If you’re an employer, freelancer, or contractor, creating accurate and professional check stubs is a crucial part of managing payroll, ensuring compliance, and maintaining financial transparency. A check stub maker can help you generate pay stubs quickly, efficiently, and with minimal error. But not all check stub makers are created equal. To get the most out of the tool, you need a solution that offers the right features to meet your specific needs.

In this guide, we’ll explore the top 10 features that every check stub maker should have to make the payroll process easier, faster, and more accurate. Whether you’re a small business owner, freelancer, or contractor, these features will ensure that you can generate pay stubs with ease and confidence.

Table of Contents

Toggle1. Customizable Templates

One of the most important features of any check stub maker is the ability to create customizable templates. The template should allow you to enter the relevant details for each paycheck, such as the employee’s name, pay rate, hours worked, overtime, and deductions.

-

Why It’s Important: Having a customizable template ensures that you can create check stubs for different types of employees (full-time, part-time, contractors, etc.) or pay structures (hourly, salaried, commission-based). It also allows for flexibility in adding unique deductions, bonuses, or commissions as needed.

-

What to Look For: Look for a tool that provides a variety of templates that you can adjust for different pay frequencies (weekly, bi-weekly, monthly) and includes fields for both standard and customized deductions or benefits.

2. Automatic Calculations for Gross and Net Pay

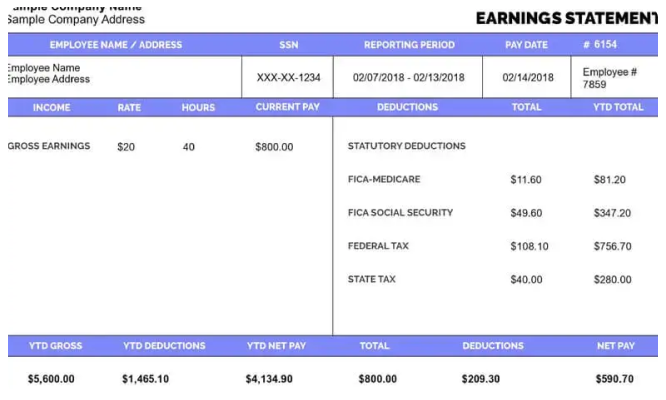

A great check stub maker will automatically calculate both gross pay (the total amount earned before deductions) and net pay (the take-home amount after deductions). You simply enter the hours worked, rate of pay, and any bonuses or overtime, and the tool will take care of the math.

-

Why It’s Important: Automatic calculations eliminate the risk of human error and save you time. With tax rates and deduction percentages constantly changing, having a tool that automatically updates and recalculates is essential for keeping everything accurate.

-

What to Look For: The check stub maker should include automatic calculations for earnings, tax deductions, benefits contributions, and other deductions like Social Security, Medicare, and retirement plans.

3. Multiple Deduction Types

Your check stub maker should allow you to add various deduction types to accurately reflect the amounts deducted from your employee’s pay. These can include:

-

Federal and state taxes

-

Social Security and Medicare

-

Health insurance premiums

-

Retirement plan contributions (401(k), IRA)

-

Union dues

-

Child support or garnishments

-

Why It’s Important: Having the ability to add multiple types of deductions ensures that your check stubs are comprehensive and reflect the full scope of the deductions made from each paycheck. This is especially critical for tax reporting and legal compliance.

-

What to Look For: Choose a check stub maker that supports a wide range of deduction types and allows you to easily adjust amounts for each pay stub.

4. Tax Rate Calculations (Federal, State, Local)

A solid check stub maker should calculate federal, state, and local taxes automatically based on the current tax rates. This includes calculating withholding amounts for income taxes, Social Security, and Medicare.

-

Why It’s Important: Tax rates are constantly changing, and keeping up with the latest regulations can be complicated. An effective check stub maker will automatically apply the correct tax rates, ensuring that your employee’s tax withholding is accurate and up-to-date.

-

What to Look For: Ensure the tool is connected to up-to-date tax rate databases, so it can apply the correct federal, state, and local tax rates. Some tools also allow you to input custom tax rates if necessary.

5. Year-to-Date (YTD) Information

An essential feature for both employers and employees is Year-to-Date (YTD) information, which shows the cumulative total of wages, deductions, and taxes for the entire year. This information is valuable during tax season, as it helps employees understand how much they’ve earned and how much has been deducted so far.

-

Why It’s Important: YTD information is crucial for accurate tax filing and financial planning. It allows both employers and employees to monitor earnings over time, ensuring everything is on track.

-

What to Look For: Look for a check stub maker that includes YTD totals for gross earnings, deductions, and net pay. It’s a helpful tool for ensuring that employees are on track for their annual financial goals and tax obligations.

6. Direct Deposit Integration

Many businesses today offer direct deposit as a preferred method of payment. A great check stub maker will allow you to integrate directly with payroll systems or banking services to facilitate direct deposits, along with issuing digital pay stubs.

-

Why It’s Important: Direct deposit is faster and more efficient than paper checks, saving both time and money. Integrating this feature into your check stub maker simplifies the entire process by automating both payment and the issuance of pay stubs.

-

What to Look For: The best check stub makers will allow you to set up direct deposit options and automatically generate digital pay stubs for employees. This feature reduces administrative workload and improves the payment process.

7. Customizable Pay Periods and Schedules

Not all businesses operate on the same pay schedule. Some may pay weekly, bi-weekly, semi-monthly, or monthly. A great check stub maker should allow you to customize pay periods and schedules according to your business needs.

-

Why It’s Important: Businesses have different payroll needs depending on their size, industry, and workforce. Having the ability to create check stubs for any pay period schedule ensures flexibility and accuracy in payment.

-

What to Look For: Look for a check stub maker that supports various pay frequencies and allows for easy adjustments for special pay periods like bonuses or one-time payments.

8. Ability to Generate Detailed Reports

A powerful check stub maker will allow you to generate detailed payroll reports for both individual employees and your entire workforce. These reports should include information on earnings, taxes, deductions, and any other relevant payroll data.

-

Why It’s Important: Payroll reports are useful for internal accounting, auditing, and tax filing purposes. They can help you track employee compensation, verify tax payments, and ensure compliance with labor laws.

-

What to Look For: Look for a tool that can generate PDF reports, export data to Excel, or integrate with your accounting software for easy financial reporting.

9. Secure Storage and Access

Security is paramount when dealing with sensitive payroll information. A check stub maker should offer secure storage options for both pay stubs and payroll data, ensuring that everything is protected from unauthorized access or loss.

-

Why It’s Important: Pay stubs contain sensitive financial and personal information. Ensuring that your payroll data is safely stored is critical for compliance with privacy regulations and protecting your employees’ personal information.

-

What to Look For: Choose a check stub maker that provides encrypted storage, secure cloud backups, and controlled access to data. It’s also helpful to have the option to securely share pay stubs with employees via email or a password-protected portal.

10. Easy-to-Use Interface and Customer Support

A user-friendly interface is essential to making the check stub creation process quick and stress-free. Your check stub maker should be easy to navigate, with intuitive features that allow you to input data, generate pay stubs, and make any necessary adjustments without a steep learning curve.

-

Why It’s Important: A straightforward, user-friendly tool saves time and reduces frustration. Having reliable customer support available is also crucial in case you encounter any issues while using the software.

-

What to Look For: Look for a check stub maker with an easy-to-use dashboard, clear instructions, and 24/7 customer support. Online tutorials and FAQs can also help address common questions.

Conclusion

Whether you’re an employer managing payroll for a team or an independent contractor creating pay stubs for clients, the right check stub maker can save you time, reduce errors, and ensure compliance with tax regulations. The top 10 features listed above will help you streamline the payroll process, create accurate and professional pay stubs, and keep track of your financial obligations.

By choosing a check stub maker with these key features, you can simplify your payroll management, improve your financial transparency, and ensure that both you and your employees are always on track.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs