Working at McDonald’s has its perks – flexible hours, decent pay, and often a fun team atmosphere. But like any job, one of the most important things to think about, especially around tax season, is your W2 form. For many employees, figuring out how to access their W2 from McDonald’s can be confusing, especially if it’s their first job or they’ve recently left the company. Don’t worry – this guide will walk you through the process in simple, easy-to-understand steps, so you can get your W2 without any headaches.

We’ll also touch on why your W2 is important and how a paystub creator can help you keep better track of your earnings. By the end of this post, you’ll feel confident about retrieving your W2 and ready to file your taxes!

What is a W2 Form, and Why Do You Need It?

Before we dive into how to get your W2 from McDonald’s, let’s clarify what a W2 form is and why it’s important.

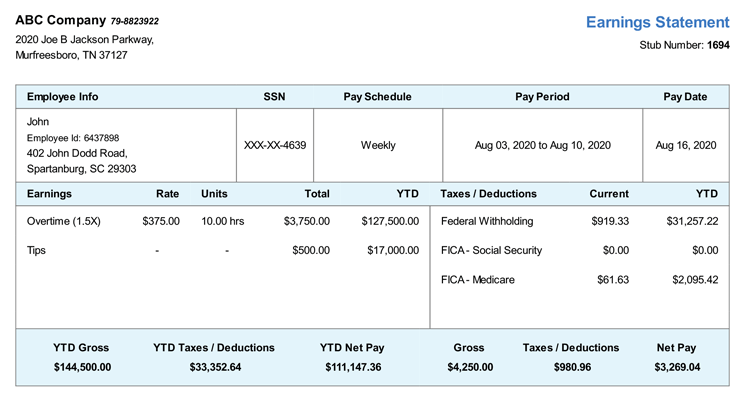

A W2 is a tax form that your employer (McDonald’s in this case) provides to you and the IRS (Internal Revenue Service). It contains all the important information about your earnings for the year, including:

- Total wages earned

- Federal, state, and local taxes withheld

- Social Security and Medicare contributions

- Other deductions (like health insurance premiums or retirement contributions)

This form is essential for filing your taxes. It helps the IRS ensure that you’ve paid the right amount in taxes throughout the year. Without it, you can’t accurately file your tax return, which could lead to penalties, delays, or even fines. The IRS requires employers to send out W2 forms by January 31st, so if it’s nearing tax time and you don’t have yours yet, it’s time to take action.

Now that you know how important this form is, let’s go through how to get your W2 from McDonald’s.

How to Get Your W2 from McDonald’s

McDonald’s, like many large companies, uses a third-party service to handle its payroll and W2 forms. Follow these simple steps to access your W2, whether you’re still employed there or have moved on to another job.

1. Check Your Email for a Digital Copy

McDonald’s has moved towards providing digital copies of W2 forms to make things easier and faster for employees. If you’re still working at McDonald’s or recently left, check the email you used during your employment. The company may have sent you an email with instructions on how to download your W2 online.

Here’s what to do:

- Search your inbox for keywords like “W2,” “McDonald’s,” or “tax form.”

- Look for an email from your payroll provider, such as ADP or another service.

- Follow the instructions in the email to access your W2 through their portal.

Make sure to also check your spam or junk folder just in case the email was filtered there.

2. Use the McDonald’s Employee Portal

If you didn’t receive an email or can’t find it, another way to get your W2 is through McDonald’s employee portal, often referred to as MCDperks. Here’s how to navigate that:

- Step 1: Go to the McDonald’s employee portal or payroll provider’s site (this could be ADP or another third-party service, depending on your franchise).

- Step 2: Log in using the credentials you created during your employment. If you’ve forgotten your login info, there should be an option to reset your username or password.

- Step 3: Once logged in, navigate to the “Tax Forms” or “W2” section.

- Step 4: Download your W2 form directly from the portal. You can print it out or save it digitally for when you’re ready to file your taxes.

If you’re having trouble accessing the portal, reach out to your manager or HR representative for help.

3. Contact Your McDonald’s Franchise

McDonald’s operates through franchisees, meaning each restaurant is independently owned and operated. This can sometimes make things tricky, especially if you worked at a franchise-owned location. If you can’t access your W2 online or haven’t received it by mail, your best bet is to contact your former employer directly.

Here’s how:

- Step 1: Call the McDonald’s location where you worked and ask to speak to the manager or payroll department.

- Step 2: Request information on how to obtain your W2 form, explaining that you haven’t received it yet.

- Step 3: If they can’t help directly, ask for contact details for the franchise’s payroll provider or HR department.

Many franchise owners use local payroll services, so they may be able to guide you in the right direction.

4. Use ADP or Other Payroll Services

Most McDonald’s locations, especially larger franchises, use ADP or another payroll service provider to manage W2s. If you registered with ADP during your employment, you can access your W2 by following these steps:

- Step 1: Go to the ADP website (www.adp.com).

- Step 2: Log in using the username and password you created when you were hired. If you forgot your password, you can reset it on the site.

- Step 3: Navigate to the “Tax Statements” or “W2” section of the website.

- Step 4: Download your W2 form for the relevant tax year.

If you didn’t set up an ADP account while employed at McDonald’s, you may need to contact your former employer to get access.

5. Request a W2 Reissue by Mail

If you’ve tried all the above options and still can’t get your W2, it may be possible that the form was lost in the mail or went to the wrong address. In this case, you can request a new copy be sent to you by mail.

Here’s what to do:

- Step 1: Contact your former McDonald’s location or franchise and explain the situation.

- Step 2: Provide them with your current mailing address and request a reissue of your W2.

- Step 3: Wait for the new copy to arrive. Make sure to give it plenty of time, as mail can be delayed, especially during tax season.

Once you’ve received your W2, you’re ready to file your taxes!

What If You No Longer Work at McDonald’s?

If you’re no longer employed at McDonald’s, you still need your W2 to file taxes for the time you worked there. Luckily, former employees can follow most of the same steps as current employees.

- Check your email for digital copies.

- Log into the employee portal using your old credentials (you may need to reset your password if it’s been a while).

- Contact your former manager or franchise to get your W2 sent to you.

Former employees have access to their W2 forms just like current ones, so don’t worry about being left out of the loop.

Why It’s Important to Keep Track of Your Pay Stubs

While your W2 gives you the full picture of your earnings for the year, keeping track of your paystubs is just as important. Paystubs help you track how much you’ve been paid each pay period, how much has been withheld for taxes, and other key financial information. This can be incredibly useful if there’s ever a discrepancy in your W2 or if you want to track your income throughout the year.

Using a free paystub creator can simplify this process. With a paystub generator, you can create professional, easy-to-read paystubs that help you keep your financial records in check. This is especially helpful if you’re working multiple jobs or need quick access to your earnings information. Plus, it can be a lifesaver if you ever misplace your actual pay stubs.

In Conclusion

Getting your W2 from McDonald’s doesn’t have to be a stressful process. Whether you’re still employed or have moved on to another job, you can follow the steps outlined above to quickly access your W2 form and file your taxes on time.

Remember, if you’re struggling to find your W2, check your email for digital copies, log into the employee portal, contact your former manager, or use ADP if applicable. Don’t forget to keep track of your earnings with a paystub creator throughout the year to stay organized and avoid any last-minute tax season stress.

With these tips in hand, you’ll be ready to get your W2 and take on tax season like a pro!