In this blog post, we’ll explore how paystub creators can optimize your payroll system, particularly for tech startups. We’ll discuss how these tools work, the benefits they offer, and how they can save you time and reduce errors. By the end of this article, you’ll understand how integrating a paystub creator into your payroll process can streamline operations, ensuring your team is paid accurately and on time.

Table of Contents

ToggleWhat Is a Paystub Creator?

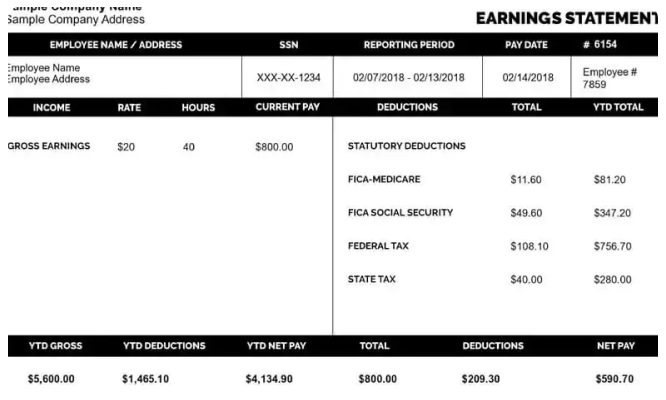

Before diving into the benefits, let’s define what a paystub creator is. A paystub creator is an online tool or software that generates pay stubs for employees. It allows employers to input payment information, tax details, deductions, and hours worked, and then automatically creates an official pay stub document. This document contains all the necessary information that an employee needs to understand their paycheck, including:

- Gross pay

- Net pay

- Deductions (taxes, benefits, retirement contributions, etc.)

- Hourly rates (if applicable)

- Overtime pay

- Year-to-date (YTD) earnings

For tech startups, using a paystub creator can significantly reduce the time and effort needed to generate these documents manually. Instead of tracking each paycheck and creating pay stubs from scratch, the creator tool takes care of the calculations for you. This can be especially useful in a startup environment where time and resources are limited.

Why Tech Startups Need Paystub Creators

Tech startups are often characterized by their rapid growth, fast-paced environment, and lean teams. Many founders start out doing everything themselves, from product development to marketing to payroll. However, as your startup grows, you need a way to manage payroll that is efficient, accurate, and scalable.

Here are some specific reasons why paystub creators are particularly beneficial for tech startups:

1. Time Savings

In a startup, time is one of your most valuable resources. Managing payroll manually can be a time-consuming process. With a paystub creator, you can generate pay stubs in minutes. This frees up valuable time for you to focus on your core business operations like product development, customer acquisition, and scaling your team.

2. Accuracy and Compliance

Payroll can be complicated, especially when it comes to calculating taxes, deductions, and benefits. Errors in payroll can lead to costly penalties or disgruntled employees. A paystub creator reduces the risk of human error by automating the calculations for you. These tools also help ensure compliance with federal and state tax regulations, which can be particularly important for startups that may not have a dedicated HR team to stay up to date with the latest regulations.

3. Scalability

As your startup grows, so does your team, and so does the complexity of your payroll system. What worked for a small team of five may not be sufficient when you reach 50 or more employees. A paystub creator can scale with your business, allowing you to add new employees, handle varying pay structures (salaries, hourly rates, commissions), and manage different benefit plans. It takes the burden off your shoulders, allowing you to focus on growing the business.

4. Improved Transparency for Employees

In the tech industry, many employees work remotely or on flexible schedules, which can sometimes lead to misunderstandings about pay. A paystub creator allows you to provide employees with clear, accurate pay stubs that break down their earnings, taxes, and deductions. This transparency helps to avoid confusion and ensures that your team members have all the information they need about their pay.

5. Data Security

Tech startups deal with sensitive data regularly, and payroll is no exception. Paystub creators often come with strong security measures to protect employee data. Many of these tools store pay stubs digitally in a secure cloud-based system, reducing the risk of paper pay stubs getting lost or mishandled. Furthermore, access to paystub records can be restricted, ensuring that only authorized personnel can view or modify sensitive information.

6. Integration with Other Systems

Tech startups often use a range of software tools to manage different aspects of the business. A paystub creator can integrate with other software you may already use, such as accounting systems, time-tracking tools, and HR platforms. This integration ensures that all your data is synced, reducing duplication and the potential for errors.

Key Features of a Paystub Creator

When choosing a paystub creator for your tech startup, there are several key features you should look for to ensure it meets your needs:

1. Customization Options

Every startup has its own payroll structure, and a paystub creator should allow you to customize the pay stubs to fit your business. This might include adding custom deductions, benefit information, or bonus structures. Look for a tool that offers flexibility to match your payroll system.

2. Tax Calculation

A good paystub creator will automatically calculate federal, state, and local taxes based on the employee’s location and tax information. This ensures compliance and saves you the headache of figuring out tax rates manually.

3. Automatic Updates

Tax laws and payroll regulations change frequently. The best paystub creators will automatically update their tax tables to reflect the latest regulations, ensuring you’re always in compliance.

4. Cloud Storage

Cloud storage is an important feature, as it allows you to securely store and access pay stubs from anywhere. Employees can also access their pay stubs at any time, which can be especially useful for remote teams.

5. User-Friendly Interface

Tech startups are typically led by people who are busy and may not have extensive HR experience. A user-friendly interface is essential for ensuring that anyone in your company can use the tool easily without extensive training. Look for a paystub creator with an intuitive design and simple workflow.

How to Implement a Paystub Creator in Your Startup

Implementing a paystub creator in your startup’s payroll system is straightforward. Here are the basic steps to get started:

- Choose the Right Tool: Research different paystub creators and select the one that best fits your needs. Consider factors like cost, features, ease of use, and scalability.

- Enter Employee Information: Set up your company profile and enter employee details, including pay rates, tax information, and benefits.

- Input Payroll Data: For each pay period, input data such as hours worked, overtime, bonuses, and deductions.

- Generate Pay Stubs: After inputting the data, the paystub creator will generate pay stubs for each employee. Review them for accuracy before sending them out.

- Distribute Pay Stubs: Once the pay stubs are generated, distribute them to your employees. Many paystub creators allow you to email them directly or provide access to an employee portal.

Conclusion

Running a tech startup comes with many challenges, but payroll doesn’t have to be one of them. By implementing a free paystub creator, you can optimize your payroll system, saving time, improving accuracy, and ensuring compliance. Whether you’re a founder managing payroll for a small team or a growing startup with many employees, a paystub creator can streamline the process and reduce the risk of errors.

Take the next step in improving your payroll system by choosing a paystub creator that fits your needs. It’s a smart move that will help you focus on what really matters—growing your business and supporting your team.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary