Whether you’re a small business owner, a freelancer, or an independent contractor, managing finances effectively is critical to your success. One essential tool that can simplify your financial record-keeping is a paystub creator. It allows you to generate accurate, professional paystubs that detail earnings, deductions, and net pay.

But with so many options available, how do you choose the right paystub creator for your needs? This guide will walk you through everything you need to know before making your decision.

Table of Contents

ToggleWhat Is a Paystub Creator?

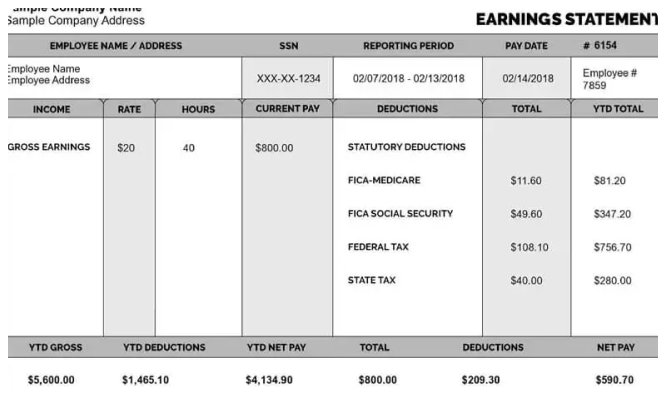

A paystub creator is an online tool designed to produce paystubs for employees, contractors, or even yourself if you’re self-employed. It provides a detailed breakdown of your earnings and deductions, ensuring your financial records are accurate and professional.

These tools are particularly useful for:

- Small businesses managing employee payroll

- Freelancers tracking income for tax purposes

- Gig workers needing proof of income for loans or rentals

Why You Need a Paystub Creator

Paystubs are more than just a document; they serve multiple purposes in personal and professional life. Here’s why having a paystub creator is essential:

1. Proof of Income

Many situations, such as applying for a loan, renting a house, or securing a mortgage, require proof of income. A paystub creator lets you produce professional, verifiable paystubs whenever needed.

2. Tax Compliance

Keeping track of earnings and deductions is vital during tax season. A paystub creator helps ensure all income and expenses are accurately documented, making tax filing straightforward.

3. Transparency for Employees

If you manage a small team, providing detailed paystubs builds trust and transparency. Employees can see exactly how their earnings were calculated, fostering better relationships.

Key Features to Look for in a Paystub Creator

Before choosing a paystub creator, it’s important to evaluate its features to ensure it meets your needs.

1. User-Friendly Interface

A good paystub creator should be easy to use, even if you don’t have much technical expertise. Look for a tool with an intuitive layout and simple instructions.

2. Customization Options

Your business is unique, and your paystubs should reflect that. Choose a paystub creator that allows you to customize details like company name, logo, and pay period information.

3. Accuracy

Accurate calculations are non-negotiable. The tool should handle gross pay, deductions, taxes, and net pay with precision. Any errors in these calculations could lead to financial or legal issues.

4. Compliance with State Laws

Different states have varying requirements for paystubs, including mandatory information. Ensure the paystub creator complies with these regulations to avoid penalties.

5. Affordability

Consider your budget when choosing a paystub creator. While some tools offer free basic features, others charge for advanced functionality. Evaluate what you truly need and pick a tool that offers the best value.

6. Security

Paystubs often contain sensitive information. Make sure the paystub creator uses encryption and other security measures to protect your data.

Benefits of Using a Paystub Creator

1. Saves Time

Creating paystubs manually can be time-consuming, especially for businesses with multiple employees. A paystub creator automates the process, freeing up your time for other tasks.

2. Professional Appearance

A well-designed paystub adds professionalism to your business. This is especially important when dealing with employees, contractors, or financial institutions.

3. Reduces Errors

Manual calculations are prone to mistakes. A paystub creator ensures that all figures, including taxes and deductions, are accurate, reducing the risk of costly errors.

4. On-Demand Access

With an online paystub creator, you can generate paystubs anytime, anywhere. This flexibility is especially useful for freelancers and remote workers.

Common Mistakes to Avoid When Choosing a Paystub Creator

1. Choosing Price Over Quality

While affordability is important, opting for the cheapest tool might compromise quality. Look for a balance between cost and features.

2. Overlooking State Compliance

Different states require specific details on paystubs. Ensure the tool you choose complies with your local laws to avoid legal issues.

3. Ignoring Security Features

Your financial data is sensitive. Avoid tools that don’t prioritize security or lack encryption protocols.

4. Not Checking for Customer Support

If you encounter issues, having access to reliable customer support is invaluable. Make sure the paystub creator offers assistance when you need it.

Who Can Benefit from a Paystub Creator?

1. Freelancers and Gig Workers

Freelancers and gig workers often face challenges proving their income. A paystub creator helps them generate professional documents to use when applying for loans, renting apartments, or filing taxes.

2. Small Business Owners

Small businesses need to provide employees with accurate paystubs to maintain transparency and comply with labor laws. A paystub creator makes this process efficient and hassle-free.

3. Self-Employed Individuals

If you’re self-employed, keeping track of your income and deductions is crucial for tax reporting. A paystub creator simplifies this by generating clear, detailed records.

4. Contractors

Independent contractors can use a paystub creator to document their earnings and ensure they have proof of income for financial or legal purposes.

How to Use a Paystub Creator

Using a pay stub creator is simple. Here’s a step-by-step guide:

- Choose a Reliable Tool: Research and select a paystub creator that fits your needs.

- Input Your Information: Enter details like your name, business name, pay period, and income.

- Add Deductions: Include any necessary deductions, such as taxes or benefits.

- Customize the Layout: Add your business logo or other custom elements.

- Review and Generate: Double-check all details for accuracy, then create the paystub.

- Save or Print: Save the pay stub for your records or print it for distribution.

Popular Paystub Creator Tools

Here are some popular paystub creators to consider:

- StubCreator: Known for its user-friendly interface and compliance with state laws.

- Real Check Stubs: Offers customizable templates and professional designs.

- Paystub Generator Free: A budget-friendly option for basic needs.

When choosing a tool, compare features, pricing, and user reviews to make an informed decision.

Why Accuracy and Compliance Matter

Generating paystubs isn’t just about convenience; it’s also about accuracy and compliance. Errors in calculations or missing details can lead to financial disputes, tax issues, or penalties. A reliable paystub creator ensures your records are accurate, protecting you from these risks.

Final Thoughts

Choosing the right free paystub creator is an important decision for freelancers, small business owners, and gig workers. It simplifies payroll, ensures compliance, and provides professional documentation for income and deductions.

By considering features like user-friendliness, customization, and compliance, you can find a pay stub creator that fits your unique needs. Take the time to research your options and invest in a tool that supports your financial goals and business growth.

Start today and make managing your finances easier, more efficient, and stress-free!

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season