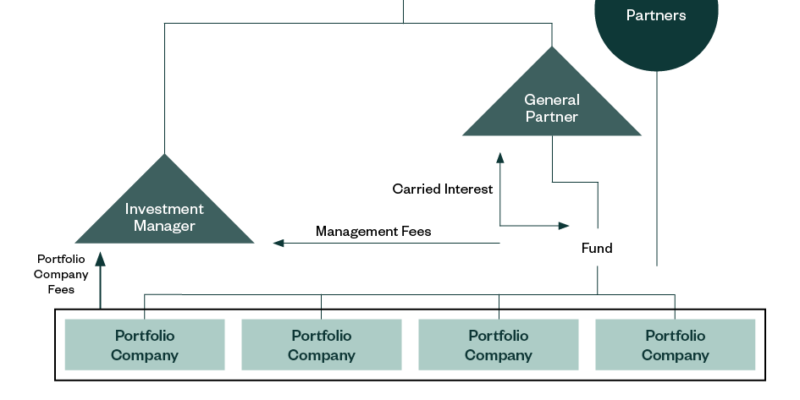

Carried interest, or “carry,” is a way for fund managers in private equity and venture capital to share in the profits they help generate. While it is an essential incentive mechanism, determining its value can be challenging.

Factors like fund structures, market conditions, and tax regulations all play a role, making a clear understanding of the process crucial for accurate and fair valuations.

What Is Carried Interest?

Carried Interest Valuation is a performance reward given to fund managers. They typically earn a percentage of the profits after meeting specific goals, like exceeding a return benchmark known as the “hurdle rate.” For example, in the widely used “2 and 20” model, fund managers receive a 2% fee on assets under management and 20% of the profits above the hurdle rate.

To ensure fairness, some funds include provisions like:

-

Hurdle Rates: Managers earn carry only after investors receive a minimum return.

-

Clawbacks: If a fund’s performance dips later, managers might return some of their earlier remittances, known as ‘carry’, to ensure fair treatment for investors.

Why Is Carried Interest Hard to Value?

Several challenges make carried interest valuation complex:

-

Illiquid Investments: Private equity and venture capital investments are not publicly traded, so their value isn’t easy to determine. Experts use detailed financial models to estimate future performance, but these rely on assumptions, which can vary.

-

Different Valuation Methods: Professionals use tools such as:

-

Discounted Cash Flow (DCF) Analysis: Focuses on expected future profits.

-

Option Pricing Models: Accounts for timing and volatility.

-

Advanced Scenario Modeling (e.g., Monte Carlo Simulations):

Evaluates many potential outcomes to provide robust predictions.

-

Each method involves unique assumptions, leading to different results, which can cause disagreements.

-

Tax Uncertainty: Carried interest is generally taxed as capital gains, but some policymakers argue it should be taxed as regular income. Changes in tax treatment can significantly impact how carried interest is valued and how much fund managers ultimately earn.

How to Value Carried Interest Effectively

Here’s how companies and professionals can simplify and improve the

process:

-

Use the Right Valuation Tools: Choose methods that suit the fund’s specifics, such as DCF analysis for future profits or advanced modeling for comprehensive outcomes.

-

Stay Updated on Regulations: Tax and accounting rules change frequently. Working closely with tax advisors ensures compliance and avoids surprises.

-

Promote Transparency: Clearly explain the assumptions and methods used for valuation. This builds trust and reduces disputes among investors and stakeholders.

-

Seek Expert Help: Hire valuation professionals experienced in private equity. Their expertise can make navigating complex scenarios easier and more accurate.

What Happens Without Proper Valuation?

Skipping or performing an inaccurate valuation can lead to serious issues:

-

Legal and Financial Penalties: Non-compliance with tax or regulatory rules can result in fines.

-

Tax Burdens for Managers: Managers may face unexpected taxes, reducing their earnings.

-

Investor Frustration: Mismanagement of carried interest can harm relationships and the fund’s reputation.

Example: Simplified Carried Interest Valuation

Imagine a fund manager earns 20% carry after a hurdle rate of 8%. If a $100 million fund generates $120 million in profits:

-

The first $8 million goes to investors to meet the hurdle rate.

-

The next $12 million (profits above the hurdle) is split, with 80% ($9.6 million) going to investors and 20% ($2.4 million) to the manager as carried interest.

Conclusion

Carried interest valuation may seem complicated. Following the right steps can ensure fairness and accuracy in funds. These steps include using reliable methods, staying informed about regulations, and being transparent. Engaging professionals with expertise in private equity adds an extra layer of confidence, helping everyone involved make better decisions and build stronger partnerships.