While generating paystubs used to require a lot of time, effort, and sometimes a hefty investment in accounting software or professional services, modern paystub creator tools have made this process much more efficient, affordable, and user-friendly. In this blog, we’ll explore how using a paystub creator can save you both time and money while providing a hassle-free experience for employers and employees alike.

Table of Contents

ToggleWhat is a Paystub Creator Tool?

A paystub creator tool is an online software that automates the process of generating paystubs. These tools are designed to simplify the calculation of wages, deductions, and taxes, and generate accurate paystubs in just a few clicks. They allow businesses to create professional pay stubs for their employees, regardless of how complex their payroll system might be.

Whether you’re running a small business, managing payroll for multiple employees, or working as a freelancer who needs to create paystubs for yourself, using a paystub creator can save you time and prevent errors that might occur when creating paystubs manually.

How Can a Paystub Creator Tool Save Time?

One of the most significant advantages of using a paystub creator tool is time-saving. Traditional methods of creating paystubs can be tedious and time-consuming, especially if you have multiple employees. Manually calculating wages, taxes, and deductions for each employee can take hours, especially if there are variations in pay rates, overtime, or bonuses.

With a paystub creator tool, most of the hard work is done for you. Here’s how it can save time:

1. Automatic Calculations

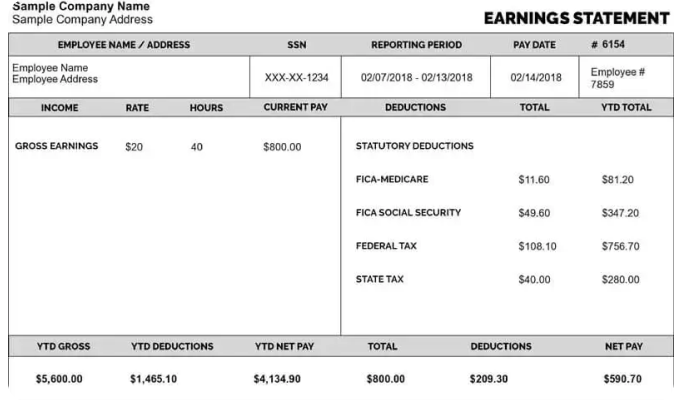

Most paystub creator tools come with built-in tax and deduction calculators that ensure your paystubs are accurate every time. Whether you’re calculating federal or state taxes, Social Security, or Medicare, the tool will automatically apply the correct rates. This means no more spending hours cross-checking your figures.

2. Pre-made Templates

Paystub creator tools often come with customizable templates, making it easy to add company details, employee information, pay periods, and other essential data. You no longer need to create paystubs from scratch, which can take a lot of time. Instead, you can simply fill in the necessary fields, and the tool will generate a professional-looking paystub in minutes.

3. Bulk Paystub Creation

For businesses with many employees, generating paystubs can be an overwhelming task. However, some paystub creators allow you to create multiple paystubs at once. This bulk feature is especially helpful for companies with large payrolls, as it reduces the time spent on each paystub.

4. Instant Delivery

Once you’ve generated a paystub, most tools allow you to send them directly to your employees via email or download them as PDFs. This eliminates the need for printing, mailing, or manually handing out paystubs, which can be time-consuming and inefficient.

How Can a Paystub Creator Tool Save Money?

Beyond saving time, a paystub creator tool can also help you save money. Running a business comes with various financial responsibilities, and making smart decisions about how you manage your payroll can lead to significant cost savings in the long run.

1. Reduce Reliance on Accountants or Payroll Services

Traditionally, businesses have hired accountants or outsourced payroll services to handle paystub creation. While this might seem like the easiest route, it can be costly, especially for small businesses. Professional payroll services often charge per employee or pay period, which can add up quickly. By using an online paystub creator, you can handle paystub generation in-house without having to pay for external services.

2. Avoid Mistakes and Penalties

Payroll mistakes can be costly for businesses, both in terms of time spent fixing errors and potential penalties for non-compliance with tax regulations. A paystub creator tool is designed to ensure accuracy in your calculations. With automated tax calculations and up-to-date information, the chances of making a costly mistake are greatly reduced. You can avoid errors such as overpaying employees or underpaying taxes, which can lead to fines and penalties.

3. Cost-Effective Subscription Plans

Many paystub creator tools offer flexible subscription plans, including free trials and low-cost monthly options. This makes them accessible to small businesses and freelancers, who may not have the budget for expensive payroll systems. The cost of these tools is typically much lower than the cost of hiring a full-time accountant or outsourcing payroll to a service.

4. No Need for Expensive Payroll Software

In the past, managing payroll required investing in expensive accounting software or custom solutions. Paystub creator tools, on the other hand, are often cloud-based, meaning you don’t need to worry about purchasing and maintaining costly software. Most paystub creator tools also include regular updates, so you’re always working with the most current tax rates and regulations.

Key Features to Look for in a Paystub Creator Tool

If you’re considering using a paystub creator tool, it’s essential to choose one that offers the right features for your needs. Here are some key features to look for:

1. Customizability

A good paystub creator should allow you to customize the paystub layout with your business logo, name, and other relevant information. You should also be able to adjust the paystub template to suit your specific payroll needs.

2. Tax and Deduction Calculations

Ensure that the tool offers automatic tax calculations based on your location and tax laws. This will help you avoid errors when calculating federal, state, and local taxes. It should also account for deductions such as insurance, retirement contributions, and other benefits.

3. Compliance with State and Federal Laws

Make sure the paystub creator tool complies with both state and federal regulations regarding paystubs. For example, some states have specific rules about what must be included on a paystub (e.g., the hours worked or overtime pay). A reliable paystub creator will help you stay compliant with these requirements.

4. Security Features

Since paystubs contain sensitive employee information, it’s essential to choose a tool with strong security measures. Look for paystub creators that offer encryption, password protection, and secure storage for your documents.

5. Ease of Use

The best paystub creator tools are intuitive and easy to use, even for people with no accounting experience. The user interface should be simple, with step-by-step guidance, so you don’t waste time figuring out how to create a paystub.

Who Can Benefit from Using a Paystub Creator?

1. Small Business Owners

For small business owners, a paystub creator tool can be a game-changer. It allows you to generate accurate paystubs without the need for complex payroll software or third-party services. You can keep your business running smoothly while saving money on expensive payroll management solutions.

2. Freelancers and Contractors

Freelancers and contractors can also benefit from using paystub creator tools. If you work independently and need to provide paystubs to clients or for your tax filing, a paystub creator can help you create professional, accurate pay records without the hassle.

3. Employees with Multiple Jobs

If you work multiple part-time jobs or have a side hustle, a paystub creator can help you keep track of your income from various sources. By generating paystubs for each job, you’ll have a clear record of your earnings for tax reporting or loan applications.

4. Accountants and HR Professionals

Accountants and HR professionals can save time by using paystub creators to quickly generate paystubs for their clients or employees. These tools are efficient and reduce the chances of making mistakes during payroll processing.

Conclusion

Using a free paystub creator tool is a smart and efficient way to save time and money when managing payroll. Whether you’re a small business owner, freelancer, or HR professional, this tool helps automate tedious tasks, reduces the risk of errors, and ensures that your paystubs are accurate and compliant with regulations.

The time and cost savings are clear: you can avoid paying for expensive payroll services, reduce the time spent on manual calculations, and ensure that your business remains compliant with tax laws. In today’s fast-paced world, a paystub creator tool can make your financial management much simpler and more efficient.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season