Address

- Tax information (such as tax exemptions and filing status)

- Pay rate (hourly or salary)

- Gross pay

- Deductions (e.g., federal taxes, state taxes, insurance contributions)

- Net pay (the final amount after deductions)

The payroll check maker tool will use this information to generate accurate payroll checks, taking care of all the calculations for you.

Step 4: Customize Your Payroll Check

One of the great benefits of using an online payroll check maker is that you can customize the appearance of your checks. You can add your company’s logo, adjust the layout, and include additional text (such as a memo for the pay period).

Make sure to verify that all the fields in the check template are filled correctly, including the employee’s name, check amount, and deductions. This helps ensure that your payroll checks are professional and error-free.

Step 5: Generate and Print the Payroll Checks

Once you’ve entered all the information and customized the check to your liking, the next step is to generate the payroll check. The tool will process the information and create a draft of the check. Review it to make sure everything looks good, and if you’re satisfied, you can proceed to print the check.

Ensure that you are using check stock paper or blank check paper to print the payroll check. Most check-making tools will allow you to print checks on standard 8.5 x 11-inch paper or on pre-perforated check paper.

Step 6: Distribute the Payroll Checks

After printing the payroll checks, you can distribute them to your employees. You can hand them out physically or send them by mail, depending on your preference and company practices.

Step 7: Keep Records

It’s important to keep records of all payroll checks issued to your employees. Most payroll check makers offer features that allow you to store and track your payroll data online. This can be helpful for tax purposes and future reference.

Legal Considerations When Creating Payroll Checks

While creating payroll checks with a free payroll check maker is relatively simple, there are some legal considerations you should be aware of to ensure compliance with state and federal regulations.

1. Follow Tax Regulations

Payroll checks must comply with the tax regulations set by the IRS and state authorities. This includes withholding the correct amount of federal, state, and local taxes, as well as other deductions such as Social Security and Medicare contributions.

Most online payroll check makers will calculate these deductions for you, but it’s important to double-check the accuracy of your information to avoid penalties.

2. Pay Stub Requirements

In addition to the payroll check, you may be required to provide a pay stub that details the breakdown of the employee’s wages, deductions, and net pay. Many payroll check makers also generate pay stubs, so be sure to include this when issuing checks to your employees.

3. Record Keeping

Payroll records must be kept for a certain period, typically at least three years. This includes copies of all payroll checks, pay stubs, and related tax documents. Be sure to keep accurate records in case of audits or legal inquiries.

Conclusion

Creating payroll checks doesn’t have to be complicated or expensive. With the help of free online payroll check makers, you can easily generate professional payroll checks for your employees, ensuring they are paid accurately and on time. By following the simple steps outlined in this blog, you can streamline your payroll process and save valuable time and money.

Remember to always double-check the accuracy of your information, comply with tax regulations, and keep detailed records of all payroll transactions. By doing so, you’ll help ensure that your business remains in good standing and that your employees are satisfied with their pay.

So, whether you’re a small business owner, freelancer, or someone just starting in payroll management, using a free payroll check maker is a smart choice for simplifying your payroll process. Try one of these tools today and experience the convenience of easily creating payroll checks without the hassle!

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs