In this blog, we’ll explore why every business, regardless of size, needs a paycheck creator to generate accurate pay stubs. We’ll discuss how a paycheck creator can streamline payroll, reduce errors, and help you comply with tax laws, all while saving you time and money.

Table of Contents

ToggleWhat is a Paycheck Creator?

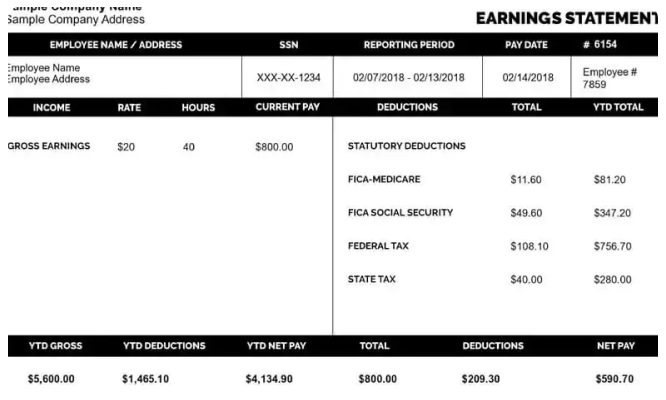

A paycheck creator is a tool or software that automatically generates pay stubs for employees. It can be used by business owners to quickly input employee information, such as hourly rates, hours worked, bonuses, and deductions, and then generate a professional, accurate pay stub. A paycheck creator ensures that the correct amounts are deducted for taxes, insurance, and retirement contributions, giving employees a clear breakdown of their earnings.

Paycheck creators often come with additional features, such as tax calculation tools, customizable templates, and the ability to track overtime, vacation time, and other allowances. Most importantly, they help businesses avoid the complexity of doing calculations manually, which can be time-consuming and error-prone.

1. Ensures Accuracy in Pay Stubs

Accuracy is the foundation of payroll management. Every business needs to make sure that pay stubs are accurate because incorrect pay stubs can lead to confusion, frustration, and even legal issues. If employees are paid the wrong amount or deductions are incorrect, it can damage your business’s reputation and create problems with compliance.

A paycheck creator removes the guesswork by automating tax calculations, deductions, and the total net pay. Once you input the required information, the paycheck creator generates a pay stub with all the necessary details, ensuring that everything is accurate. This not only reduces the chances of mistakes but also gives you peace of mind knowing that the pay stubs you are issuing are correct.

For example, if you have multiple employees with different pay rates, benefits, or deductions, a paycheck creator can calculate everything for you—eliminating the risk of human error.

2. Saves Time and Reduces Administrative Burden

For small business owners or HR departments, time is a valuable resource. Payroll processing can take up hours every pay period, especially if you are manually calculating pay for each employee, tracking benefits, or working with complex tax rates. In many cases, business owners spend more time on payroll than any other task, and that takes away from other important areas of the business.

A paycheck creator can save you significant time. Instead of manually calculating each paycheck, you can enter the employee’s information into the tool, and it will instantly generate an accurate pay stub. Whether you have one employee or hundreds, the process becomes far more efficient, and you can focus your time on growing your business rather than dealing with payroll problems.

Most paycheck creators are easy to use, so even if you don’t have extensive experience with payroll, you can still quickly generate pay stubs without much hassle. Many tools also allow you to automate the entire payroll process, so once you set everything up, you don’t have to repeat the task each pay period.

3. Helps Ensure Legal Compliance

Another crucial reason every business needs a paycheck creator is for compliance with federal, state, and local employment laws. Employers are legally required to provide employees with a breakdown of their wages, deductions, and taxes, which is typically done through a pay stub. These records must also be maintained for tax purposes.

With a paycheck creator, you can ensure that all necessary information is included in each pay stub, such as:

- Employee’s gross pay: The total amount earned before deductions.

- Deductions: These could include federal and state income taxes, Social Security, Medicare, and any other deductions like health insurance or retirement contributions.

- Net pay: The amount the employee takes home after all deductions have been made.

A paycheck creator can also help you stay up-to-date on changing tax laws. Many tools automatically update with the latest tax rates and regulations, so you can rest assured that your pay stubs are compliant with the most current laws. This helps you avoid penalties and fines for failing to meet legal requirements.

4. Reduces Payroll Errors

Payroll errors are costly and can lead to unhappy employees. Whether it’s paying an employee too much or too little, or incorrectly calculating tax deductions, payroll errors can result in additional work to correct mistakes, as well as potential legal or financial consequences.

The paycheck creator eliminates many of these risks by automating the payroll process. When you enter an employee’s information, the software automatically calculates the correct deductions and generates the accurate gross and net pay. This reduces the likelihood of errors in payroll and helps ensure that employees receive the correct pay on time.

Moreover, most paycheck creators are equipped with features like error-checking, which can alert you to discrepancies in the data you input. This added layer of security makes sure that no mistake goes unnoticed.

5. Improves Employee Satisfaction and Transparency

Employees value transparency when it comes to their pay. They want to understand how their wages are calculated, what deductions have been made, and why certain amounts are withheld. Providing clear and accurate pay stubs is not only good practice—it also builds trust with your workforce.

By using a paycheck creator, you can give your employees detailed pay stubs that outline all the necessary information. These pay stubs show the breakdown of gross pay, deductions, and net pay, ensuring that employees can easily see where their money is going. This transparency helps avoid confusion or disputes about pay.

Additionally, having pay stubs available on time, every time, boosts employee satisfaction. Workers will appreciate the professionalism of timely, accurate pay stubs, and they’ll feel confident in their compensation package.

6. Customization and Professionalism

A paycheck creator often allows you to customize pay stubs with your business’s logo and branding, which gives your pay stubs a professional appearance. This customization is important for maintaining a consistent image and professionalism in all your business communications, including payroll.

You can choose templates that best suit your business, including those that show the level of detail your employees need. For example, if you want to show employees the breakdown of hours worked, vacation time used, or overtime pay, the paycheck creator can accommodate these details. Having a professional, clean design helps reinforce your company’s commitment to accuracy and professionalism.

7. Easy Record-Keeping and Digital Access

A paycheck creator can also simplify record-keeping for your business. By using a digital tool, you can store pay stubs electronically and easily access them when needed. This is particularly helpful during tax season or if an employee needs a copy of their pay stub for a loan or financial inquiry.

Digital pay stubs are easier to organize and retrieve than paper ones, reducing the risk of losing important records. Many tools also allow you to export pay stubs in PDF format, making it easy to share them with employees or store them securely for future reference.

Conclusion

In today’s fast-paced business environment, having a reliable, accurate, and efficient way to manage payroll is essential. A Free paycheck creator not only saves you time and reduces the risk of errors but also helps ensure legal compliance, improves transparency with your employees, and provides a professional solution for generating pay stubs. Whether you have a handful of employees or a growing team, using a paycheck creator is a smart investment that can simplify payroll and enhance your business’s operations.

For small businesses looking to improve their payroll process, a paycheck creator is a must-have tool. It ensures that your employees are paid accurately and on time, every time. With the time and money saved, you can focus on growing your business and meeting the needs of your employees.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons

Why Keeping Your Starbucks Pay Stub Is Important

Why Instacart Pay Stubs Matter for Your Financial Records?