Running a small business is no easy feat, and managing payroll can often feel like a complex and time-consuming task. Whether you’re a freelancer, a startup, or a growing small business, ensuring that your employees are paid correctly and on time is crucial. The good news is, you don’t have to break the bank to handle payroll—using a free paycheck tool can simplify the entire process, saving you both time and money while ensuring your payroll is accurate.

In this blog, we’ll explore why using a free paycheck tool is essential for small business owners, the benefits it offers, and how to choose the best one for your needs.

Table of Contents

ToggleWhat is a Free Paycheck Tool?

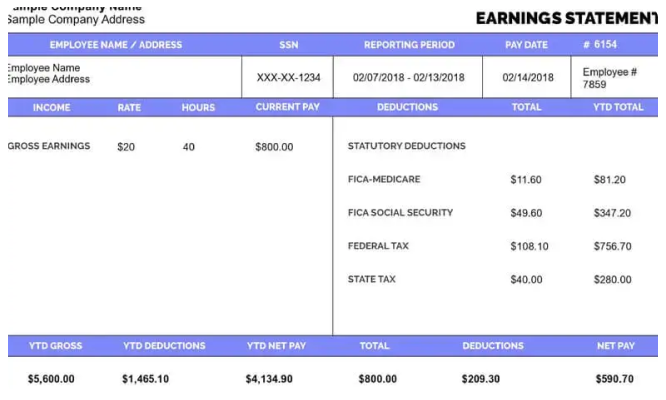

A free paycheck tool is an online platform or software that helps businesses create accurate paychecks for their employees. These tools typically automate payroll processes, including tax calculations, deductions, and the generation of pay stubs. By using a free paycheck tool, small business owners can generate paychecks quickly and accurately, without the need for manual calculations.

Most free paycheck tools are cloud-based, making them easy to access from any device with an internet connection. They offer various features like calculating hourly wages, salaries, tax deductions, overtime pay, and even employee benefits. Many tools also allow you to generate pay stubs that can be shared with employees.

Why Small Business Owners Should Use a Free Paycheck Tool

As a small business owner, you wear many hats—from managing daily operations to overseeing marketing, sales, and customer service. Payroll is just another task to add to your plate, but it’s one of the most important aspects of running a business. Ensuring that your employees are paid correctly, on time, and in compliance with tax laws is essential for employee satisfaction and business success.

Here’s why a free paycheck tool is vital for small business owners:

1. Saves Time and Reduces Errors

Manual payroll calculations can take up a significant amount of time, especially for businesses with multiple employees. With a free paycheck tool, the entire payroll process is automated. You simply input the necessary information (such as hours worked, pay rates, and deductions), and the tool does the math for you.

Automating payroll also helps reduce the risk of errors. Manual calculations can lead to mistakes, such as incorrect tax withholdings or overtime pay miscalculations. A free paycheck tool eliminates these errors by ensuring that everything is calculated accurately, reducing the chances of costly mistakes.

2. Cost-Effective Solution

For many small businesses, budgeting is a top concern. Payroll software can be expensive, especially for businesses just starting or with limited resources. A free paycheck tool is an affordable alternative that helps small business owners handle payroll without incurring additional costs.

These tools are designed to be user-friendly and efficient, which means you don’t have to pay for complex, enterprise-level payroll solutions that come with features you don’t need. With a free paycheck tool, you get the basics of payroll management at no cost, allowing you to allocate your budget to other areas of your business.

3. Accurate Tax Calculations

Payroll taxes are one of the most complicated aspects of payroll management. There are federal, state, and local taxes to consider, not to mention Social Security and Medicare contributions. A mistake in tax calculations can lead to fines and penalties from the IRS or other tax authorities.

A free paycheck tool takes the guesswork out of tax calculations. The best tools automatically calculate federal, state, and local tax withholdings based on the latest tax rates. They also account for deductions such as Social Security, Medicare, and unemployment taxes. By using a free paycheck tool, small business owners can ensure that their employees’ taxes are calculated correctly and on time.

4. Helps with Compliance

Payroll compliance is a legal requirement for all businesses. You must follow federal and state labor laws, tax regulations, and withholding rules. A free paycheck tool can help ensure that your business complies with these laws, reducing the risk of non-compliance issues.

Most paycheck tools are updated regularly to reflect changes in tax laws and regulations. This means you don’t have to worry about staying on top of tax code changes—your paycheck tool will handle it for you.

5. Convenient Record-Keeping

Another benefit of using a free paycheck tool is that it helps you keep organized records of payroll data. The tool automatically generates pay stubs, which can be downloaded or printed for your records. You can also track employee earnings, deductions, taxes paid, and other important payroll information.

Having organized records is essential for tax filing and audits. If you ever need to provide proof of payroll or tax payments, having these records easily accessible can save you time and effort.

6. Employee Satisfaction and Trust

Your employees rely on timely and accurate paychecks. Late or incorrect payments can lead to frustration, mistrust, and even employee turnover. By using a free paycheck tool, you ensure that your employees are paid correctly and on time, which helps build trust and loyalty.

Many free paycheck tools also allow employees to access their pay stubs online, making it easy for them to keep track of their earnings and deductions. This transparency helps foster a positive working relationship between you and your employees.

7. Flexible Payment Options

A good free paycheck tool will offer multiple payment options for your employees, including direct deposit, check payments, and sometimes even prepaid cards. Providing flexible payment options can improve employee satisfaction and make payroll management more efficient.

Direct deposit, in particular, is a preferred method for many employees as it eliminates the need for physical checks and speeds up the payment process. Many free paycheck tools allow you to set up direct deposit easily, even if you don’t have a payroll service provider.

How to Choose the Best Free Paycheck Tool

Not all free paycheck tools are created equal. When choosing the best tool for your small business, there are a few key factors to consider:

1. Ease of Use

The best paycheck tools should have an intuitive and user-friendly interface. As a small business owner, you likely have a lot on your plate, so you don’t want to waste time trying to figure out how to use complicated software. Look for a tool that allows you to quickly input data and generate paychecks without needing a lot of training.

2. Tax and Deduction Features

A good free paycheck tool will automatically calculate taxes, deductions, and other withholdings for you. Make sure the tool you choose supports all the tax requirements for your business, including federal, state, and local taxes. It should also account for other deductions like health insurance, retirement contributions, and garnishments.

3. Employee Information Management

The tool should allow you to easily input and manage employee information, including pay rates, hours worked, and tax exemptions. It should also allow you to track vacation and sick days if applicable.

4. Pay Stub Generation

Look for a paycheck tool that automatically generates pay stubs that can be printed or downloaded by employees. These pay stubs should include details like gross pay, net pay, deductions, and taxes withheld.

5. Support and Updates

Even though you’re using a free tool, you must have access to support if needed. Choose a paycheck tool that offers online support or resources, such as FAQs or customer service. Additionally, the tool should be regularly updated to reflect changes in tax laws and other payroll requirements.

Conclusion

For small business owners, managing payroll is an essential but often time-consuming task. Using a free paycheck tool can make the process more efficient, accurate, and cost-effective. With automated calculations, accurate tax withholdings, and easy-to-generate pay stubs, a free paycheck tool simplifies payroll management and helps ensure compliance with tax laws.

By choosing the right free paycheck tool, small business owners can save time, reduce errors, stay compliant with tax regulations, and improve employee satisfaction. Ultimately, this frees up valuable time and resources to focus on growing your business and achieving your goals.

If you’re a small business owner looking for a simple and affordable way to manage payroll, a free paycheck tool is a great place to start.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal