Payroll processing can be one of the most time-consuming tasks for small businesses, freelancers, or anyone who employs others. But what if there was a way to create payroll checks quickly and easily without having to hire an expensive payroll service or manually calculate each paycheck? The good news is, there are free paycheck creator tools available online that can help you generate payroll checks in minutes!

In this blog post, we’ll walk you through how to make payroll checks quickly using a free online paycheck creator. We will cover everything you need to know to ensure you can easily generate accurate payroll checks, including the benefits of using free online tools, how to find the best paycheck creators, and step-by-step instructions for creating your payroll checks.

Why Use a Free Paycheck Creator?

When you’re running a small business or managing your freelance work, managing payroll can often feel like a daunting task. However, paying employees or contractors on time and accurately is a critical part of any business’s success. Traditional payroll services can charge steep fees, and manually calculating taxes and deductions can lead to costly mistakes.

A free paycheck creator can simplify the payroll process and save you both time and money. Here are a few key benefits of using a free online paycheck creator:

-

Quick and Easy: Free paycheck creators are designed to be user-friendly, allowing you to generate payroll checks in minutes. You won’t need to spend hours figuring out tax rates or manually calculating deductions.

-

Accuracy: Many free paycheck creators automatically calculate federal and state taxes, Social Security, and other deductions. This helps reduce errors and ensures that your paychecks are accurate.

-

Cost-Effective: As a small business or freelancer, you may not have the budget to hire a payroll service. A free paycheck creator is an excellent alternative that can save you money on payroll processing.

-

Customization: You can customize your paychecks with various details, including employee names, pay periods, hours worked, deductions, and more.

How to Find a Free Paycheck Creator

There are plenty of free paycheck creators available online, so how do you choose the best one for your needs? Here’s what you should look for when selecting a free paycheck tool:

-

Ease of Use: Choose a tool that has an intuitive and easy-to-navigate interface. It should allow you to quickly input information without feeling overwhelmed.

-

Tax Calculations: The tool should automatically calculate the correct amount of tax to withhold, including federal and state taxes (if applicable). This will ensure that your paychecks are accurate and compliant with tax laws.

-

Customization Options: Look for a paycheck creator that lets you customize the details on the paycheck, such as employee information, payment date, pay period, hours worked, overtime, and deductions.

-

Export Features: If you need to keep records of your paychecks or print them for your employees, make sure the tool has options to export or download the paychecks in formats like PDF or Excel.

-

Security: Ensure the online tool uses encryption to keep your data safe. Sensitive information like Social Security numbers and bank details should be protected.

Steps to Create Payroll Checks Using a Free Paycheck Creator

Now that you know what to look for, let’s dive into how to actually create payroll checks using a free online tool. The process is quick and straightforward, so let’s break it down step by step.

Step 1: Choose a Free Paycheck Creator

Search for a reliable, free paycheck creator. Some of the most popular online tools include:

- Paycheck City

- Payroll Calculator

- FormSwift

- W-4 Calculator

For this example, we’ll use Paycheck City, but most free paycheck creators follow a similar process.

Step 2: Enter Employee Information

Start by entering basic information about the employee you are paying. This will typically include:

- Employee name

- Address

- Employee ID number (if applicable)

- Social Security number (for tax purposes)

- Employment status (full-time, part-time, contractor)

Make sure that the details are accurate, as they will appear on the paycheck.

Step 3: Input Pay Information

Next, you’ll need to input the pay details:

-

Hourly or Salary: Indicate whether the employee is paid by the hour or has a fixed salary. For hourly employees, enter the hourly wage and the number of hours worked. For salaried employees, input the annual salary.

-

Overtime: If applicable, you can include any overtime hours worked. Overtime rates usually apply after 40 hours worked in a week, and they’re typically calculated at 1.5 times the regular hourly rate.

-

Bonuses or Commissions: If the employee is receiving a bonus or commission, you can add this amount as well.

Step 4: Add Deductions

Now, you’ll need to enter any applicable deductions. These might include:

-

Federal Tax: This is usually automatically calculated by the paycheck creator based on the information you’ve entered about the employee’s income and filing status.

-

State Tax: If your state requires income tax withholding, the tool should automatically calculate this as well.

-

Social Security and Medicare: These deductions are also typically calculated automatically by the tool.

-

Other Deductions: You can also add other deductions such as retirement contributions (e.g., 401(k)), health insurance premiums, or union dues.

Step 5: Review the Paycheck

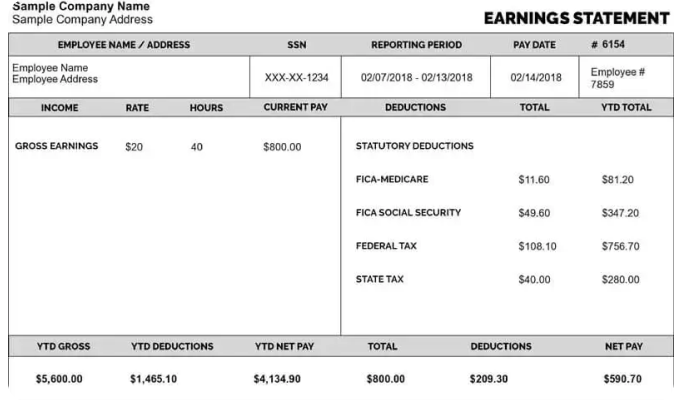

Once all the necessary information is entered, the paycheck creator will generate a preview of the paycheck. This will show the employee’s gross pay, deductions, and net pay (the amount the employee will receive after deductions).

Double-check the information to ensure everything is correct. Pay particular attention to:

- Hours worked

- Overtime pay

- Correct tax rates

- Deductions for benefits, taxes, etc.

Step 6: Generate and Export the Paycheck

Once everything looks good, you can generate the paycheck. Most tools will allow you to download the paycheck in a printable format (like PDF) or email it directly to the employee.

Some paycheck creators even let you print multiple paychecks at once, which can be useful if you have a team of employees to pay.

Step 7: Repeat for Other Employees

If you have more employees to pay, repeat the process for each person. The free paycheck creator will save you time by making sure that the calculations are accurate each time.

Other Features to Look for in a Free Paycheck Creator

While most free paycheck creators will have the basics covered, there are a few additional features you might find useful:

-

Pay Stub Generation: Some paycheck creators also generate pay stubs, which provide a more detailed breakdown of the employee’s pay and deductions. These can be helpful for record-keeping and tax filing.

-

Payroll Schedules: A good paycheck creator might allow you to set up payroll schedules for your employees. This could include weekly, bi-weekly, or monthly pay periods.

-

Tax Filing Assistance: Some tools provide resources or even direct connections to help you with tax filing. These tools can guide you through the filing process or let you download tax forms you need.

Conclusion

Creating payroll checks doesn’t have to be complicated or expensive. By using a free paycheck creator, you can save time, reduce errors, and ensure your employees are paid accurately and on time. Whether you’re a small business owner, freelancer, or independent contractor, there’s no reason to waste valuable time on complex payroll tasks when a free, easy-to-use online tool can do the job for you.

With just a few simple steps, you can generate professional-looking payroll checks and stay compliant with tax regulations. So, the next time payroll time rolls around, use a free paycheck creator and get your payroll done in minutes. Your employees will thank you, and you’ll have more time to focus on growing your business!

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons