In today’s fast-paced world, managing finances and keeping accurate records can be challenging. Whether you’re a small business owner, an independent contractor, or even an employee looking to keep track of your earnings, a free paystub maker is an invaluable tool. It simplifies payroll, saves time, and eliminates unnecessary costs associated with traditional accounting methods. Here, we’ll explore how a free paystub maker can benefit various audiences, provide tips for using one effectively, and address frequently asked questions.

What Is a Paystub Maker?

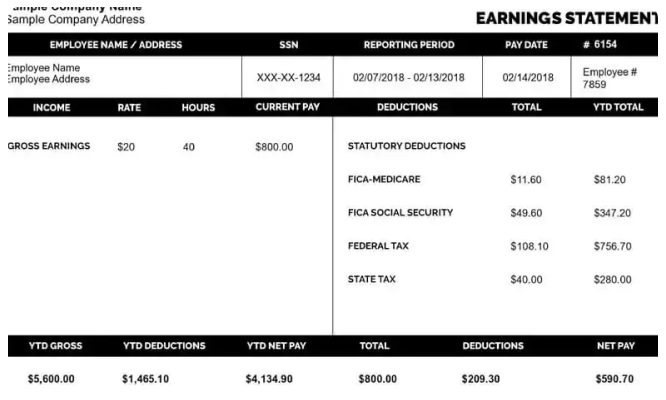

A paystub maker is an online tool designed to create paystubs—documents that summarize an employee’s earnings, deductions, and net pay for a specific period. These tools are particularly useful for:

-

Small business owners who handle payroll in-house.

-

Freelancers and contractors who need proof of income.

-

Employees who want to organize their financial records.

Free paystub makers are online platforms that provide these services without charge, making them an attractive option for those on a budget.

Benefits of Using a Free Paystub Maker

1. Cost-Effective

One of the biggest advantages of a free paystub maker is cost savings. Traditional payroll services can be expensive, especially for small businesses or self-employed individuals. With a free tool, you can create professional paystubs without spending a dime.

2. Time-Saving

Manual payroll processing is time-consuming. Free paystub makers streamline this process, allowing you to generate accurate paystubs in minutes. The easy-to-use interfaces and pre-designed templates reduce the effort required.

3. Accuracy

Free paystub makers often include built-in calculators that minimize errors. Simply input your details—such as hours worked, hourly rate, and deductions—and the tool will do the math for you.

4. Professional Appearance

A well-designed paystub enhances credibility. Free paystub makers offer customizable templates that produce professional-looking documents, whether for employees or personal record-keeping.

5. Convenience

With an online paystub maker, you can create paystubs anytime, anywhere. All you need is an internet connection, making it perfect for remote workers or business owners who travel frequently.

Who Can Benefit from a Free Paystub Maker?

Small Business Owners

Managing payroll is a daunting task for small business owners. A free paystub maker allows them to:

-

Create detailed paystubs for employees.

-

Maintain compliance with tax and labor laws.

-

Save money that would otherwise go to hiring an accountant.

Freelancers and Independent Contractors

For freelancers, proving income can be a challenge, especially when applying for loans or renting an apartment. A paystub maker enables them to:

-

Generate proof of income easily.

-

Keep track of earnings for tax purposes.

-

Maintain a professional image when dealing with clients.

Employees

Employees can use free paystub makers to:

-

Monitor their earnings and deductions.

-

Ensure their employers’ calculations are accurate.

-

Stay organized for tax filing and financial planning.

How to Use a Free Paystub Maker

Step 1: Gather Your Information

Before using a paystub maker, collect the necessary details, including:

-

Employer’s name and address.

-

Employee’s name and contact information.

-

Pay period dates.

-

Hours worked or salary amount.

-

Deductions (taxes, insurance, etc.).

Step 2: Choose a Reliable Free Paystub Maker

Search for a tool with positive reviews and robust features. Ensure the platform is secure, especially if you’re entering sensitive financial information.

Step 3: Input the Details

Enter the collected information into the paystub maker. Double-check for accuracy to avoid discrepancies.

Step 4: Customize the Template

Many free paystub makers offer customizable templates. Choose one that aligns with your needs and brand identity.

Step 5: Generate and Save

Once you’ve completed the details, generate the paystub. Save a copy for your records and share it as needed.

Key Features to Look For in a Free Paystub Maker

When selecting a free paystub maker, consider the following features:

-

Ease of Use

-

The tool should have a user-friendly interface that simplifies the process.

-

-

Customizable Templates

-

Look for options to customize fonts, colors, and layouts to suit your preferences.

-

-

Automatic Calculations

-

Built-in calculators ensure accuracy in earnings, deductions, and net pay.

-

-

Data Security

-

Ensure the platform uses encryption to protect your sensitive information.

-

-

Download and Sharing Options

-

The tool should allow you to download paystubs in PDF format and share them via email or print.

-

Common Questions About Free Paystub Makers

Are Free Paystub Makers Safe to Use?

Most reputable free paystub makers are safe. However, always check for SSL encryption and read user reviews before entering your information.

Can I Use a Free Paystub Maker for Tax Purposes?

Yes, paystubs generated with these tools are often sufficient for tax filing and proof of income. However, ensure the data entered is accurate and matches official records.

Do Free Paystub Makers Work for All Industries?

Yes, these tools are versatile and can accommodate various industries, including retail, construction, healthcare, and freelance work.

Are There Limitations to Free Paystub Makers?

Some free tools may have limitations, such as restricted features or ads. If you require advanced functionalities, consider premium options.

Conclusion

A free payroll check maker is a game-changer for small business owners, freelancers, and employees alike. It offers a cost-effective, time-saving, and reliable way to manage payroll and keep financial records organized. By choosing the right tool and following best practices, you can enjoy seamless payroll management without the need for expensive software or services.

Start using a free paystub maker today and experience the benefits of streamlined payroll processing and accurate record-keeping. It’s a smart, efficient solution for anyone looking to save time and money while staying on top of their finances.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons