Starting a new business comes with a long list of responsibilities, and payroll is one of the most important tasks on that list. As a startup owner, you need to ensure that your employees are paid accurately and on time, and that you’re compliant with tax laws. For many new businesses, handling payroll manually or through expensive software isn’t always feasible. This is where a free payroll check maker can come into play.

A free payroll check maker is a tool that helps businesses generate pay stubs and manage payroll processes efficiently. But is it the right choice for your startup? In this blog, we’ll explore the pros and cons of using a free payroll check maker and help you decide if it’s the best option for your growing business.

Table of Contents

ToggleWhat is a Payroll Check Maker?

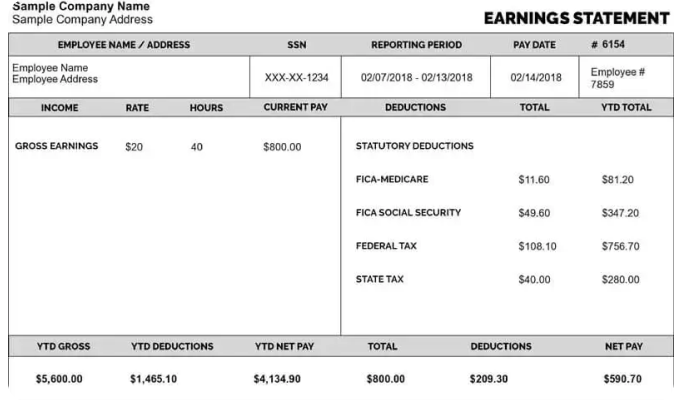

Before we dive into the pros and cons, it’s important to understand what a payroll check maker is. A payroll check maker is a tool or software designed to help businesses generate pay stubs or paycheck details for their employees. It calculates employee wages, taxes, and other deductions, providing a detailed breakdown of the employee’s earnings and withholding.

For startups, a free payroll check maker offers an affordable way to streamline payroll processing without the need for expensive payroll services or complex accounting software. While these tools are generally simple and user-friendly, they are a great option for small businesses with a limited budget.

The Benefits of Using a Free Payroll Check Maker

1. Cost Savings for Startups

As a startup, you are likely operating with a tight budget. Payroll services can be expensive, and investing in premium software can be a significant financial burden. A free payroll check maker offers a budget-friendly solution to manage payroll without adding another hefty expense.

With a free tool, you can eliminate the need to hire an external payroll service, which can cost hundreds of dollars per month. Instead, you can manage payroll internally, keeping your costs low and freeing up funds for other critical areas of your business.

2. Ease of Use and Accessibility

Most free payroll check makers are designed to be user-friendly, meaning that even if you don’t have experience with payroll or accounting, you can still use the tool effectively. The interface is typically intuitive, allowing you to enter employee data, set up pay rates, and calculate deductions in just a few clicks.

Additionally, many free payroll check makers offer cloud-based access, meaning that you can access your payroll data from anywhere with an internet connection. This feature is especially useful for startups with remote or distributed teams, as it allows you to manage payroll from any location, at any time.

3. Time-Saving Features

As a startup owner, time is precious, and you need tools that can help you work more efficiently. A payroll check maker saves you time by automating key payroll tasks. For example, the tool can automatically calculate employee wages, tax deductions, and benefits, saving you the hassle of doing these calculations manually.

Many payroll check makers also generate pay stubs automatically, which means you don’t have to create them from scratch each pay period. This feature is not only time-saving, but it also ensures that the pay stubs are accurate and consistent.

4. Tax Compliance and Accuracy

Tax compliance is a critical aspect of payroll management. As a startup, you must comply with federal, state, and local tax regulations. A free payroll check maker can help you stay on top of tax requirements by calculating the correct amount of taxes to withhold from each employee’s paycheck.

Many free payroll check makers are updated regularly to reflect changes in tax rates, deductions, and regulations, helping you avoid errors that could lead to penalties or audits. This is especially helpful for startups that may not have an in-house accountant to handle payroll and tax filings.

5. Professional and Transparent Pay Stubs

A free payroll check maker generates professional pay stubs that include all the necessary details of an employee’s earnings and deductions. These pay stubs are not only important for tax purposes but also provide transparency for your employees, helping them understand how their pay is calculated.

Providing your employees with detailed pay stubs builds trust and ensures that they are aware of their earnings, taxes, and other deductions. Professional pay stubs can also be used when employees need to verify their income for loans, leases, or other financial matters.

Potential Drawbacks of a Free Payroll Check Maker

While there are many benefits to using a free payroll check maker, it’s important to consider the potential drawbacks as well. Here are some challenges you may face when using a free tool:

1. Limited Features

One of the main drawbacks of free payroll check makers is that they often come with limited features compared to paid software. For example, a free tool might only allow you to generate basic pay stubs, whereas a paid tool may offer additional features like direct deposit integration, time tracking, or advanced reporting.

For a small startup, this may not be a major issue, but as your business grows, you may find that a free tool doesn’t provide everything you need to scale your payroll system effectively.

2. Lack of Customer Support

Many free tools don’t offer the same level of customer support as paid software. If you run into issues or have questions about payroll, you might not have access to immediate assistance. While some free payroll check makers offer email or community support, response times may be slower compared to paid services that offer phone support or live chat.

For startups that rely on payroll being processed accurately and on time, the lack of customer support could be a challenge if problems arise.

3. Security Concerns

Since free payroll check makers typically don’t come with the same level of security as premium options, there may be concerns regarding data protection. Payroll involves sensitive information, including employee names, salaries, and tax details, so it’s essential to ensure that this information is protected from unauthorized access.

When using a free payroll check maker, make sure the tool employs strong encryption methods and has secure data storage. If the security features are inadequate, you might want to consider upgrading to a more secure, paid service.

4. Scalability

As your startup grows and you hire more employees, you may find that a free payroll check maker doesn’t scale well with your business. Free tools typically have limitations on the number of employees you can add or the number of pay stubs you can generate each month.

If you anticipate rapid growth or plan to expand your team, it’s important to consider whether a free payroll check maker will continue to meet your needs as your business evolves.

Is a Free Payroll Check Maker Right for Your Startup?

A free payroll check maker can be an excellent choice for startups, particularly those with a small team or a limited budget. It offers cost savings, ease of use, and time-saving features that can help you manage payroll more efficiently while staying compliant with tax laws.

However, it’s important to carefully consider your business needs and the limitations of free tools. If you expect rapid growth or need advanced features like direct deposit or detailed reporting, a paid payroll solution might be a better fit. For many startups, though, a free payroll check maker is a great way to get started with payroll management without breaking the bank.

In the end, the right choice for your startup depends on your unique needs, business model, and long-term goals. Take the time to evaluate your options and choose the tool that will help you manage payroll efficiently and effectively as you grow your business.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons

Why Keeping Your Starbucks Pay Stub Is Important