Managing your finances is a crucial aspect of life, whether you’re an employee or a business owner. A big part of that involves understanding your paycheck and ensuring it’s accurate. Fortunately, technology has made this process much easier with the introduction of tools like paycheck creators. A free paycheck creator can help you calculate your paycheck with ease, saving you time and ensuring you don’t miss out on any important deductions or benefits.

In this step-by-step guide, we’ll walk you through how to use a free paycheck creator and why it can be beneficial for both employees and employers.

What is a Paycheck Creator?

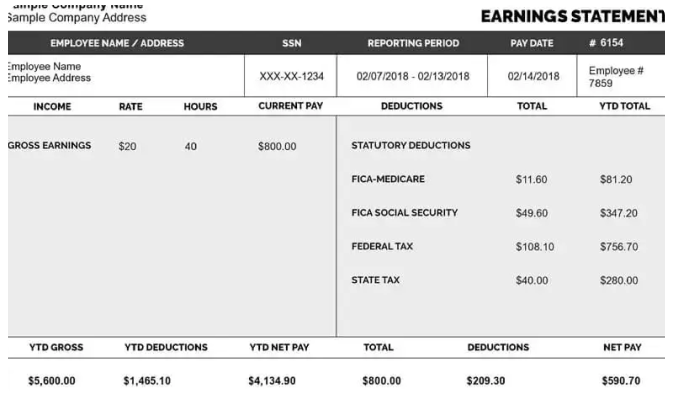

A paycheck creator is an online tool that helps you calculate the net income (the amount you take home) after all taxes and deductions are applied to your gross income (the amount before deductions). These tools often include federal and state tax rates, Social Security, Medicare, and other deductions that are specific to your location or situation.

By using a free paycheck creator, you can ensure that your paycheck calculations are accurate. These tools are especially helpful for freelancers, small business owners, and even those who are simply looking to double-check their pay stubs.

Why Use a Free Paycheck Creator?

-

Accuracy: Paycheck creators are designed to account for all the necessary calculations based on your specific tax rates, deductions, and filing status. This reduces the risk of mistakes that can occur with manual calculations.

-

Save Time: Instead of spending hours calculating your paycheck or relying on your payroll department, a free paycheck creator can generate results in just a few minutes.

-

Free and Accessible: As the name suggests, these paycheck creators are available for free. Many websites and apps offer these tools, and they’re easy to access from any device with an internet connection.

-

Flexibility: Whether you’re a salaried employee, an hourly worker, or a freelancer, a paycheck creator can cater to different pay structures, making it a versatile tool for various users.

-

Understanding Your Pay: For employees, it’s essential to understand how much of your gross income is deducted for taxes and other withholdings. A paycheck creator can break this down for you and provide a clear understanding of where your money is going.

Step-by-Step Guide to Using a Free Paycheck Creator

Step 1: Find a Reliable Paycheck Creator

The first step is to choose a free paycheck creator. A simple online search will provide you with several options, but make sure you’re using a trusted website or app to avoid incorrect calculations.

Some popular and reliable paycheck creator tools include:

- PaycheckCity: A well-known tool with a variety of calculators for different pay structures and tax situations.

- ADP Payroll Calculator: ADP is a leader in payroll services and offers a free paycheck calculator on their website.

- SmartAsset Paycheck Calculator: This tool gives you a detailed breakdown of your paycheck, including tax withholdings and other deductions.

Make sure the tool you choose is updated with the most recent tax rates and regulations.

Step 2: Enter Your Personal Information

Once you’ve chosen a paycheck creator, the next step is to input your personal information. This information is essential for the tool to calculate your paycheck accurately. You’ll typically need to provide the following details:

- Filing Status: Are you filing as a single individual, married, or head of household? This will affect your tax rate.

- Pay Frequency: Select whether you are paid weekly, biweekly, semimonthly, or monthly. Paycheck creators use this to determine the correct deductions and tax rates based on how often you receive a paycheck.

- Gross Income: This is your total income before any deductions, including salary or hourly wages, overtime, bonuses, or commissions.

- Allowances/Exemptions: These are based on your tax filings. If you’ve filled out a W-4 form with your employer, this will determine how much federal income tax is withheld from your paycheck.

- State of Residence: Tax laws vary by state, so providing this information will ensure that state-specific taxes are taken into account.

Some paycheck creators will also ask for additional information, such as local taxes, retirement contributions, and health benefits, which can all impact your take-home pay.

Step 3: Add Deductions and Benefits

After inputting your personal information, the next step is to add any deductions and benefits that might apply to your paycheck. Deductions can include:

- Federal Income Tax: This is based on your filing status and allowances. A free paycheck creator will calculate the federal tax based on the information you provided.

- State Income Tax: Not all states have an income tax, but those that do will have different tax rates. The paycheck creator will adjust for this based on the state you live in.

- Social Security and Medicare: These are federal programs, and both employees and employers contribute to them. A paycheck creator will automatically calculate these withholdings.

- Retirement Contributions: If you contribute to a 401(k) or other retirement plan, this will be deducted from your gross income.

- Health Insurance and Other Benefits: If you have employer-sponsored health insurance, dental, vision, or other benefits, these amounts will also be deducted from your paycheck.

Some paycheck creators even allow you to enter specific deductions, such as charitable donations or wage garnishments.

Step 4: Review Your Results

Once you’ve entered all the necessary information, the paycheck creator will calculate your net income. This will be the amount you take home after all the deductions have been applied.

You’ll typically see:

- Gross Pay: Your total income before any deductions.

- Deductions: A breakdown of all taxes, contributions, and other withholdings.

- Net Pay: Your take-home pay, or the amount you will receive in your paycheck.

Review these results carefully to make sure everything looks accurate. If you’re unsure about any deductions or calculations, you can adjust the inputs and re-run the calculations until everything seems correct.

Step 5: Save or Print Your Paycheck Information

Many free paycheck creators give you the option to download or print your paycheck details. This can be helpful for record-keeping purposes, especially if you need to refer to your pay information later.

You can also save the calculation on your device, which makes it easy to keep track of your earnings over time. Some tools even let you track multiple pay periods so that you can see how your income and deductions change over time.

Step 6: Use the Paycheck Information Wisely

Once you’ve calculated your paycheck, you’ll have a better understanding of how much you’re earning versus your gross pay. This information is important for budgeting, planning for savings, and making sure you’re not overpaying on taxes.

Here are a few ways to use this information:

- Budgeting: Knowing your net income allows you to create a realistic budget. You can allocate funds for essential expenses like rent, utilities, and groceries, while also saving for future goals.

- Tax Planning: If your withholding is too high or too low, you can adjust your W-4 form with your employer to ensure that you’re paying the right amount of taxes throughout the year.

- Financial Planning: If you’re trying to save for specific goals (e.g., a vacation, emergency fund, or home purchase), understanding your paycheck will help you set aside the right amount each month.

Conclusion

Using a free paycheck creator is an easy and effective way to manage your finances and understand your take-home pay. Whether you’re an employee, freelancer, or small business owner, this tool can save you time, prevent mistakes, and help you plan for the future. By following this step-by-step guide, you can ensure that your paycheck calculations are accurate and that you’re making the most of your income.

Don’t hesitate to use these free tools to keep your financial life in order and make informed decisions about your pay, taxes, and deductions.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal