IMARC Group, a leading market research company, has recently released a report titled “Travel Insurance Market Report by Insurance Type (Single Trip Travel Insurance, Annual Multi-Trip Insurance, Long-Stay Travel Insurance), Coverage (Medical Expenses, Trip Cancellation, Trip Delay, Property Damage, and Others), Distribution Channel (Insurance Intermediaries, Banks, Insurance Companies, Insurance Aggregators, Insurance Brokers, and Others), End User (Senior Citizens, Education Travelers, Business Travelers, Family Travelers, and Others), and Region 2025-2033”. The study provides a detailed analysis of the industry, including the global travel insurance market trends, share, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

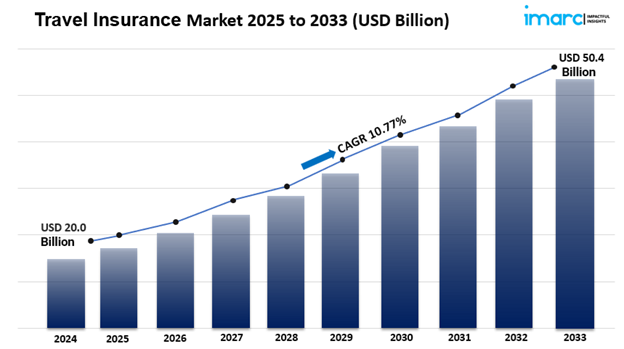

The global travel insurance market size reached USD 20.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 50.4 Billion by 2033, exhibiting a growth rate (CAGR) of 10.77% during 2025-2033.

Request to Get the Sample Report:

https://www.imarcgroup.com/travel-insurance-market/requestsample

Travel Insurance Market Trends in 2025

The travel insurance market is set to evolve significantly as it adapts to changing consumer preferences and emerging trends. One of the most prominent trends is the increasing focus on health and safety coverage, particularly in response to the ongoing effects of the global pandemic. In 2025, travelers will prioritize insurance policies that provide comprehensive health coverage, including medical expenses, emergency evacuations, and coverage for quarantine-related costs. This heightened emphasis on health will drive demand for policies that specifically address health risks associated with travel, reflecting a broader concern for personal safety.

Moreover, as international travel resumes and expands, travelers will seek insurance solutions that offer peace of mind against unforeseen circumstances. Insurers will respond by enhancing their offerings with features such as 24/7 emergency assistance, telemedicine services, and coverage for trip interruptions due to health-related issues.

Additionally, the integration of technology will play a crucial role in shaping the travel insurance landscape. Digital platforms will enable travelers to easily access and manage their insurance policies, file claims, and receive real-time support during their trips. This trend towards digitization will not only improve the customer experience but also streamline operations for insurers, allowing them to respond more effectively to the evolving needs of travelers.

Overall, the travel insurance market in 2025 will be characterized by a strong focus on health and safety, enhanced digital solutions, and a commitment to providing travelers with the comprehensive coverage they need to navigate an increasingly complex travel environment.

Market Dynamics of the Travel Insurance Market

Increased Awareness and Demand for Comprehensive Coverage

The travel insurance market is witnessing a significant shift towards increased awareness among consumers regarding the importance of comprehensive coverage. As travelers become more informed about potential risks associated with travel, such as trip cancellations, medical emergencies, and lost luggage, the demand for robust travel insurance policies is on the rise.

In 2025, consumers are expected to prioritize policies that offer extensive coverage, including COVID-19-related issues, natural disasters, and other unforeseen events. This heightened awareness is partly driven by the experiences of travelers during the pandemic, where many faced challenges due to inadequate insurance coverage. Consequently, insurers are adapting their offerings to meet these evolving needs, providing policies that encompass a wider range of risks.

Additionally, the rise of online platforms and comparison tools has empowered consumers to make informed decisions, leading to a more competitive market. Insurers are now focusing on educating potential clients about the benefits of comprehensive coverage, promoting transparency in policy details, and emphasizing the importance of travel insurance as an essential component of travel planning. This dynamic is likely to result in a more informed consumer base that actively seeks out policies that provide peace of mind during their travels.

Technological Advancements and Digital Transformation

Technological advancements are playing a pivotal role in transforming the travel insurance market, enhancing both the purchasing experience and claims processing. In 2025, the integration of artificial intelligence (AI), machine learning, and big data analytics is expected to revolutionize how travel insurance products are developed and marketed. Insurers will leverage these technologies to analyze consumer behavior, preferences, and risk profiles, allowing them to create personalized insurance solutions that cater to individual needs.

Additionally, the rise of mobile applications and digital platforms will streamline the purchasing process, making it easier for travelers to compare policies, obtain quotes, and purchase coverage on-the-go.

Furthermore, AI-powered chatbots and customer service tools will enhance customer support, providing instant assistance and information to travelers. Claims processing will also benefit from automation, reducing the time and effort required to file and settle claims. This digital transformation will not only improve customer satisfaction but also increase operational efficiency for insurers. As a result, the travel insurance market will become more accessible and user-friendly, attracting a broader audience and driving demand for innovative insurance solutions.

Shift Towards Customization and Flexible Policies

The travel insurance market is experiencing a notable shift towards customization and flexibility in policy offerings, catering to the diverse needs of modern travelers. In 2025, consumers will increasingly seek insurance products that allow them to tailor coverage based on their specific travel plans, preferences, and activities. This trend is driven by the growing popularity of personalized travel experiences, where travelers engage in unique activities such as adventure sports, long-term travel, and multi-destination trips. Insurers are responding by offering modular policies that enable customers to select coverage options that align with their travel itineraries.

For instance, travelers can choose to add specific coverage for adventure sports, rental car protection, or cancellation for any reason. This level of customization not only meets the varied needs of travelers but also enhances their overall travel experience.

Additionally, the demand for flexible policies that adapt to changing circumstances, such as trip modifications or cancellations, is expected to rise. Insurers will need to innovate and develop products that provide the necessary flexibility without compromising on coverage, ensuring that travelers feel secure and protected throughout their journeys.

Travel Insurance Market Report Segmentation:

By Insurance Type:

· Single-Trip Travel Insurance

· Annual Multi-Trip Insurance

· Long-Stay Travel Insurance

Annual multi-trip insurance holds the majority of the market share due to its cost-effectiveness and convenience for frequent travelers who make multiple trips throughout the year.

By Coverage:

· Medical Expenses

· Trip Cancellation

· Trip Delay

· Property Damage

· Others

Medical expenses accounted for the largest market share because medical emergencies abroad can incur significant costs, making comprehensive medical coverage a top priority for travelers.

By Distribution Channel:

· Insurance Intermediaries

· Banks

· Insurance Companies

· Insurance Aggregators

· Insurance Brokers

· Others

Insurance intermediaries represented the largest segment as they provide personalized advice and assistance, helping customers choose the best policies to meet their specific needs.

By End User:

· Senior Citizens

· Education Travelers

· Business Travelers

· Family Travelers

· Others

Family travelers hold the majority of the market because families often seek comprehensive travel insurance to cover multiple members and various potential risks during their trips.

Regional Insights:

· North America

· Asia Pacific

· Europe

· Latin America

· Middle East and Africa

North America’s dominance in the market is attributed to the high volume of outbound travel, higher disposable income, and greater awareness of the benefits of travel insurance among travelers in the region.

Competitive Landscape with Key Players:

The competitive landscape of the travel insurance market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

· Allianz SE

· American Express Company

· American International Group

· AXA SA

· Berkshire Hathaway Specialty Insurance Company

· Generali Group

· Insure & Go Insurance Services (Mapfre S.A.)

· Seven Corners Inc.

· Travel Insured International Inc (Crum & Forster)

· USI Affinity (USI Insurance Services)

· Zurich Insurance Group AG

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=2432&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800